EUR/USD

The euro holds overall negative tone, with near-term action moving in narrowing range, following pullback from 1.1421 high that found footstep at 1.1460, 50% of 1.1096/1.1421. Daily 10SMA and Tenkan-sen, capped corrective rally for now and while the price holds below, downside will remain vulnerable. Trigger for fresh weakness is seen on a break below 1.1460 and 1.1420, higher base and Fibonacci 61.8% retracement, to open fresh low of 26 Jan at 1.1096 and next target at psychological 1.1000 support. Close above daily 10SMA and Tenkan-sen, is required to signal fresh upside action, with break of static barriers at 1.1421, 27 Jan high and 1.1458, 16 Jan former low, to accelerate rally.

Res: 1.1366; 1.1387; 1.1421; 1.1458

Sup: 1.1300; 1.1260; 1.1220; 1.1172

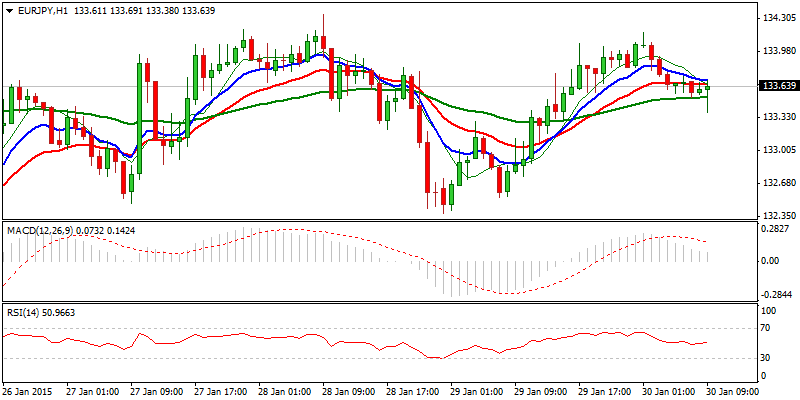

EUR/JPY

The pair trades in near-term sideways mode, entrenched within 132.40 and 134.35 range, with neutral hourly studies. However, negative tone prevails on 4-hour and daily charts, which, along with daily 10SMA that capped corrective rally, sees the upside limited for now. Attempts above initial dynamic barrier of daily Tenkan-sen, currently at 133.88, were unsuccessful so far, with sustained break here and 134.45, range top, reinforced by daily 10SMA, required to signal an end of consolidative phase and commence fresh extension of near-term recovery from 130.13 low, towards initial barriers at 134.56/68, Fibonacci 38.2% of 141.76/130.13 descend / former low of 16 Jan. Otherwise, fresh weakness could be expected on completion of consolidative phase, while 10SMA stays intact. Loss of 132.38, yesterday’s low and range floor, to confirm.

Res: 134.17; 134.35; 134.68; 135.00

Sup: 133.30; 132.73; 132.38; 131.74

GBP/USD

Cable remains under pressure in the near-term, after recovery rejection at 1.5220 zone, with fresh weakness under way and approaching psychological 1.5000 support. Past two days close in red, with descending daily 20SMA, keeping the upside capped and slide below daily 10SMA / Tenkan-sen, confirms near-term bearish scenario for attempt through 1.50 handle and retest of fresh low at 1.4950. Break here to signal an end of near-term consolidative phase and resumption of larger downtrend, towards targets at 1.4910, Fibonacci 61.8% of larger 1.3501/1.7189 ascend and 2013 higher base at 1.4830/12. Alternatively, close above daily 20SMA would sideline immediate downside risk, while break above pivotal 1.5220/67 barriers, is required to accelerate bulls for stronger correction.

Res: 1.5100; 1.5160; 1.5221; 1.5267

Sup: 1.5013; 1.5000; 1.4950; 1.4900

USD/JPY

The pair continues to trade in near-term sideways mode, congested under daily 20 SMA and daily cloud top, with range base being established at 117.20. Neutral near-term studies maintain directionless trade, however, the downside risk increases while daily cloud top continues to cap. Break below range floor to confirm an end of near-term corrective phase and shift focus towards 115.83, 16 Jan low and key 115.55 support, low of 16 Dec 2014, as well as low of short-term consolidation phase, established between fresh high at 121.83 and 115.55. Alternatively, fresh strength and eventual break above pivotal barrier at 118.85, is required to bring bulls back to play and shift focus towards barriers at120.00/80.

