The U.S. Dollar weakened against the majority of its trading counterparts as demand for safe havens increased on speculation the Federal Reserve may scale back on monthly asset purchases very soon. The greenback was weighed down as China released lackluster economic data which indicated that the Manufacturing Purchasing Manager’s Index dropped from 50.4 in April to 49.6 this month. The U.S. Department of Labor announced that the number of individuals who applied for Unemployment Compensation declined by 23,000 to a seasonally adjusted 340,000 while analysts had anticipated they would fall by 18,000 to 345,000. Furthermore, Unemployment Claims for the prior week were revised up from 360,000 to 363,000. Other reports revealed that New Home Sales climbed by 2.3 percent up to a seasonally adjusted 454,000 annual units for last month. Gold prices surged after James Bullard, President of the Federal Reserve Bank of St. Louis, indicated that the central bank may continue with the current level of asset purchases for the time being. Gold Futures for June delivery rose 1.36 percent and settled at $1,353.55 a troy ounce on the Comex Division of the New York Mercantile Exchange.

The Euro’s quiet movements came to an end as the shared currency went on a rollercoaster ride after the Federal Reserve Chairman, Ben Bernanke, indicated on Wednesday that the central bank may cut back on stimulus at some point over the next few months. It rallied versus the U.S. Dollar after an official from the Federal Reserve suggested that policy makers were not ready to dismantle quantitative easing and it dropped again as China released metrics which showed a contraction in Manufacturing –a factor that caused market investors to assume that several global economies were still facing some tough challenges. The 17-nation currency rebounded after official news confirmed the expansion of Germany’s Manufacturing PMI and growth in the region’s Manufacturing and Services sectors. The British Pound rose from a 10-week low against the greenback on the likelihood that its 3 percent decline may have been “excessive,” and as U.K. reports indicated that the nation’s economy improved during the initial quarter of 2013. The Sterling strengthened against most of the majors on data revealing an increase in Inventories and in Consumer Spending.

In Japan, stocks declined as technical indicators showed a rapid increase, thereby dampening risk appetite in the Forex while prompting the Yen to rally the most in almost three months against the U.S. Dollar. The Japanese monetary unit was also supported by the possibility the Federal Reserve may reduce stimulus along with data which confirmed that China’s Manufacturing sector shrank.

Lastly in the South Pacific, the Australian Dollar reversed earlier losses versus the greenback but dipped again to 11-month lows as the release of Chinese Manufacturing figures sparked concerns over the outlook for growth for the world’s major economies. The New Zealand Dollar traded at 8-month lows versus its U.S. peer as weak Manufacturing metrics out of China prompted investors to worry about economic expansion in the world’s second biggest economy.

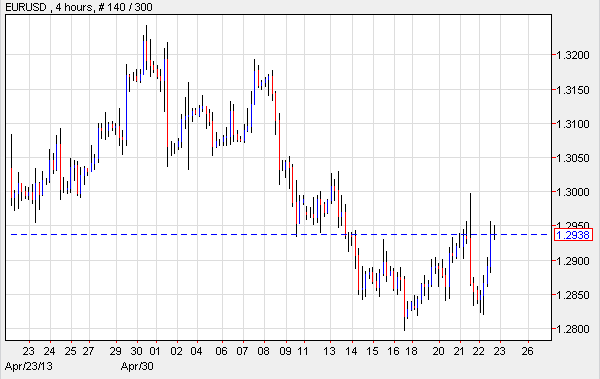

EUR/USD- Euro Rallies On Positive Reports

The Euro advanced versus the greenback after high-ranking official James Bullard of the U.S. Federal Reserve commented that policy makers aren’t prepared to reduce stimulus. The Euro remained strong as reports showed that the region’s Manufacturing Purchasing Manager’s Index went up from 46.7 in April to 47.8 this month. And although it remained in contraction territory, economists suggested there’s been an improvement. Furthermore, Germany, the Euro-zone’s biggest economy, indicated that Manufacturing PMI climbed to a two-month high as it went from 48.1 in April to 49.0 in May. The E.U.’s Services PMI also revealed an improvement from 47.0 to 47.5 this month, another factor that supported the Euro. EUR/USD" title="EUR/USD" width="600" height="379">

