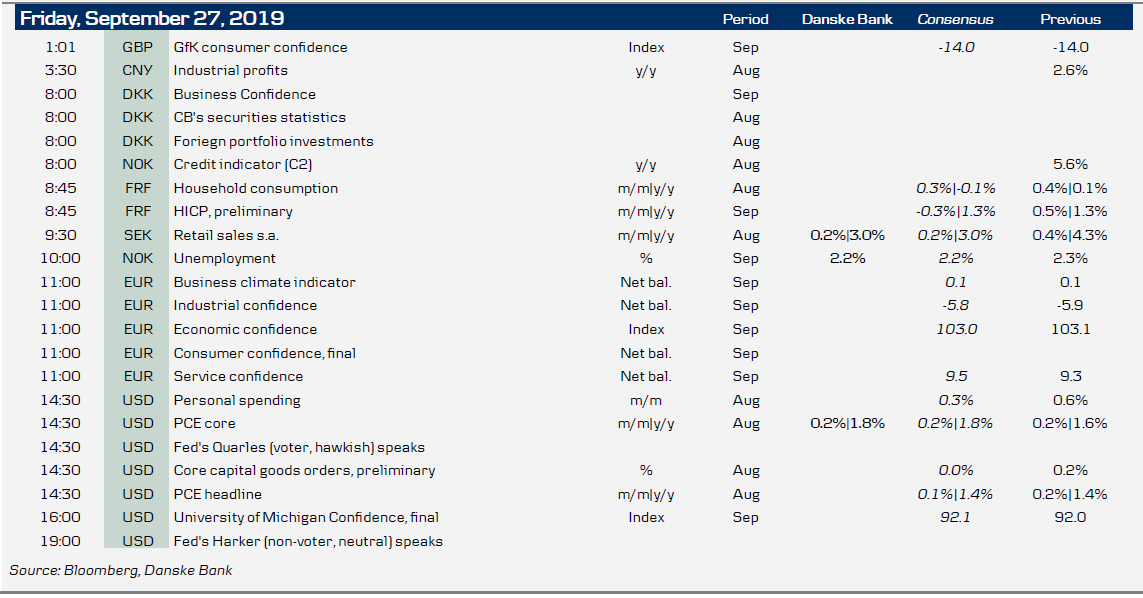

Market movers today

This morning, we published a comprehensive presentation looking into the risk of a global recession, possible recession drivers and the policy space to counter a downturn, see A Deep Dive Into The Global Recession Risk . Based on our findings, we see about a 30% chance of a global recession over the next two years.In terms of data releases, today's focus is on the US PCE core, Swedish retail sales and the Norwegian unemployment rate (see next). We expect US PCE core to have risen +0.2% m/m in August, implying an unchanged PCE core inflation rate at 1.8% y/y.A range of ECB speakers will also draw attention. We will watch in particular what Chief Economist Philip Lane has to say at 16.30 CEST today, as sceptical voices about the ECB package have grown louder. In a Handelsblatt interview yesterday, he already hinted that the ECB has leeway to cuts interest rates further.In the euro area, today's highlight will the Commission's economic confidence indicators. PMIs and Ifo painted a gloomy picture about the state of the euro area economy. In today's release, in particular we will look out for whether service sector confidence is sliding further.Selected market news

Market sentiment continues to be on shaky ground as the US congressional impeachment proceedings and trade concerns continue to weigh on the mood, and safe havens are in demand. Yesterday, a CIA whistle blower alleged White House officials used a classified storage system to hide the transcript of a call between US President Donald Trump and his Ukrainian counterpart.

Asian equity markets are in the red this morning and US index futures also point to a weaker opening across the Atlantic. Oil is still on track for a weekly drop of some 3%, after signs that Saudi Arabia is restoring production faster than expected.

