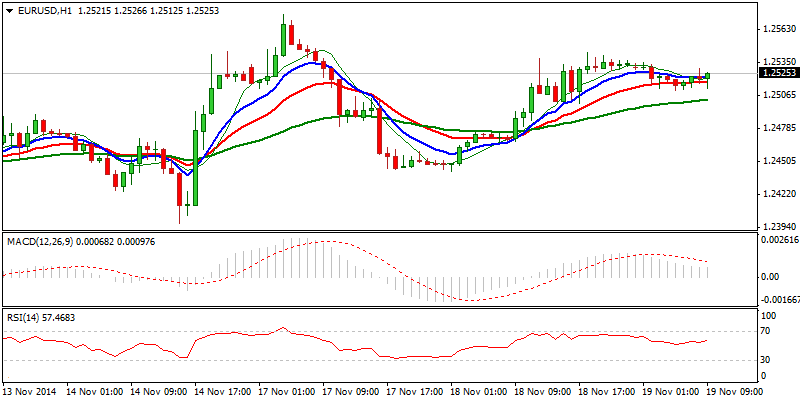

EURUSD

The Euro regained positive tone in the near-term picture, following yesterday’s positive close, which occurred above 1.25 handle. Bounce from 1.2442 hourly higher base, peaked at 1.2544, Fibonacci 76.4% of 1.2576/1.2442 upleg, capped by descending daily 20SMA and bear-trendline off 1.2884 peak. Daily MACD/RSI bullish divergence still signals further upside which requires sustained break above the trendline resistance and 1.2576, 04/17 Nov peaks, to spark stronger recovery. Otherwise, prolonged range-trade, with downside risk seen on violation of 1.25 support, could be expected in the near term.

Res: 1.2544; 1.2576; 1.2610; 1.2683

Sup: 1.2510; 1.2480; 1.2442; 1.2425

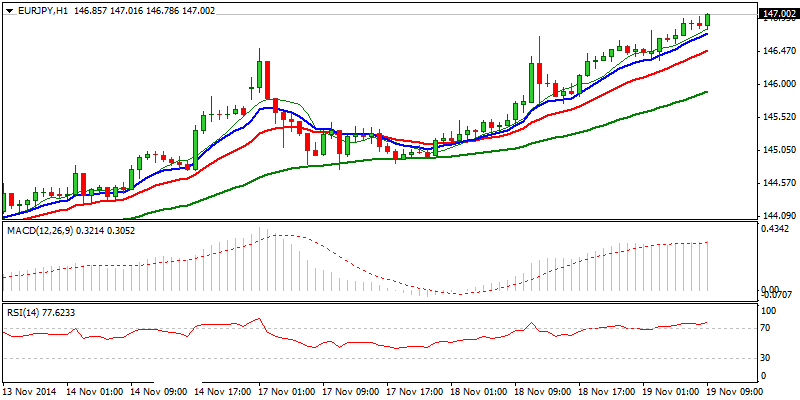

EURJPY

The pair resumes uptrend after breaking previous peak at 146.51, with psychological 147 barrier being dented. Overall positive tone sees scope for extension towards psychological 150 barrier in the near term, with Fibonacci 76.4% retracement of multi-year descend from 169.95/94.10, at 152.05, expected to come in focus. Overbought near –term technicals suggest corrective action, which should be ideally contained at 145.70 higher low. Key near-term support lies at 144.70 zone and break here will be bearish.

Res: 147.50; 148.00; 148.50; 149.00

Sup: 146.60; 146.35; 146.00; 145.70

GBPUSD

Cable came under pressure and nearly fully reversed corrective 1.55911.5734 rally, on renewed probe below 1.56 handle. Negative tone prevails on all timeframes and favors eventual clear break below 1.56, to open way towards next target at 1.5375, Fibonacci 76.4% of 1.4812/1.7189 ascend. On the other side, hesitation at psychological support cannot be ruled out, as near-term studies are approaching oversold territory, with recovery high at 1.5734, offering good resistance. Only break here and 1.58 barrier, also 61.8% of 1.5939/1.5591 descend, would delay and signal near-term base formation.

