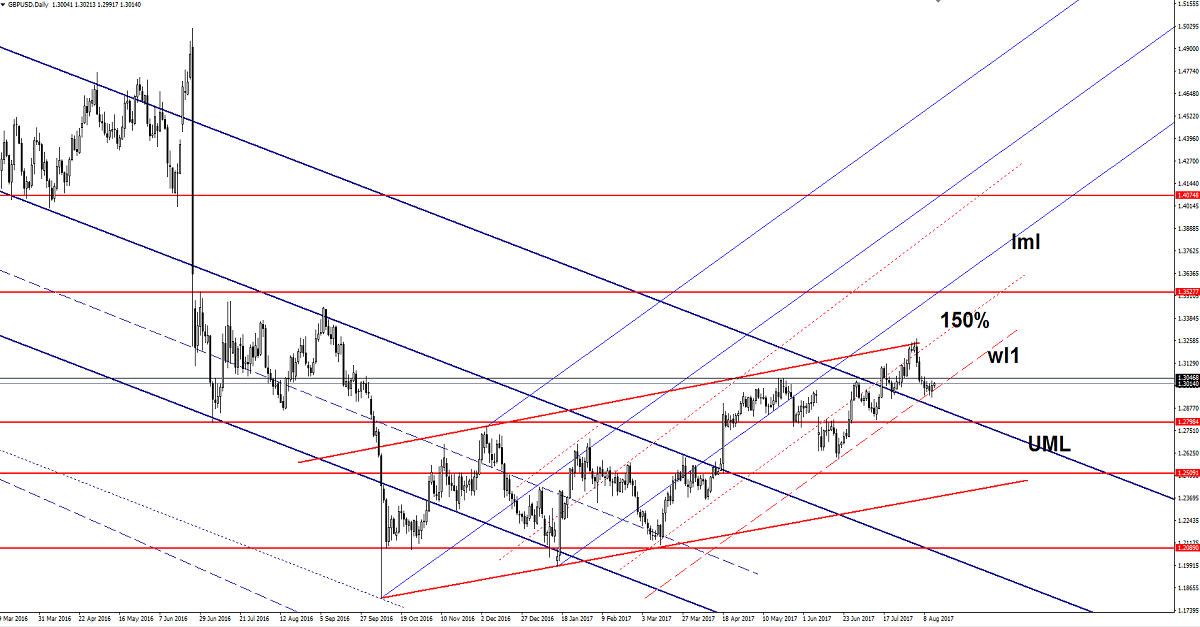

GBP/USD Setting Up For The Next Move

Price increased today and stays bullish until more sellers appear. GBP/USD could rebound as the USDX is still under selling pressure on the short term. USDX dropped in the last three days and is pressuring the 93.00 psychological level again.

The index could still come down to retest the 92.49 long term support in the upcoming days if the US data will come in mixed. Only a failure to reach the 92.49 support and the 92.55 previous low will signal a reversal.

The behavior will change if the rate will start to make higher lows, but needs a bullish spark from the United States economy to do that.

Is the retreat completed? This is the question right now, price retested the warning line (wl1) and now is fighting hard to rebound and to jump above the 1.3046 static resistance (support turned into resistance). Only a breakout above the static resistance will validate a further increase because a breakdown will become imminent if will stay too long on the warning line (wl1).

The perspective is bullish as long as the warning line (wl1) remains intact. You can notice that we had a false breakdown o Friday, signaling that the bulls are still in the game and could drive the price higher.

Remains to see what will happen because a retest of the 1.3046 level could signal a breakdown below the wl1. Support can be found at the UML as well and lower at the 1.2798 static support.

