The U.S. Dollar weakened against most of its forex counterparts as a drop in commodities and equities raised demand for refuge in the markets. Risk appetite was also affected by reports issued by the International Monetary Fund in which officials confirmed that they had cut the growth outlook for China. During a press conference in Beijing, the Deputy Managing Director of the IMF said they expect China’s economy to expand by approximately 7.75 percent for this and next year rather than the previously predicted 8 and 8.2 percent. Appetite for risk remained low after Germany reported that the number of unemployed climbed by 21,000 in May. The greenback dipped over 1 percent against the Yen and the Euro as its recent advance prompted market investors to take profits. Meanwhile, gold prices rallied during the American trading session due to the weakening greenback and reports of higher demand for gold in China.

The Euro climbed against the U.S. Dollar for the first time in close to a week after the European Commission indicated that it will relax the austerity measures promoted by Germany during the start of the regional debt crisis. In easing up on these policies, the EC also allowed Spain, Italy and France more budget freedom. In Germany, economic releases showed that the Unemployment Rate remained unchanged while 21,000 more individuals lost their jobs last month. Separate announcements revealed that the nation’s Consumer Price Index went up to 1.5 percent from the previous year. The Swiss Franc climbed against most of the majors as the OECD suggested that the Swiss National Bank may be forced to boost the benchmark interest rate in an effort to manage the growing real estate market. The British Pound also extended gains versus the greenback after the U.S. currency declined due to a weakness in the stock markets and higher demand for safe havens. This occurred as the Organization for Economic Cooperation and Development lowered the growth predictions for the world economies from 3.4 to 3.1 percent. U.K. economic reports disappointed as they revealed a drop in Retail Sales and a decline in the Index of Retailers.

In Japan, the central bank’s governor, Haruhiko Kuroda, stated that the country’s economy has stabilized. This caused the Yen to rally versus the U.S. Dollar and to strengthen versus most of its trading peers. The Japanese currency traded higher after the Organization for Economic Cooperation and Development stated that the world economies will expand, with Japan and the U.S. outpacing the Euro-zone. A decline in equities and commodities weighed on risk appetite, benefitting the Yen even further.

Lastly, Australia’s Dollar reached a 1 ½ year low against the greenback after domestic data disappointed investors. The Aussie slipped versus its counterparts on comments by the International Monetary Fund which indicated that China’s economy would grow at a slower pace than previously suggested. New Zealand’s Dollar also edged lower against the greenback while demand for the American currency remained strong on speculation the Federal Reserve will cut back on monthly asset purchases.

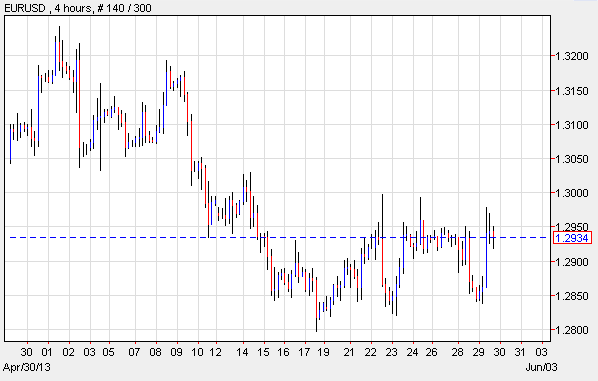

EUR/USD- Euro Rallies As Investors Profit

The shared currency gained against the greenback as market investors sold off the U.S. Dollar to capture profits after a surge in U.S. Consumer Confidence prompted it to appreciate. On the data front, Germany reported that 21,000 more individuals were out of work last month, which is more than the predicted 5,000. Germany’s Unemployment Rate stayed at 6.9 percent, in line with predictions. And the nation’s Consumer Price Index rose to 1.5 percent in May from the year before. The Euro performed well while the OECD requested that the European Central Bank lower its deposit rate and take into consideration expanding quantitative easing. The Organization remains concerned that the region’s Unemployment is high and it anticipates that the E.U. economy may shrink by 0.6 percent this year.

