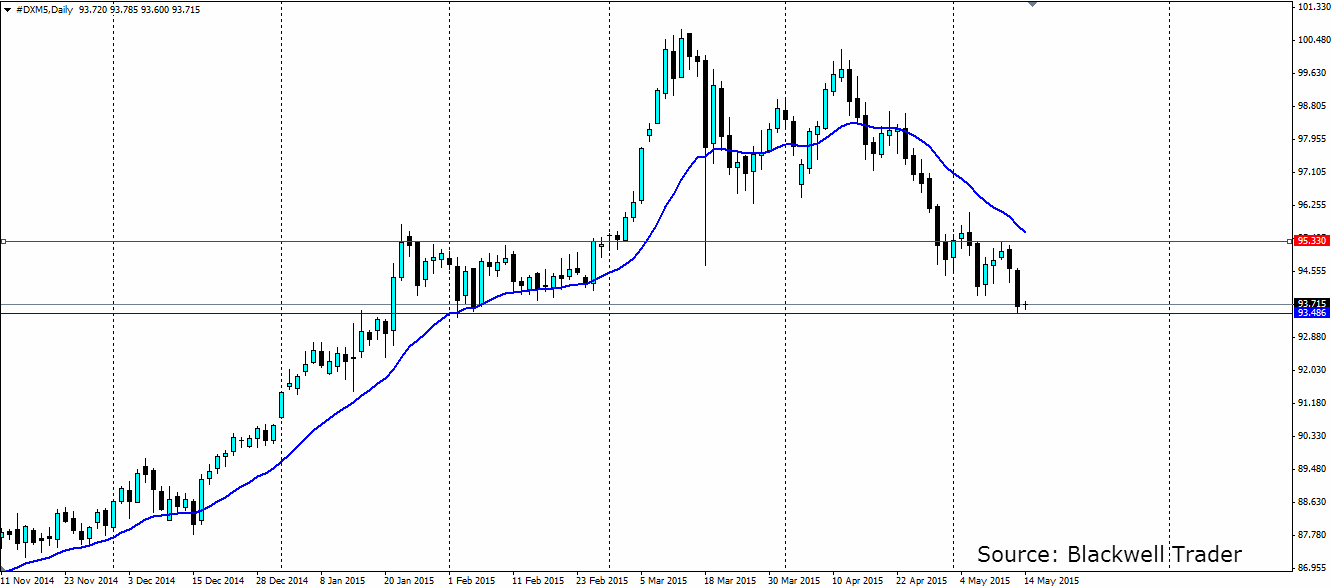

Taking a look at the US dollar first up, it had another day to forget as it pushed down to a three month low. Weaker than expected retail sales figures were the main culprit for the dollar sell-off as core retail sales came in well short of the 0.5% the market expected, at just 0.1% month on month. This is another example of weakening economic data out of the US that will make the US Federal reserve’s job difficult in deciding when to raise interest rates.

