U.S. indices have started this week off with modest gains ahead of the Federal Reserve’s rate meeting Tuesday/Wednesday. Expectations are high that rate cuts will be discussed, which is helping to support stock markets.

US30USD Daily Chart

Source: OANDA fxTrade

- The US30 index rose modestly last week as stalemate in the US-China trade talks was overcome by rising prospects the Fed may be shifting to an easing bias. The index has started positively in early trading this morning

- The index is still holding above the 55-day moving average at 25,990, while the 100-week moving average at 24,703 remains a key support level below

- The key event of the week will be the FOMC meeting with markets expecting some comments/discussion about rate cuts. There are no major economic data releases scheduled for today.

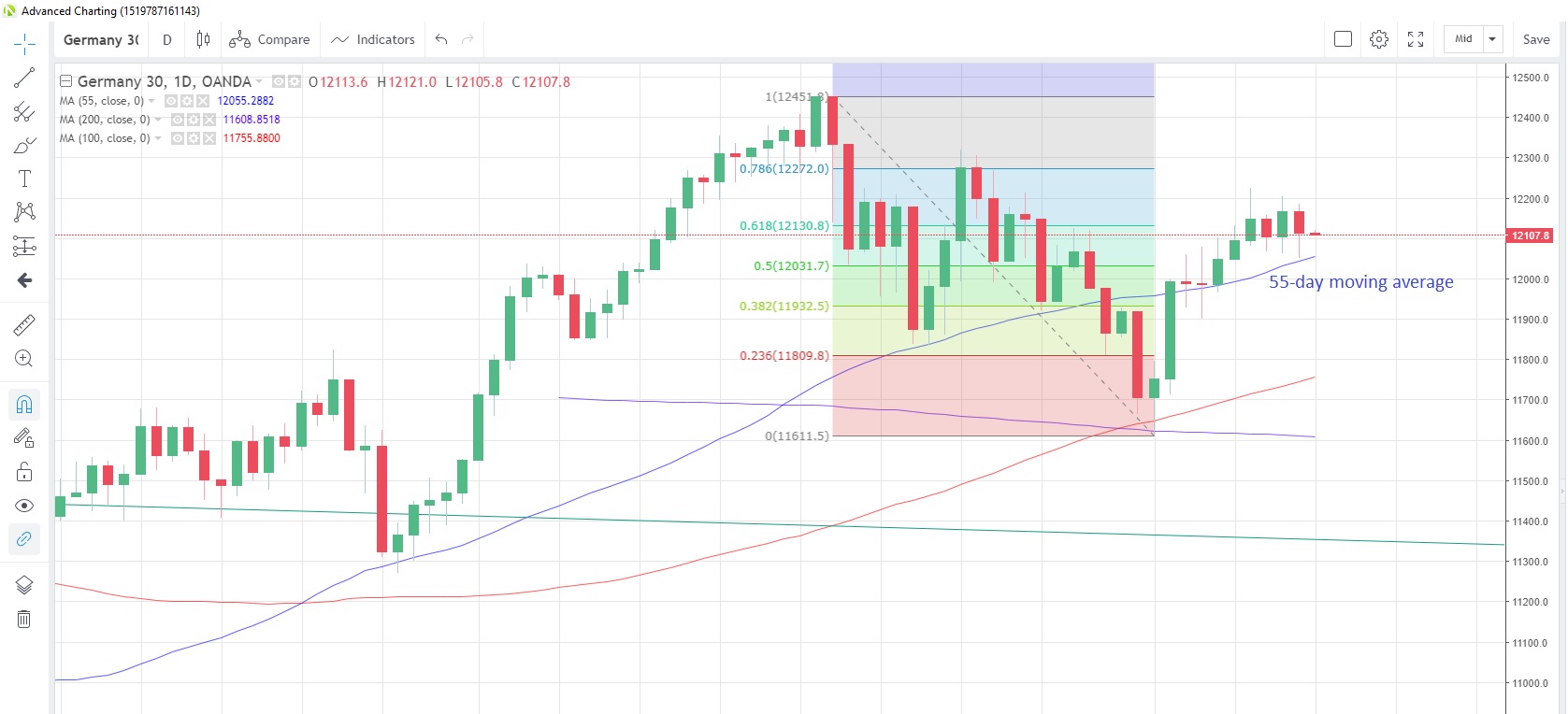

DE30EUR Daily Chart

Source: OANDA fxTrade

- The Germany30 index declined on Friday and has opened this morning with a negative bias

- The index is still above the 55-day moving average at 12,055, which has supported prices on a closing basis since June 3

- Italy appears to be heading for a confrontation with the EU over next year’s budget after Italy’s Deputy PM Salvini that tax cuts are needed next year, adding that the EU’s fiscal rules are outdated. There are no major releases for either Germany or the Euro-zone today.

CN50USD Daily Chart

Source: OANDA fxTrade

- The China50 index fell the most since May 23 on Friday as the Hong Kong protest against the extradition law hit sentiment

- The index is sandwiched between 55-day moving average resistance at 13,185 and 100-day moving average support at 12,753

- Retail sales rebounded in May, rising 8.6% y/y, above economists’ estimates. However, industrial production missed forecasts with a slump to +5.0% y/y, the weakest expansion in 17 years, according to data released Friday.