The U.S. Dollar weakened against several currency majors in the Forex as many traders remain baffled by the Dollar's weakness even during a sell-off of U.S. yields. Following the announcement by U.S. President Barack Obama indicating that he was authorizing airstrikes on Islamic militants in Iraq, the greenback declined. Furthermore, 10-year Treasury yields plunged to the lowest level in 14 months. However, when Russia reported that it was pulling back some troops from the Ukrainian border, the markets breathed a sigh of relief and risk appetite reigned once again across the Forex. This prompted the greenback's rally as well as that of Treasury yields. In the days ahead, speculators will monitor the different crises around the world, and will pay special attention to key releases out of Japan and the Euro region on second quarter economic growth. Gold Prices surged to the highest level in three weeks, before they weakened slightly. Futures for delivery in December reached $1,324.30 a troy ounce, the most since mid-July; and sold at $1,311.00 by the end of Friday. Risk aversion ebbed in the foreign currency exchange, once Russia stated that it was ending military exercises on the eastern border of Ukraine, signaling that an invasion is not likely to happen. The shiny metal was up and down as sentiment dominated market trends. It jumped again when Israel indicated that Hamas did not honor the 72-hour cease fire and resumed rocket strikes in the Gaza Strip.

The Euro rose after France revealed progress in its Industrial Production, but its gains were kept in check after Germany said that the Trade Surplus narrowed in June. The Euro traded to the downside throughout most of last week, and the announcement by the European Central Bank to leave stimulus unchanged did not alter the currency's overall trend. Sources believe that this week's announcements may reveal the contraction of Gross Domestic Product, a factor that could debase the Euro. The British Pound traded at a two-month low versus the U.S. monetary unit following lackluster releases out of the U.K. denoting a drop in Exports, and stayed low as tensions around the globe increased demand for safe havens. In the U.K., the Trade Deficit expanded in June, overshadowing positive news issued in the week showing an advance in Construction activities.

And after news revealed that American aircraft struck Islamic insurgents in Iraq, bringing the U.S. back into the conflict, demand for harbor assets increased. This contributed to the Yen's biggest weekly rise in close to one month versus the greenback. The Yen pared its rally once Russia's Defense Minister said that their warplanes had concluded drills and would pull back from the area close to the border with the Ukraine. News reports out of Russia boosted risk appetite and demand for Australia's Dollar. The Aussie went up against the greenback despite less than stellar macroeconomic fundamentals which showed that the jobs' sector is still weak. New Zealand's Dollar remained to the downside, days after official reports divulged that employers added fewer payrolls than expected in the months of April to June. In addition, the Commodities Futures Trading Commission said that market traders lowered speculation that on the New Zealand Dollar's hike.

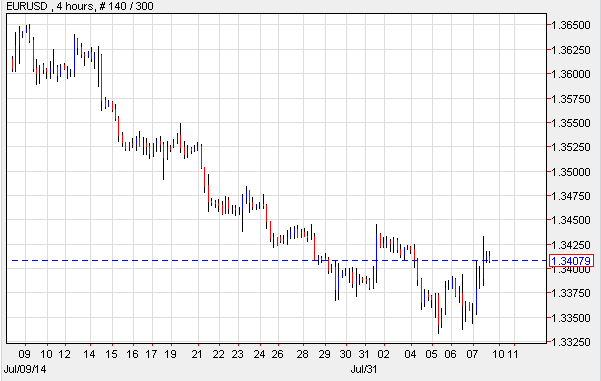

EUR/USD- E.U. Could Receive Bad News

The EUR/USD dipped after the European Central Bank announced its policy decision. Mario Draghi, the bank's President, indicated that the monetary authorities are set to purchase asset-backed securities, a sign that the bank is still thinking about increasing stimulus. He added that the ECB will move in the opposite direction of the Federal Reserve's for some time to come, as it aims to reduce inflationary pressures. Analysts took this as a sign that the ECB plans to leave the costs of borrowing money unchanged for a while. Mr. Draghi emphasized that the geopolitical tensions, especially the situation with Russia could affect the Euro-zone's economy. And while it's too early to know how the sanctions imposed against Moscow will impact the E.U., the bank's officials have voiced their concern about the likelihood that energy prices could go up. Mr. Draghi concluded his press conference by saying that the ECB believes the Euro region's economy has sustained a moderate recovery and expects it to continue improving.

