Why the U.S. dollar still reigns supreme

The Fed held rates at yesterday’s meeting but hinted that future cuts could come. The FOMC dropped the word patient from its statement, adding they would “act as appropriate” to sustain the economy. Oil prices rose as inventories fell.

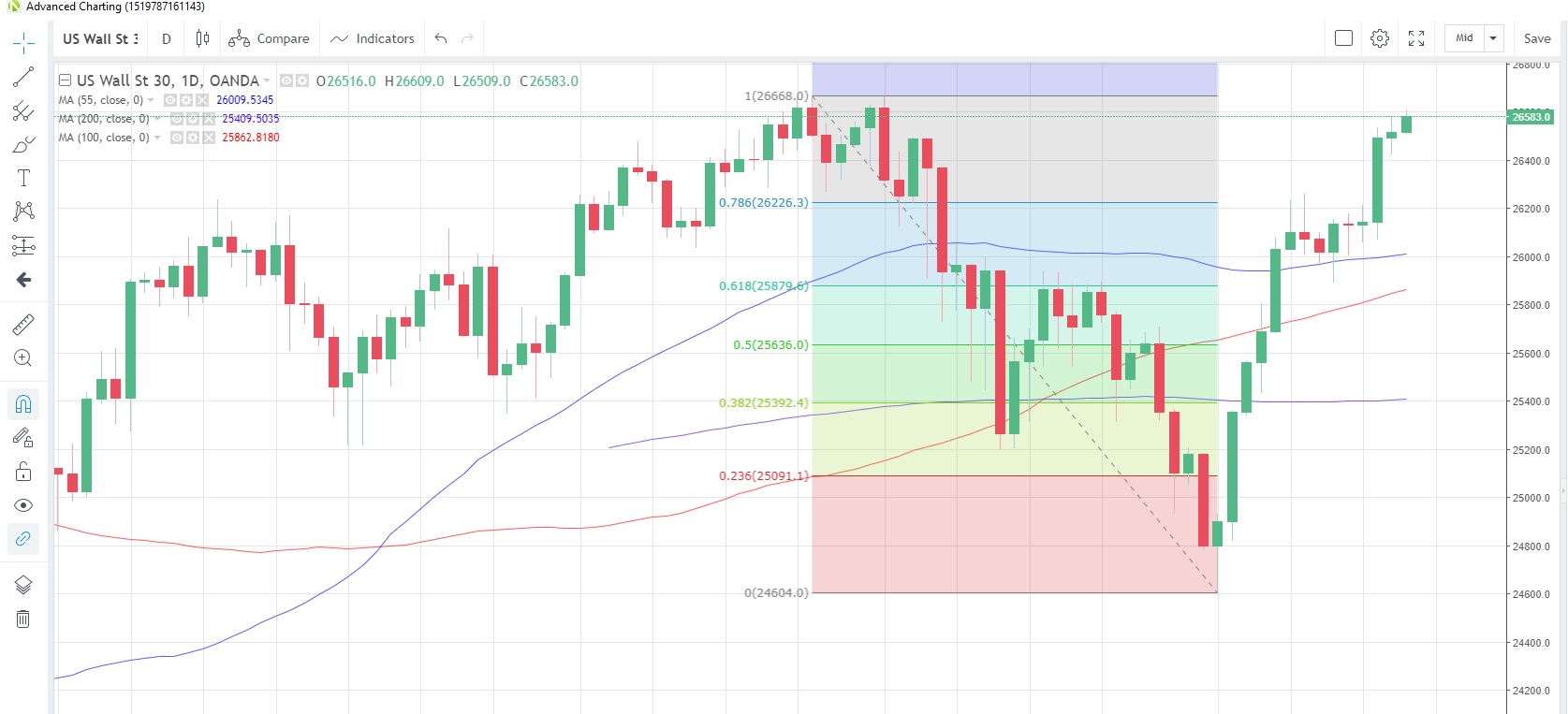

US30USD Daily Chart

Source: OANDA fxTrade

- The US30 index rose yesterday and look set to extend gains into a fourth consecutive day today on the Fed outlook

- The index is nearing the April high of 26,668 and touched the highest since May 1 in early trading this morning

- The Philadelphia Fed manufacturing index is seen sliding to 11.0 in June from 16.6 last month. That would still be the fourth consecutive month it has stayed above zero.