Res: 1.5670; 1.5700; 1.5734; 1.5765

Sup: 1.5597; 1.5591; 1.5550; 1.5500

USDJPY

The pair remains firm and posts fresh multi-year highs, after clearing psychological 117 barrier. Yesterday’s positive close, with past two days candles with longer lower shadow, confirm strong bullish tone, which focuses immediate target at 117.95, Oct 2007 peak and psychological 120 barrier, also Fibonacci 61.8% retracement of multi-year 147.68/75.55 descend, expected to come in near-term focus, previous peaks at 117 zone, offer immediate support, with 116.30/00 zone expected to ideally contain dips.

Res: 117.50; 117.95; 118.50; 119.00

Sup: 117.00; 116.80; 116.30; 116.00

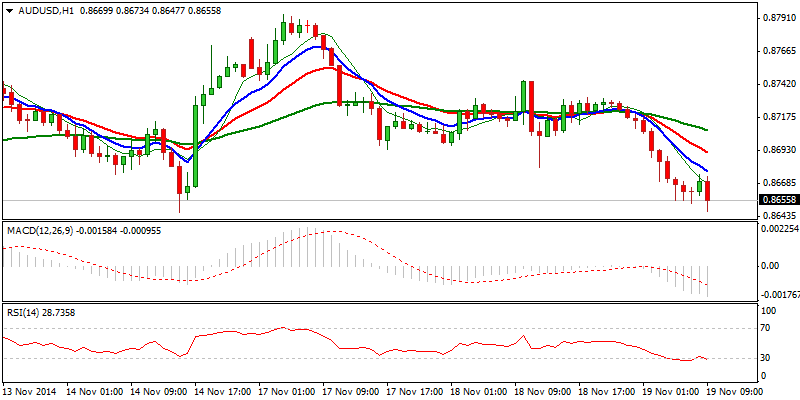

AUDUSD

The pair remains under pressure and attacks 0.8646 higher low, also near 50% of 0.8539/0.8794 corrective rally. The pair is under pressure and sees increased downside risk for full reversal of the rally, on a break below 0.8646. Next supports lay at 0.86, round-figure and 0.8589 trough, below which to open key 0.8539, 07 Nov low. Yesterday’s positive close did not produce any positive action for now, with bullish divergence of RSI and MACD, being still in play and requiring break above minimum 0.8750 and regain of 0.88 barrier on the next step, to avert downside risk.

Res: 0.8700; 0.8745; 0.8762; 0.8794

Sup: 0.8646; 0.8636; 0.8589; 0.8539

AUD/NZD

The pair resumed downmove from 1.13 top after completing the first stage, 1.0980/1.1301 ascend, with fresh weakness through psychological 1.10 support, dipping to 1.0931, ticks away from key 1.0914, low of 22 Sep and 1.0907, 200SMA. However, subsequent quick bounce and close with long lower shadow Doji candle and above 1.10 level, suggests further hesitation ahead of critical supports. Corrective rally was so far capped below broken bull-trendline at 1.1040, which no marks breakpoint and should cap consolidative action before fresh attempts lower. Otherwise, break and close above 1.1040, would signal near-term bottom and sideline immediate downside risk.

Res: 1.1020; 1.1044; 1.1080; 1.1100

Sup: 1.0995; 1.0931; 1.0914; 1.0907

XAUUSD

Spot Gold remains supported and attempts again above psychological 1200 barrier, after completing consolidation at 1190, where hourly higher base is building up and is reinforced by daily Kijun-sen line. Break and close above 1200 barrier to open 1207, Fibonacci 61.8% of 1255/1131 downleg and daily 55SMA at 1213, as immediate targets. Only loss of 1180 base and 38.2% of 1146/1204 rally, would delay bulls.

Res: 1204; 1207; 1213; 1220

Sup: 1193; 1190; 1180; 1175

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Daily Market Outlook: November 19, 2014

Published 11/19/2014, 05:30 AM

Updated 02/21/2017, 08:25 AM

Daily Market Outlook: November 19, 2014

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.