Source: StockCharts (edited by Short Side of Long)

Health Care sector is in a terminal stage of its parabolic run. Is the bubble about to pop?

Topic: Equity sentiment survey updated with a mixed picture

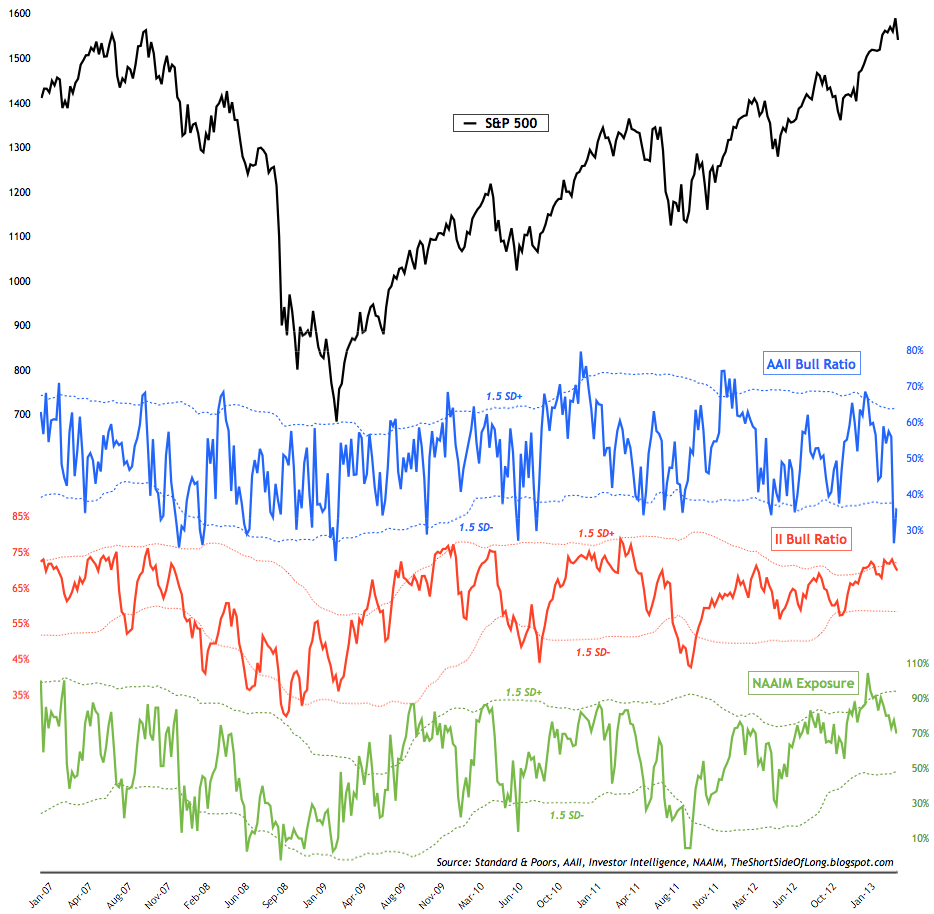

Yesterday we discussed the fact that market internals have been deteriorating for some weeks already. Today, we will take a quick look at the sentiment conditions within the equity space.

AAII bull ratio is extremely bearish and at the lowest level since March 2009 equity bottom, giving a contrarian buy signal. II bull ratio is extremely bullish, with readings at one of the higher levels since 1990s, giving a contrarian sell signal. Finally, NAAIM reached record long exposure sometime earlier in the year, but has slowly reverted back towards the mean.

What to make of all this?

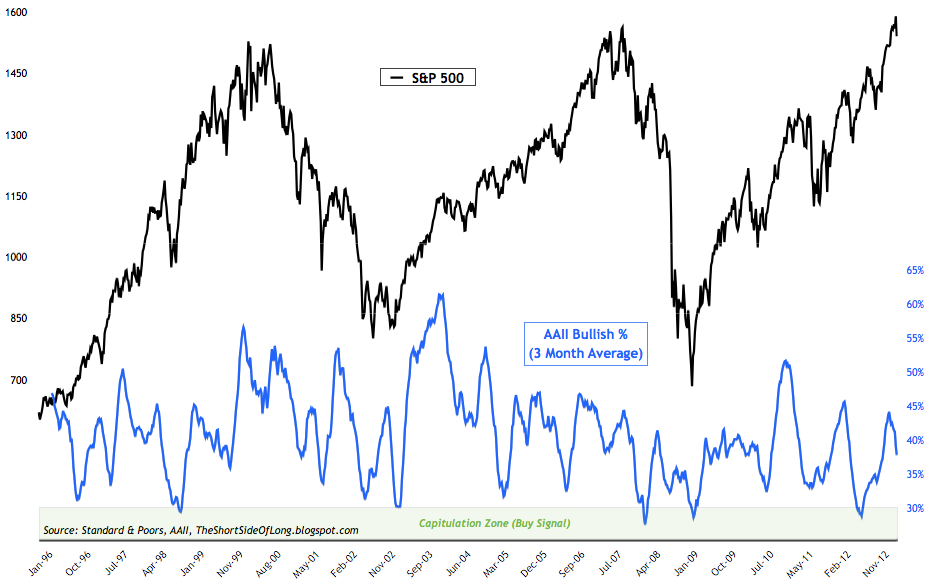

Topic: From the long term perspective, AAII bulls are neutral

Anyone following contrary indicators knows that AAII bulls have been ridiculously low for two weeks in the row. It is quite strange, because a) stock prices have been rising almost vertically since November 2012 and; b) other sentiment surveys do not confirm the bearish conditions AAII is portraying.