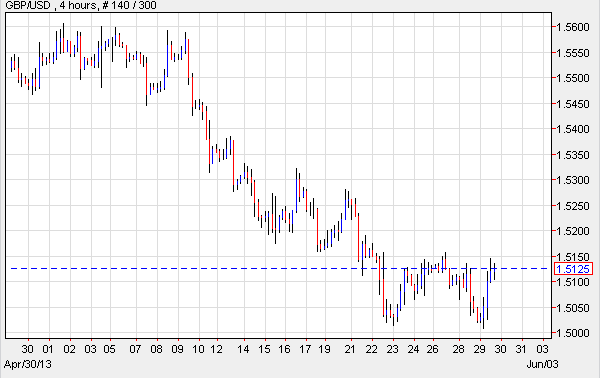

GBP/USD- Retail Sales Drop

The British Pound rallied against the greenback as risk appetite ebbed in the market following a drop in equities and commodities which took place after the Organization for Economic Cooperation and Development cut the global growth forecast from 3.4 to 3.1 percent. In the U.K., reports indicated that Retail Sales dropped to a 13-month low in May and the Confederation of British Industries stated that the Index of Retailers slipped from -1.0 in April to -11.0 this month.

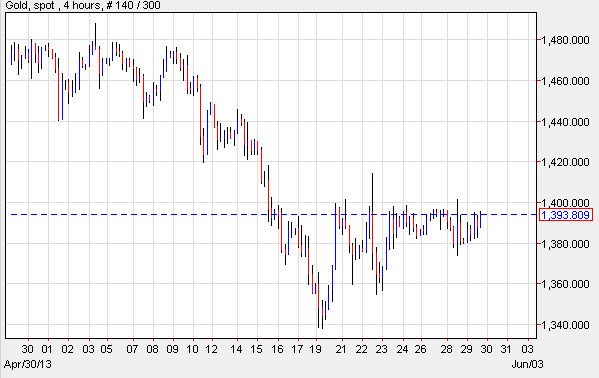

XAU/USD- Gold Rises On Chinese Demand

Gold prices advanced during the U.S. market hours as the greenback weakened, and as reports showed that demand for gold may be increasing in China. According to the World’s Gold Council, demand for the metal in India headed for a record this quarter as imports reached 300 to 400 metric tons. Analysts say this denotes that demand in Asia is still high and it’s compensating for ETF liquidations. Gold Futures for August delivery rose 0.61 percent and settled at $1,388.15 a troy ounce on the Comex Division of the New York Mercantile Exchange.

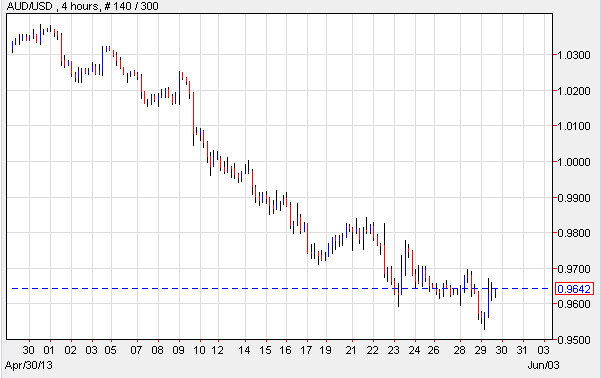

AUD/USD- Data Disappoints

Australia’s Dollar dropped to one and a half year lows versus its U.S. counterpart after domestic reports showed that New Home Sales in the South Pacific nation only increased 3.9 percent in April, after they climbed 4.2 percent the prior month. Separate releases indicated that Construction work performed in Australia dipped 2 percent in the initial quarter of the year, disappointing those who anticipated a 1 percent hike. The greenback remained strong after the International Monetary Fund predicted that China’s economy will grow at a slower pace than previously forecast.

Today’s Outlook

Today’s economic calendar shows that Switzerland will report on Gross Domestic Product. The U.K. will issue data on Nationwide HPI. The Euro region will release Retail PMI, Business Climate, Consumer Confidence and Industrial Sentiment. The U.S. will announce Initial and Continuing Jobless Claims, the GDP Price Index, GDP and Crude Oil Inventories. Japan will publish Manufacturing PMI, Household Spending, National Core CPI, CPI, Tokyo Core CPI, Tokyo CPI and Industrial Production. New Zealand will provide information on Business Confidence; and Australia will issue metrics on Private Sector Credit.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Daily Report: Dollar Weakened Against Most Of Its Peers

Published 05/30/2013, 07:22 AM

Updated 09/16/2019, 09:25 AM

Daily Report: Dollar Weakened Against Most Of Its Peers

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.