EUR/USD

The euro holds within a narrow-range, awaiting the verdict from today’s meeting of ECB. Near-term tone remains weak, with yesterday’s probe above daily, sideways-moving Tenkan-sen that spiked to a fresh high at 1.1680, being short-lived. Overall bearish technicals keep focus at the downside, as past few days consolidation stays capped by descending daily 10SMA, with renewed weakness through fresh 11-year low at 1.1458, expected to focus next targets at 1.1375, Nov 2003 low, ahead of Fibonacci 61.8% retracement of multi-year 0.8225/1.6039 ascend at 1.1210. Alternative scenario sees break through current range top, reinforced by daily 10SMA, required for an acceleration towards breakpoints at 1.1850, daily 20SMA at 1.1870, 12 Jan lower top, to neutralize bears and signal stronger recovery, on close above the latter.

Res: 1.1627; 1.1680; 1.1700; 1.1754

Sup: 1.1540; 1.1500; 1.1458; 1.1400

EUR/JPY

The pair recovered a good part of yesterday’s acceleration lower, which bottomed at 135.80, but yesterday’s close in red, suggests that upside attempts are sidelined for now. Overall bearish picture was reinforced by recovery action stall at descending daily 10SMA / Tenkan-sen line, seen as initial barriers to signal further rally on a break. Doji in Asian session shows quiet near-term action, ahead of ECB. Euro-positive decision is expected to accelerate higher, with close above daily 10SMA / Tenkan-sen, to open Fibonacci barriers at 138.20 and 139.00, 50% and 61.8% respectively, for possible test of breakpoint at psychological 140 barrier, reinforced by 200SMA. Conversely, fresh weakness and close below 135.80 low, to bring near-term bears back to play for retest of pivotal 134.68 support, low of 16 Jan, for fresh extension towards key med-term support and breakpoint, low of Oct 2013 at 134.12.

Res: 137.30; 137.62; 138.00; 138.77

Sup: 136.36; 135.80; 135.11; 134.68

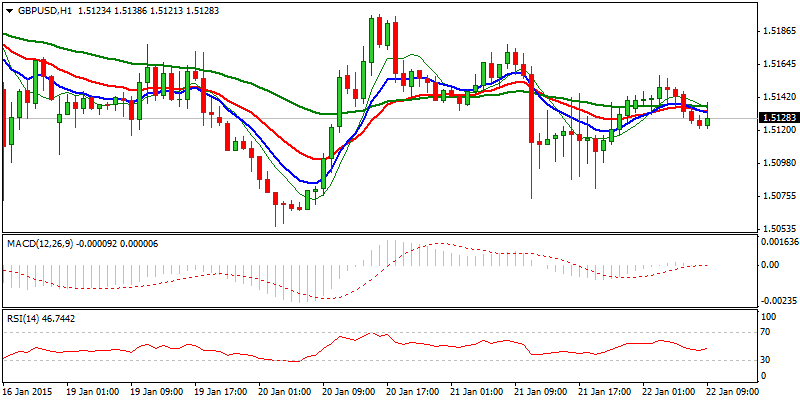

GBP/USD

Cable remains in near-term consolidative phase above fresh low at 1.5032, with upside attempts being capped at 1.5267. Overall negative picture sees downside favored and fresh push lower is expected after completion of consolidation, confirmed by neutral near-term studies and yesterday’s Doji candle. Repeated failures to close above daily 10SMA, currently at 1.5155, keep the downside under pressure. Upticks are for now seen as corrective movements while price action holds below descending daily 20SMA, currently at 1.5261. Break and close above the latter is required to sideline immediate risk of testing initial target at 1.5000 and acceleration lower, seen on a break.