S: 93.486, R:95.330

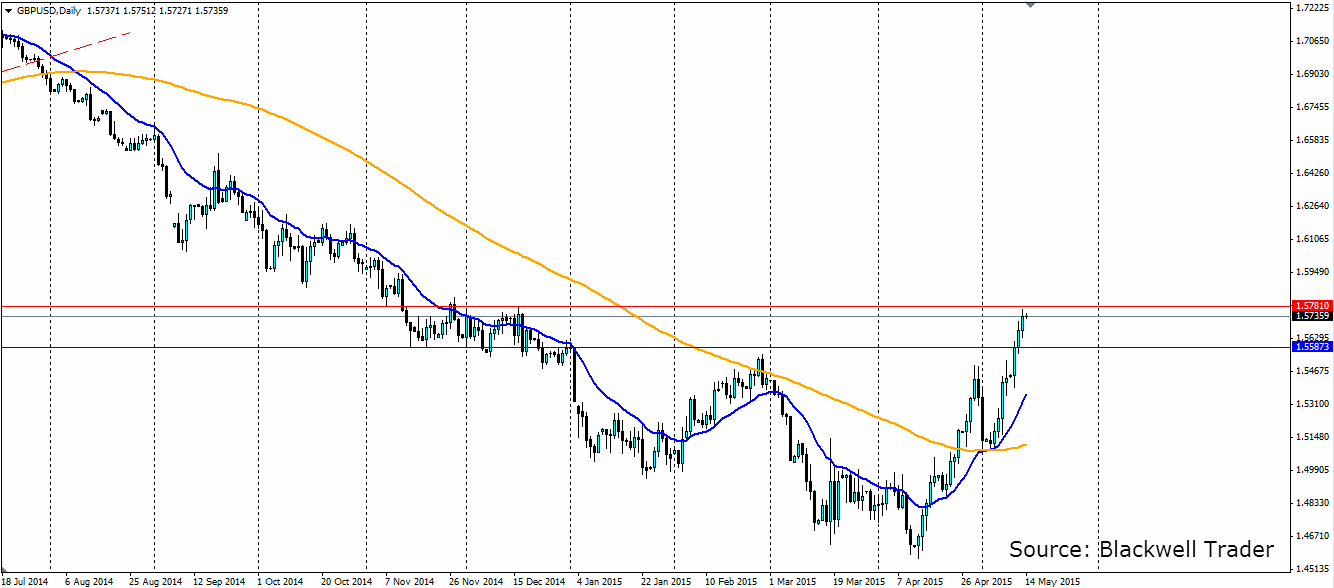

Looking at the cable now, it charged higher once again marking 23 days in the green out of the last 27. It has now retraced all of the losses from the beginning of 2015 and hit a high not seen since the 16th of December last year. The UK Unemployment rate fell from 5.5% to 5.4% and US dollar weakness helped the pair. The Bank of England downgraded its 2015 growth forecast from 2.9% to 2.5% but this was not enough to dampen the buying.