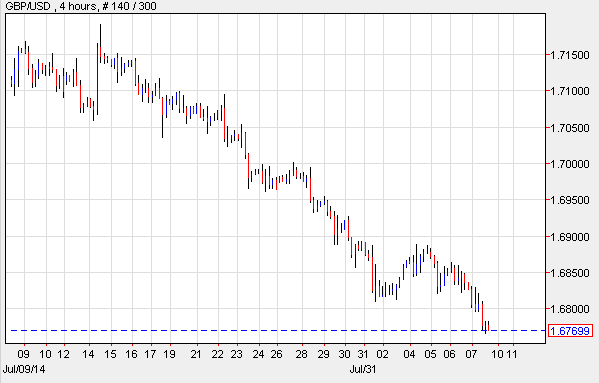

GBP/USD- BOE Leaves Policy Unchanged

The GBP/USD slumped to the lowest rate in almost two months, just days after the Bank of England left monetary policy at the same level it's been for months. Analysts say this would be a proper time to raise the interest rate to make certain the transition is smooth. However, last week's reports showed that home values are still high, while activities in Manufacturing have dropped. In the week ahead, the Bank of England may offer clues on what it plans regarding monetary policy. Investors will pay close attention to Friday's releases on Trade Balance, especially since economists predict that the country could print a deficit. They say that with the fall of the PMI index, and a slowdown in Industrial Output, the metrics may disappoint. On Wednesday, the central bank will publish the second quarter's Inflation report, another factor that could dictate the GBP/USD's trend. Lastly, analysts have indicated that the level of Unemployment has not made a difference for the bank to set the key cash rate; and the bank's governor, Mark Carney has not provided forward guidance based on employment. On the data front, the British Trade Deficit expanded in June, but this alone does not explain why the GBP/USD depreciated.

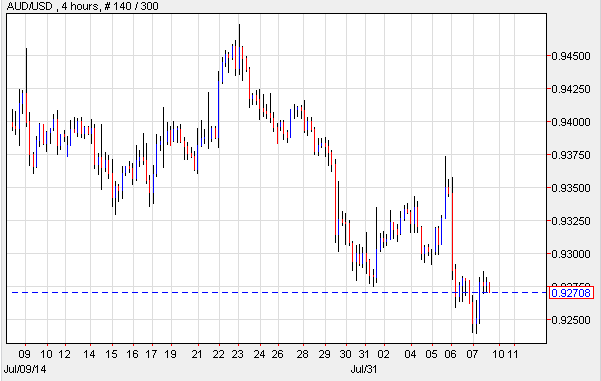

AUD/USD- Aussie Rebounds

The AUD/USD recouped its footing despite the rise in domestic unemployment. It gained as risk appetite returned to the Forex after Russia announced its decision to end the military drills it held near the border with the Ukraine. Experts say that the pair could have dipped even lower than it did in the past week, had it not been for the uncertainty felt in the markets regarding the mounting crises in Iraq, the Ukraine and Israel. The pair was supported by positive data out of China showing that shipments abroad have increased. The recent metrics have denoted that the Chinese economy is rebounding nicely as a result of the government's stimulus programs and the hike in demand for Chinese products from abroad. However, economists predict that future reports may denote a dip in exports and this may drive the Trade Surplus down. The AUD/USD was affected by s surprising report indicating that the rate of Joblessness rose to the highest level in 12-years in July, even though only 300 payrolls were lost. Economists explained that this was due to the loss of participation in the employment market. The 6.4 percent in Unemployment worries investors as the level posted higher than that of the U.S. for the first time in seven years.

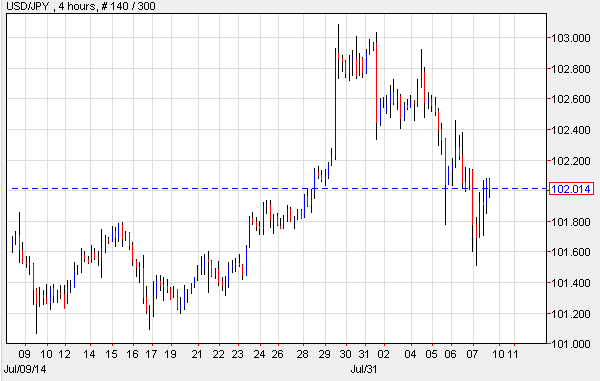

USD/JPY- Airstrikes Prompt Risk Aversion

The USD/JPY slumped after American war planes were authorized to strike Islamic militants approaching the town of Erbil in Iraq. Mr. Obama indicated that the move was aimed at protecting U.S. personnel situated in that area, and to ensure the safety of Iraqis. Since Japan's monetary unit is the quintessential harbor currency, it rose dramatically as the announcement bolstered risk aversion. In the past few days, the Bank of Japan announced that it will refrain from expanding stimulus, and the bank's governor, Haruhiko Kuroda expressed that he is confident the economy will continue to show moderate improvement. He did however indicate that the export sector remains weak and production has slowed due to the slack seen in the emerging economies. Just like Mario Draghi, the President of the European Central Bank, Mr. Kuroda stated that geopolitical crises could impact global economies but that Japan's economy would not be swayed by these events. This week Japan will release metrics on the second quarter's Gross Domestic Product, a release that will divulge the damage the sales tax hike may have caused.

Today's Outlook Today's economic calendar shows that Japan will issue the central bank's monthly report as well as data on Household Confidence, CGPI, and Machine Tool Orders. Switzerland will release Retail Sales. The U.K. will publish BRC Retail Sales. And Australia will announce the House Price Index and NAB Business Confidence.