After the surprising resignation of ECB Board member Sabine Lautenschläger yesterday, the German finance ministry announced it will soon propose a "suitable candidate" to succeed her. Both Isabel Schnabel, member of German Council of Economic Experts, and Claudia Buch, vice-president of the Bundesbank, have been mentioned as possible successors.

With German monetary hawks in retreat, hope for a similar shift in the fiscal policy sphere gained traction again after former finance minister and renowned fiscal hawk Wolfgang Schäuble seemingly endorsed a fiscal policy rethink (see Reuters) and Chancellor Angela Merkel admitted at a conference that politicians must ensure, through with sensible reforms and finance policies, that the ECB is not overburdened.

Still, we remain sceptical of a sizeable policy shift on the fiscal front from Germany in the near term, not least because the climate package unveiled on Friday was generally received with disappointment (see also Research Germany - Loosening the brake ).

Scandi markets

We expect Swedish retail sales to have slowed to 3.0 % y/y in August, from 4.3 % y/y. Last year, there was a sharp m/m increase in August, which we don’t expect to be repeated to the same extent.

In Norway, unemployment has begun to level off after falling continuously for three years. While this could be a sign that growth is slowing, the number of vacancies is rising fast.

This suggests that demand for labour is holding up, but that firms are increasingly having difficulty sourcing the right skills among the jobless, i.e. there are bottlenecks. Therefore, we expect registered unemployment to be unchanged in seasonally adjusted terms at 2.2% in September, with LFS unemployment for July (June-August) inching down to 3.5%.

Fixed income markets

Today, the Italian Debt Office will be selling up EUR3.75bn in a new 6Y bond as well as tapping in the 6Y floater and an 11Y bond. We expect there will be decent demand at the auction even though spreads have tightened to EU peers. However, the need for yield is still very strong and with the new Italian government looking for a budget deficit around 2% in 2020, the outlook for Italian debt looks strong.

Yesterday, Reuters ran a story saying that Sabine Lautenschläger did in fact – as most had already probably assumed – decide to leave the ECB because of her resistance to the current monetary policy.

After the ECB meeting, the hawks have been most vocal, but yesterday we had ECB Chief Economist Lane on the wires saying that the ECB has room to lower rates further, pointing to Denmark and Switzerland with policy rates at -0.75%. Hence, rate cuts are certainly not off the table and we can expect new downward pressure on EONIA forwards if the European numbers weaken further.

The US curve bull flattened yesterday night as 10Y US treasury yields dropped some 4bp. Risk appetite remained under pressure as the impeachment discussion continues in the US and as the media reported that the US will not extend a temporary waiver for US companies supplying Huawei.

The market is also concerned about the liquidity situation ahead of quarter-end. The 14- day repurchase agreements attracted USD72.8bn in bids after the Fed doubled the maximum offering to USD60bn. That said, the overnight operation attracted only USD50.1bn of bids compared to the EUR100bn offering. See also this research note.

FX markets

The majors are set to focus on possible key developments in the coming days/weeks on both the possible Trump impeachment process and/or trade negotiations gaining traction or not.

Yesterday saw limited moves in G4 currencies but we stress that the USD liquidity situation remain precarious longer term despite recent Fed moves to calm the nerves, see FX Edge: After the USD liquidity scare.

Also, as our economists have pointed out in A Deep Dive Into The Global Recession Risk, 27 September, as we still see some 30% probability of as recession in 2020, cyclical currencies could be in for a rough ride still – also during the autumn, where we do not see signs of a sustained stabilisation in global activity data.

In the Scandies, beyond the global developments, the NOK will also take its cue from unemployment data due this morning. In Sweden, the rise in joblessness has been a wakeup call for FX markets recently but we do not see any signs yet that a significant rise in unemployment is about to happen in Norway.

Retail sales in Sweden are normally not a major market mover and we doubt it will send EUR/SEK out of the recent range below 10.70. Instead, we recommend Reading the Markets Sweden, due for publication this morning, where we discuss October seasonality in the SEK and upcoming market movers.

Key figures and events