Wall Street extends gains on tariff postponement

The early news that Trump was to defer the March 1 tariff deadline stayed with equities for most of the day yesterday, prompting further gains, though momentum waned into the close. Oil prices tumbled after Trump tweeted they were too high.

US30 USD Daily Chart

Source: OANDA fxTrade

- The US30 index tested the November high yesterday but pared gains to close only marginally in the black. The index has opened flat this morning

- Resistance at the November high of 26,249 remains intact for now. Support may be found at the 200-day moving average at 25,086

- Fed Chairman Powell faces day one of his two-day testimony on the economy and monetary policy before Congress. The Q&A session after the testimony is usually more interesting.

DE30EUR Daily Chart

Source: OANDA fxTrade

- The Germany30 index lost momentum into the close after touching the highest since Dec. 3, buoyed by the shift in the tariff deadline

- The index has started today’s session in negative territory, prompting a decline in the slow stochastics

- We have another confidence indicator published today. This time it’s the GfK survey for March, which is seen steady at 10.8. Other surveys have disappointed recently.

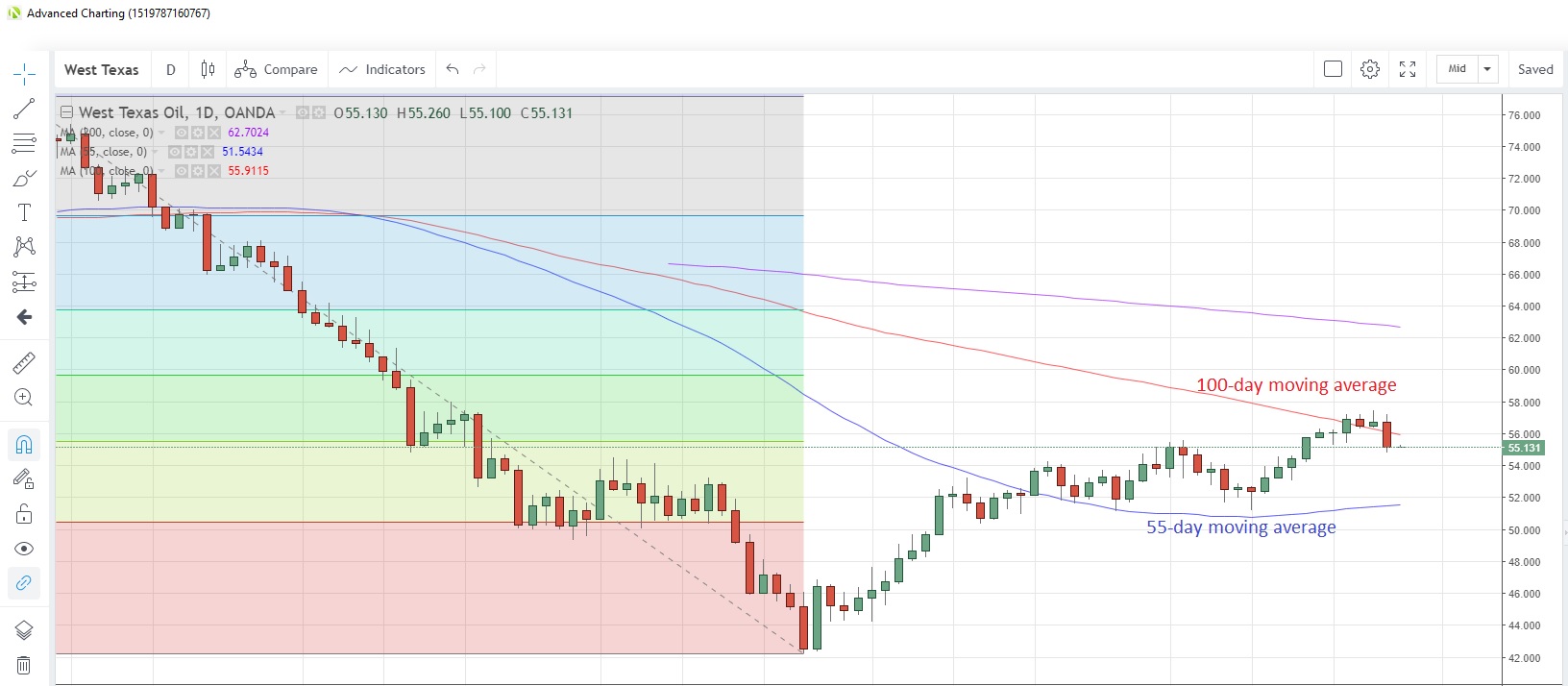

WTICOUSD Daily Chart

Source: OANDA fxTrade

- WTI posted the biggest one-day drop so far this year yesterday after U.S. President Trump tweeted that oil prices were too high and the global economy could not take more price hikes. He called on OPEC to “relax."

- Prices are pivoting around the 100-day moving average at 55.91. The 55-day moving average is at 51.54, and has supported prices on a closing basis since Jan. 17

- The American Petroleum Institute releases weekly crude stocks data as at Feb. 22 later today. Last week saw an addition to stockpiles of 1.26 million barrels.