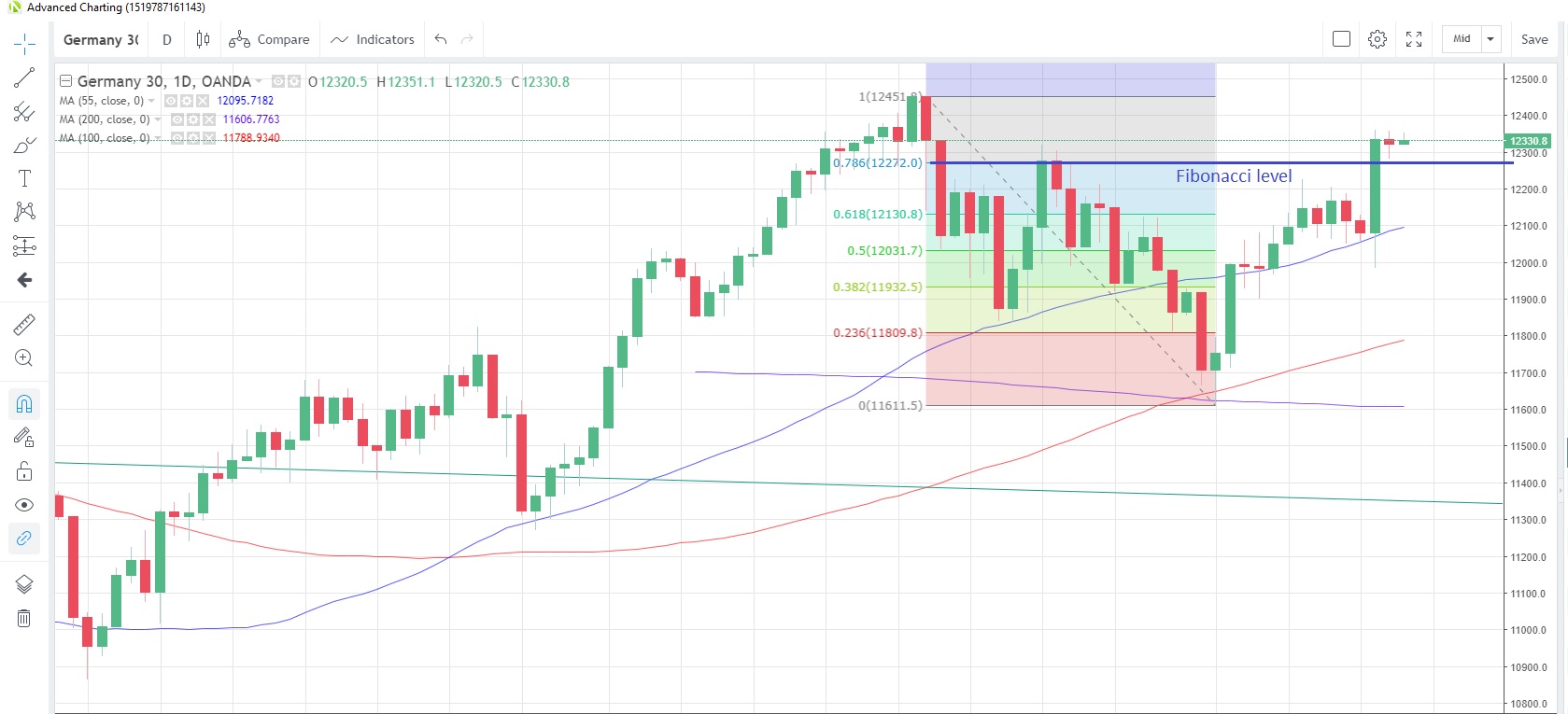

DE30EUR Daily Chart

Source: OANDA fxTrade

- The Germany30 gave back some of Tuesday’s gains yesterday as it consolidated the strong upmove. It’s trading slightly higher in early trading today

- The index is likely eyeing the May high of 12,452 after holding above 78.6% Fibonacci retracement of the May-June drop at 12,272

- Reports suggest ECB policy makers are divided on the next policy step, with either a rate cut, guidance change or further quantitative easing all being considered.

WTICOUSD Daily Chart

Source: OANDA fxTrade

- Crude oil prices rose after weekly inventory data revealed drawdowns across all three categories. The EIA data showed a drawdown of 3.1 million barrels in the week to June 14, the first reduction in stockpiles in three weeks

- WTI is testing the June 10 high of 54.77 and a rise above it could bring the 100-day moving average at 58.46 into play

- OPEC and its allies have confirmed a meeting on July 1-2 in Vienna to discuss oil output, a shift from the late-June time that had been suggested earlier.