EUR/USD" title="EUR/USD" width="600" height="379">

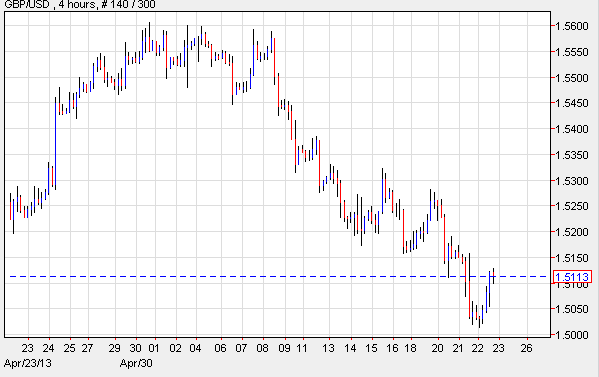

GBP/USD- GDP Shows Growth

The British Pound rebounded from a 10-week low against the greenback after official releases indicated that the U.K.’s Gross Domestic Product climbed 0.3 percent in the first quarter of 2013. The Office for National Statistics also confirmed that Inventories rose by 2.5 billion Pounds in the initial three months of the year, and Consumer Spending climbed 0.1 percent. The Sterling continued to appreciate as government releases suggested the currency’s 3 percent drop was excessive. GBP/USD" title="GBP/USD" width="599" height="377">

GBP/USD" title="GBP/USD" width="599" height="377">

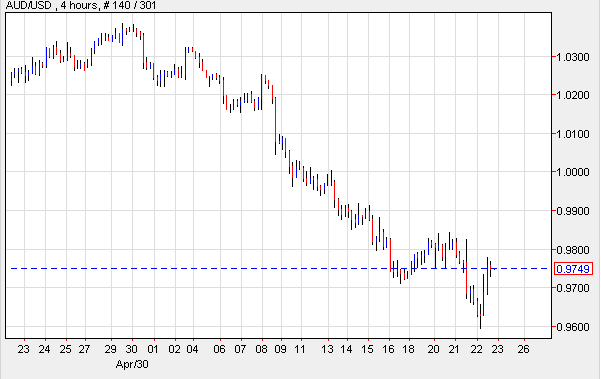

AUD/USD- Chinese Data Reignites Concerns

Australia’s Dollar traded at 11-month lows versus the U.S. currency as the release of Chinese data reignited concerns the second biggest economy is still facing headwinds. The so-called Aussie dropped after China’s HSBC Manufacturing Purchasing Manager’s Index declined below 50, from 50.4 to 49.6 this month. China is this country’s largest export partner. Furthermore, the Melbourne Institute increased its Inflation forecasts from 2.2 to 2.3 percent, a factor that weighed on the Australian Dollar. AUD/USD" title="AUD/USD" width="601" height="336">

AUD/USD" title="AUD/USD" width="601" height="336">

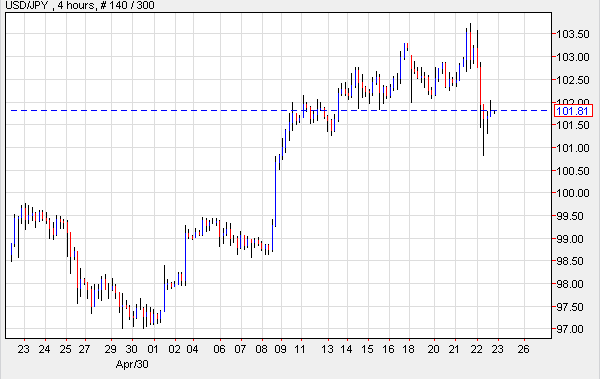

USD/JPY- Yen Rallies Most In 3 Months

The Yen rose the most in close to three months versus the U.S. Dollar as risk appetite ebbed in the market after technical indicators suggested the country’s stocks gained too much. The Nikkei fell 7 percent, spurring a wave of deleveraging in the markets that prompted investors to go for the panic button. The Yen received support due to speculation that the Federal Reserve may cut monetary easing and as China revealed that its Manufacturing sector contracted. In Japan, reports showed that investors sold 804.4 billion Yen ($7.8 billion) in foreign bonds. USD/JPY" title="USD/JPY" width="600" height="379">

USD/JPY" title="USD/JPY" width="600" height="379">

Today’s Outlook

Today’s economic calendar shows that the U.K. will report on BBA Mortgage Approvals. The Euro region will release German GDP, German Current Assessment, German Business Expectations, Spanish PPI, and Italian Consumer Confidence. The U.S. will issue data on Durable Goods Orders and Core Durable Goods Orders.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Daily Report: EUR/USD, GBP/USD, AUD/USD And USD/JPY : May 24, 2013

Published 05/24/2013, 07:08 AM

Updated 09/16/2019, 09:25 AM

Daily Report: EUR/USD, GBP/USD, AUD/USD And USD/JPY : May 24, 2013

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.