With market being overbought and the long term AAII bulls not nearly as low as the short term volatile readings (chart above), I would be extremely hesitant to follow this indicator all on its own and just blindly buy equities here.

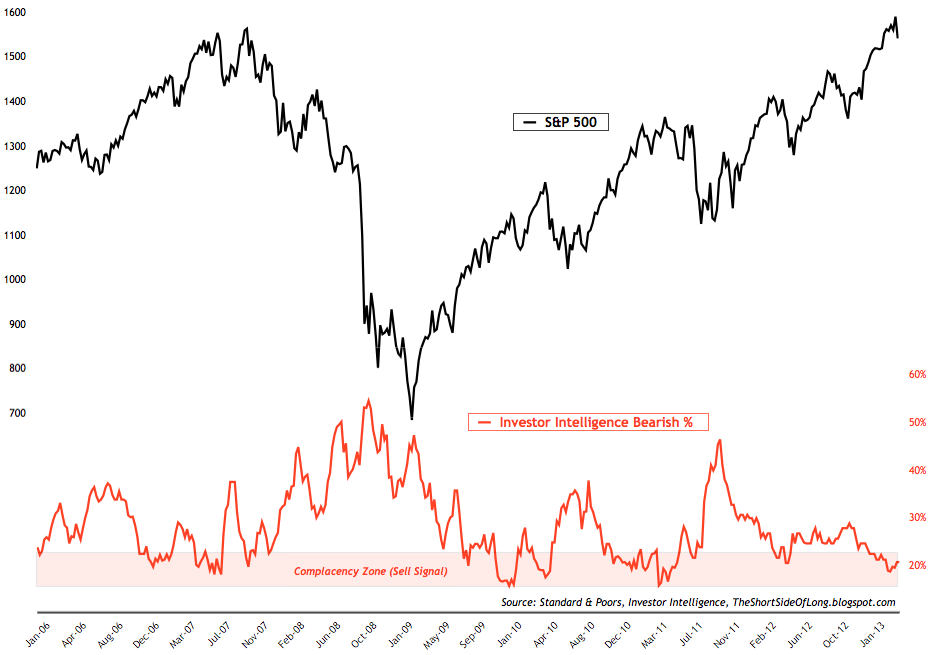

Topic: Investor Intelligence bearish level is giving a sell signal

Contrary to what AAII readings show, II bearish levels have been indicating that the market is overbought and investors extremely complacent for quite some time. Similar readings were seen in middle of 2007, early 2010 and middle of 2011 - with all of them resulting in an intermediate top. With S&P at a major resistance from 2000 and 2007, it is quite possible for a pull back to start.

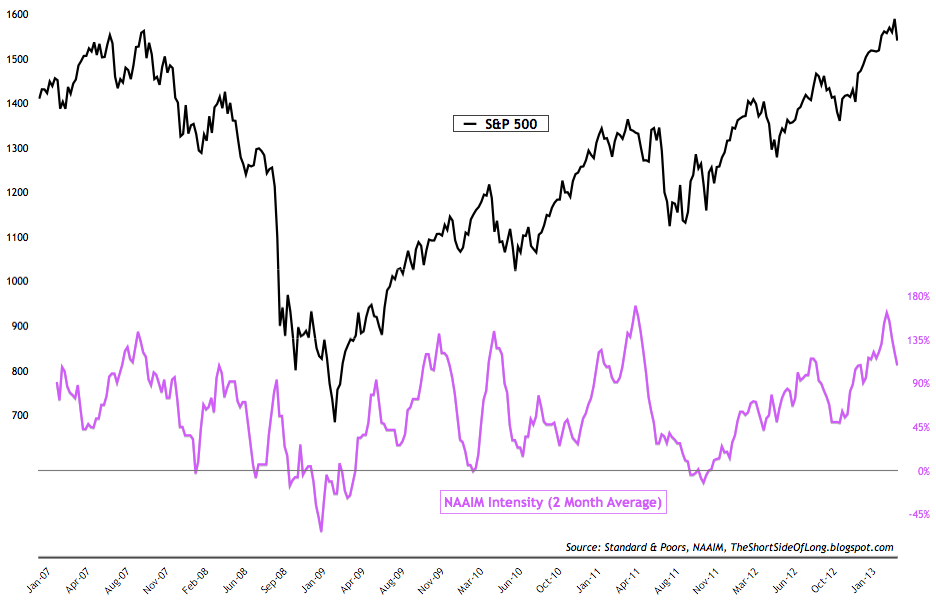

Topic: Intensity of managers who are long has been extreme

According to the NAAIM survey, fund managers held record net long exposure to US equities in early parts of 2013, exceeding that of 2007 peak. Moreover, when we measure the intensity of these positions (number of managers long including their leverage minus number of managers short including their leverage), we can see that fund managers have been bullishly over-leverged in recent months. Similar conditions were seen in mid 2011, prior to a August market crash.