S: 1.5587, R: 1.5781

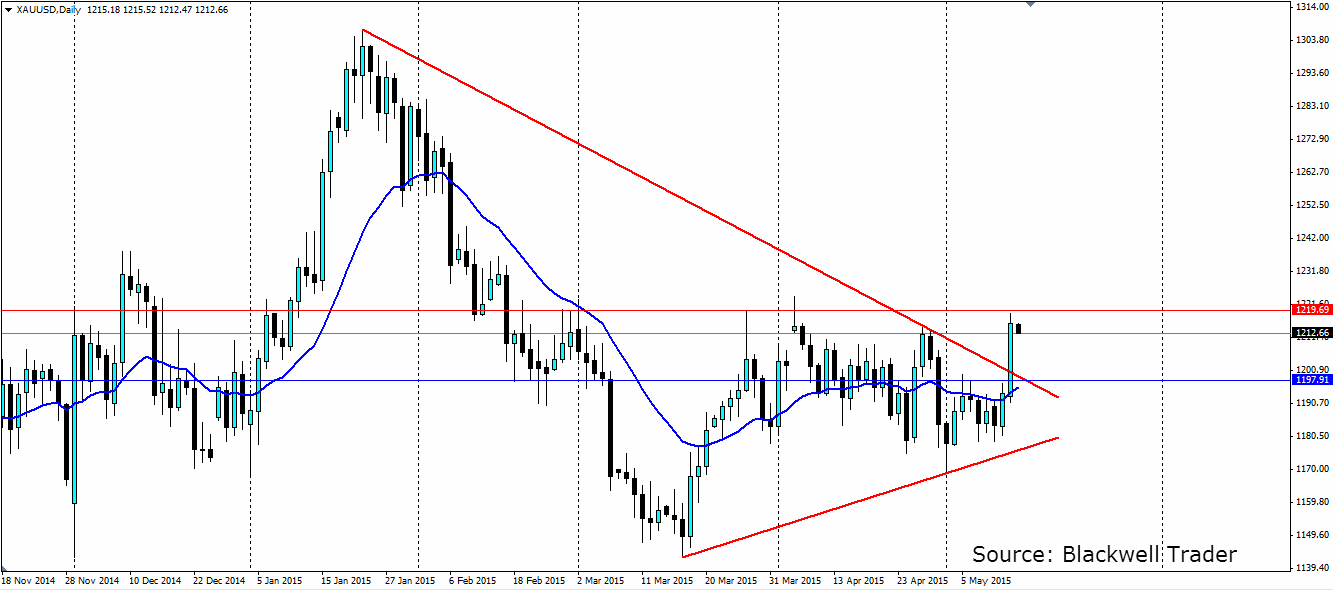

Taking a look at gold now, it pushed up out of the recent bearish trend to post a one month high. The precious metal was in demand as the US dollar weakened and the soft retail sales figures led to safe haven buying. If the US economy continues to slow down, we could see a solid push higher in the gold market as investors look for somewhere safe to put their money.

S: 1197.91, R:1219.69

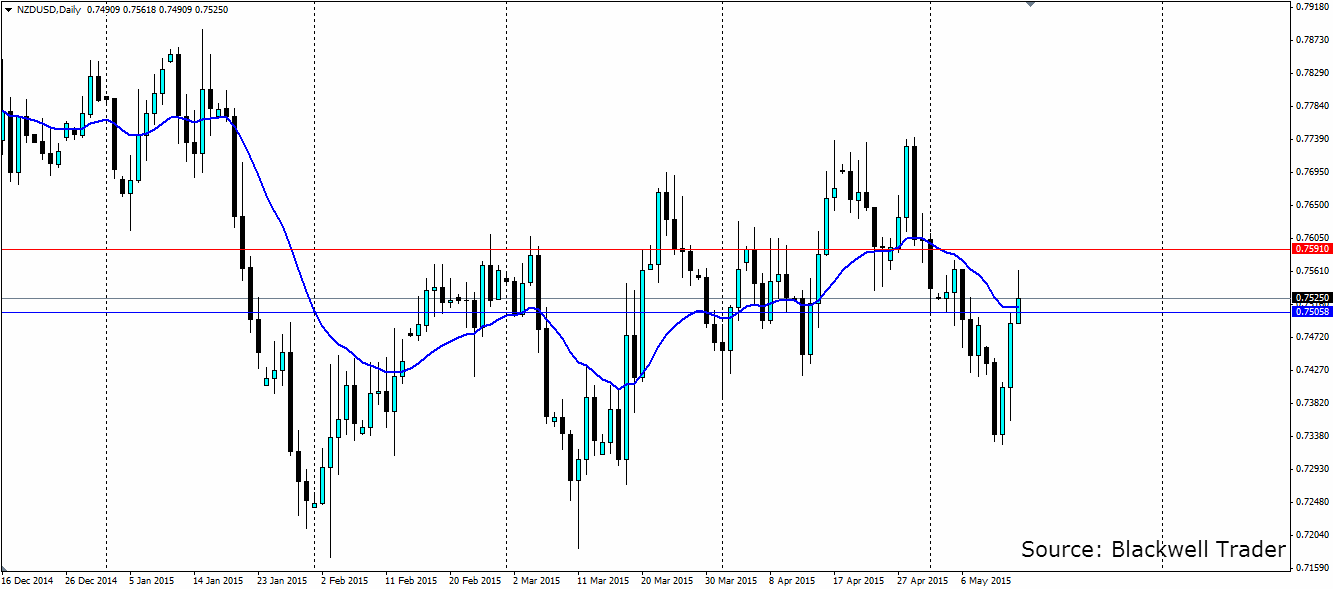

And finally today, the kiwi has found plenty of bullish support this morning thanks to stronger than expected retail sales figures. New Zealand Core retail sales lifted from 1.5% to 2.9% quarter on quarter in a sign that the domestic market is still relatively strong, despite weakening commodity prices and a lift in the unemployment rate. This may take some pressure off the RBNZ to cut rates, so we could see the bullish sentiment in the kiwi dollar continue.

S: 0.7591, R: 0.7505