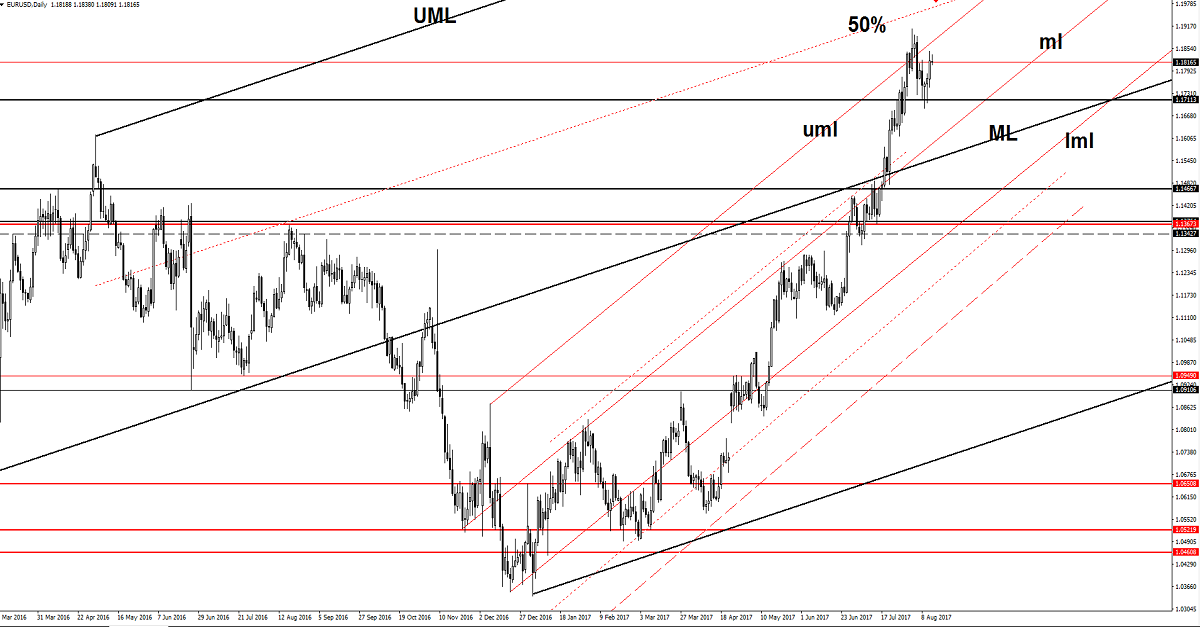

EUR/USD Struggling To Hold Ground

Price rebounded in the previous week and tries to reach and retest the upper median line (uml) of the minor ascending pitchfork, where he may find resistance again. A retest followed by a minor decrease will signal at drop at least towards the 1.1711 static support and towards the median line (ml) of the minor ascending pitchfork. The perspective is bullish as long as is trading above the median line (ml).

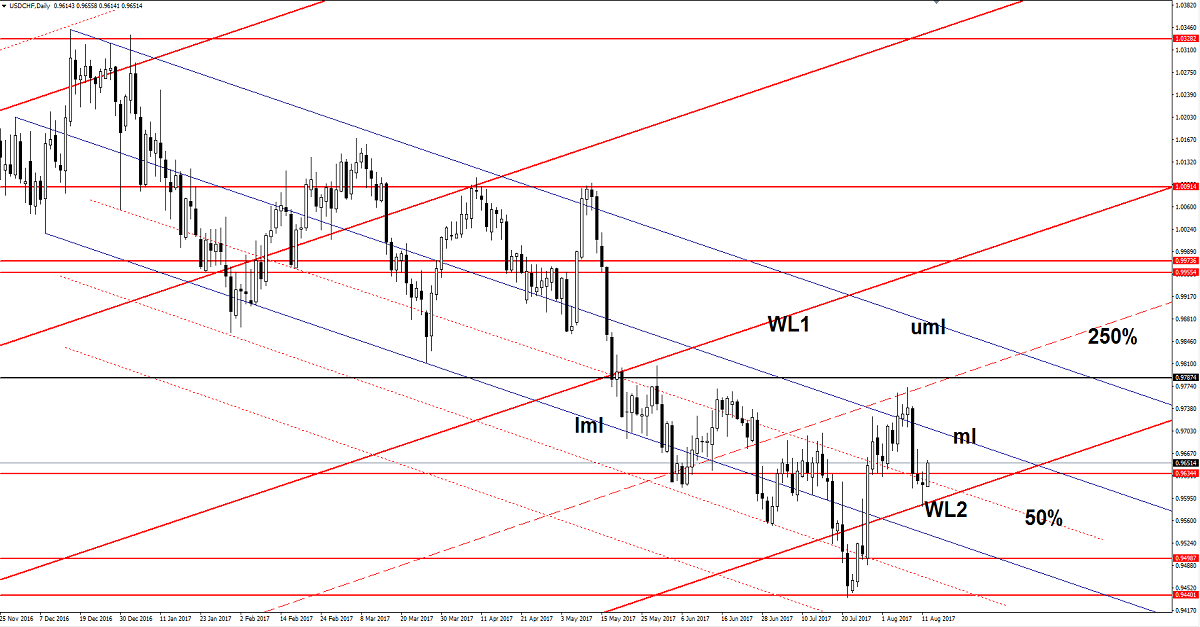

USD/CHF Is The Retreat Completed?

USD/CHF edges higher and is trading much above the 0.9634 and above the 50% Fibonacci line (descending dotted line). The next upside target will be at the median line (ml) of the minor descending pitchfork. A valid breakout will attract more buyers, which will drive the rate towards the upper median line (uml).