Res: 118.11; 118.25; 118.64; 118.85

Sup: 117.57; 117.20; 116.90; 116.55

AUD/USD

The pair remains under pressure, with near-term consolidative phase under way, following yesterday’s acceleration lower that nearly met the target at 0.7700, July 2009 low, on extension to 0.7718 so far. Strong bearish setup of larger timeframes, along with yesterday’s long red candle, suggests further downside, with break below 0.77 handle, showing no significant supports until 0.7204, Fibonacci 76.4% retracement of 0.6007/1.1079, 2008 /2011 ascend. Former low at 0.7856, also 50% of 0.8023/0.7718 downleg, should ideally cap upside attempts, with extended rallies, expected to hold below psychological 0.8000 barrier.

Res: 0.7800; 0.7856; 0.7906; 0.7940

Sup: 0.7760; 0.7718; 0.7700; 0.7650

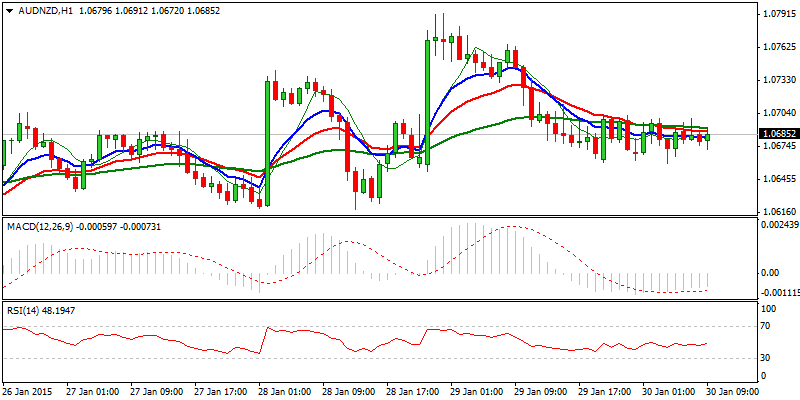

AUD/NZD

The pair remains supported by bull-trendline, drawn off 1.0350 low, which so far contained corrective pullback from fresh high at 1.0792, posted yesterday. However, near-term studies are losing traction and warn of possible extended pullback through trendline support, currently at 1.0650, towards hourly higher base and Fibonacci 38.2% of 1.0350/1.0792 upleg and 1.0571 trough and 50% retracement, where extended dips should be contained for fresh attempt higher. Otherwise, further acceleration lower would signal top at 1.1792 and trigger further retracement of rally from 1.0350, signaled by yesterday’s bearish Inside Day. Conversely, early downside rejection and violation of psychological 1.08 barrier, would open 200SMA at 1.0882.

Res: 1.0742; 1.1753; 1.0792; 1.0864

Sup: 1.0658; 1.0620; 1.0571; 1.0520

XAU/USD

Spot Gold came under increased pressure and accelerated pullback from 1307 high, to crack strong support at 1253, 200SMA and Fibonacci 38.2% retracement of 1167/1307 rally. Bearish near-term studies and yesterday’s long red candle, maintain downside risk of break through 1253 support that would open way for further retracement and confirm near-term top at 1307. Near-term consolidative phase is under way and expected to hold below 1271/74, previous low of 27 Jan and lower top and 50% retracement of 1297/1251 downleg, to keep fresh bears intact. Otherwise, break and close above here would neutralize immediate downside risk and open way for further recovery.

Res: 1263; 1271; 1274; 1280

Sup: 1257; 1251; 1246; 1240

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Daily Market Outlook: January 30, 2015

Published 01/30/2015, 04:27 AM

Updated 02/21/2017, 08:25 AM

Daily Market Outlook: January 30, 2015

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.