Res: 1.5155; 1.5178; 1.5197; 1.5232

Sup: 1.5100; 1.5075; 1.5055; 1.5032

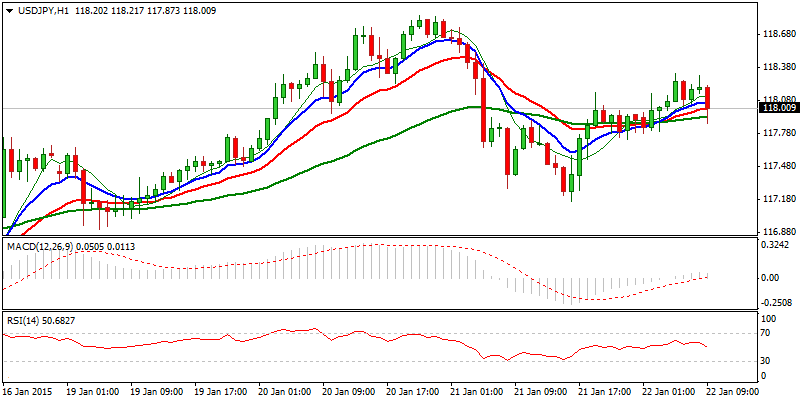

USD/JPY

The pair regains 118 handle, on a bounce from yesterday’s low at 117.16, reached on a pullback from 118.85, fresh recovery high, reinforced by daily cloud top / 20SMA. Yesterday’s close in red and weakening daily studies, keep the downside vulnerable, with increased risk of fresh weakness, seen while strong 118.85 barrier caps. On the other side, positively aligned near-term studies see room for renewed attempts towards 118.85 breakpoint, close above which to confirm trough at 117.16 and trigger fresh acceleration higher. Otherwise, repeated rejection at 118.85 would signal renewed weakness, with firm bearish tone to be established on sustained break below 117.16.

Res: 118.32; 118.85; 119.30; 120.00

Sup: 117.73; 117.16; 116.90; 116.31

AUD/USD

Yesterday’s strong acceleration lower left lower top at 0.8232, to nearly fully retrace corrective rally from 0.8031 to 0.8292. Near-term studies turned bearish, with negative setup of daily chart technicals, keeping focus at initial 0.8031 support, violation of which to signal an end of near-term consolidative phase and resumption of larger downtrend towards immediate targets at psychological 1.50 level and 0.7945, Fibonacci 61.8% retracement of multi-year 0.6007/1.1079 ascend. Only recovery and close above 0.82 barrier would sideline immediate downside risk .

Res: 0.8110; 0.8150; 0.8200; 0.8232

Sup: 0.8054; 0.8031; 0.8000; 0.7945

AUD/NZD

The pair maintains positive near-term tone and is about to complete near-term consolidation under fresh high at 1.0730, confirmed by yesterday’s Doji. Positively aligned daily technicals, with indicators and 10/20SMA’s heading north and price attempting above 55SMA, which for now capped upside attempts, see scope for further recovery. Daily close above 1.07 barrier and 55SMA, is required to confirm and shift focus towards next strong barriers at 1.0865, 08 Dec lower top and 1.0888, 200SMA. Alternatively, repeated upside rejection would signal prolonged consolidative phase, with current range floor at 1.0662, offering solid support. Only extension and close below the latter and 1.0630 zone, previous tops and Fibonacci 38.2% of 1.0471/1.0730 upleg, would question near-term bulls.

Res: 1.0730; 1.0754; 1.0800; 1.0843

Sup: 1.0662; 1.0630; 1.0600; 1.0570

XAU/USD

Spot gold trades in near-term consolidative mode, off fresh high at 1305, posted on a probe above psychological 1300 barrier. Yesterday’s Doji signals hesitation at 1300 handle, as the price failed to close above here, suggesting further consolidation before fresh attempt higher. Dips were so far contained at initial 1284 support, with further easing not ruled out as near-term studies are losing traction. Ideally, extended dips should be contained at 1274/72 zone, Fibonacci 38.2% of 1225/1305 upleg / higher base, to prevent stronger corrective pullback. Fresh strength through 1300 barrier, is expected to open next targets at 1322/24, lower tops of 08 Aug / 17 July 2014, ahead of key barrier at 1344, 10 July 2014 lower top of larger descend from 1392. Golden cross of 10/200SMA’s at 1255, also double-Fibonacci, 38.2% of 1167/1305 rally and 61.8% of 1225/1305, underpins the action.

Res: 1295; 1305; 1310; 1322

Sup: 1284; 1281; 1272; 1265

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Daily Market Outlook: January 22, 2015

Published 01/22/2015, 04:18 AM

Updated 02/21/2017, 08:25 AM

Daily Market Outlook: January 22, 2015

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.