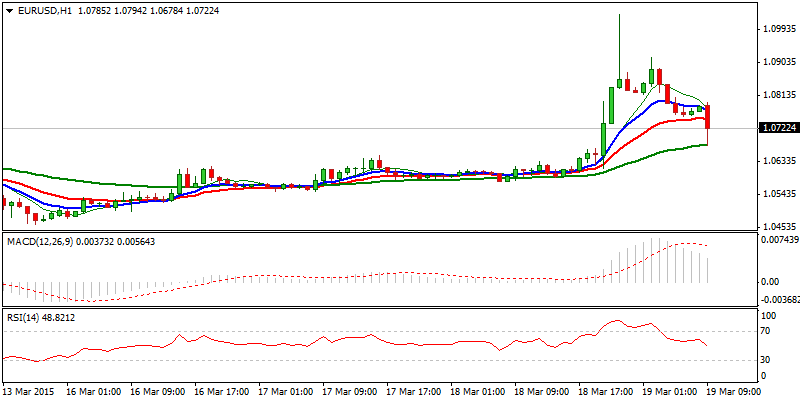

EUR/USD

The euro reverses off fresh highs and slips below 1.08 handle, following yesterday’s rally on dovish Fed that briefly probed above 1.10 barrier. Bullish tone has been established on near-term studies, as strong rally cracked Fibonacci 61.8% retracement level of 1.1378/1.0461 descend, with subsequent pullback finding temporary support just above 50% retracement of 1.0461/1.1003 corrective rally, where ascending hourly 20EMA and sideways-moving daily Tenkan-sen reinforce support. On the other side, near-term direction is still uncertain. The pair broke above daily 10SMA that reinforces next support at 1.0680, Fibonacci 61.8% of 1.0461/1.1036, while descending daily 20SMA, currently at 1.0952, continues to cap, after being dented on yesterday’s rally. Tone on daily studies remains negative and sees increased downside risk in case of further easing and close below daily 10SMA that would signal lower top formation. Otherwise, close above daily 20SMA, would keep the upside focused for fresh attempts higher.

Res: 1.0795; 1.0850; 1.0918; 1.0952

Sup: 1.0700; 1.0680; 1.0650; 1.0580

EUR/JPY

The pair erased over 50% of yesterday’s strong rally that peaked at 131.68, where daily 20SMA / Tenkan-sen line capped the rally, on fresh acceleration of the pullback from 131.68 high. Positive near-term tone, regained on the rally, is fading, as the price slides below broken daily 10SMA, as well as 129 handle, former pivotal barrier. Former higher base at 128 zone marks next strong support, with break here to confirm an end of corrective phase, as daily studies maintain bearish tone. Alternative scenario requires regain and close above daily 20SMA, to signal fresh recovery.

Res: 129.14; 129.57; 130.02; 130.83

Sup: 128.25; 128.10; 127.65; 127.30

GBP/USD

Cable spiked to 1.5160 on post-Fed’s rally, where rally was capped by daily Ichimoku cloud base and daily 20SMA and subsequent quick pullback erased part of earlier gains on a daily close below psychological 1.50 level. Asian session and beginning of European trading saw further easing that returns below broken daily 10SMA and extension below strong support at 1.4850 zone, former double-top and near Fibonacci 61.8% of 1.4633/1.5160 rally. Close below here to signal lower top formation and shift near-term focus lower, as daily technicals remain bearish. Alternative scenario requires fresh strength and close above daily 20SMA, to confirm reversal.

Res: 1.4850; 1.4906; 1.4935; 1.5008

Sup: 1.4770; 1.4722; 1.4697; 1.4633

USD/JPY

The pair dipped below 120 support on yesterday’s post-Fed dollar’s bearish acceleration, ending near-term consolidative phase and sidelining immediate attempts at fresh high at 122.01. Yesterday’s close in long red candle, after triple Doji, signals weakening of near-term tone, however, quick recovery above 120.60, former pivotal support and Fibonacci 61.8% of 121.39/119.28 fall, keeps in play hopes of renewed attempts higher. Near-term studies are still negative, with indicators in strong ascend and daily bulls remain intact that supports the notion. Daily 20SMA , currently at 120.15, now acts as support, with close above daily 10SMA at 121.06, also former consolidation floor, required to confirm higher low at 119.28 and re-focus the upper targets.

Res: 120.89; 121.06; 121.39; 121.65

Sup: 120.43; 120.15; 119.66; 119.28

AUD/USD

The pair returned to the negative near-term mode on acceleration of the pullback from yesterday’s spike high at 0.7845. Quick reversal to 0.7740, where yesterday’s close occurred and today’s fresh acceleration below 0.7687, Fibonacci 61.8% of 0.7589/0.7845 rally, softens near-term tone and increases risk of full retracement of yesterday’s rally that would put fresh low of 11 Mar at 0.7558, under strong pressure. Bearish acceleration tests broken daily 10SMA, with close below here to confirm negative scenario, as daily studies remain bearish. Conversely, return above daily 20SMA, currently at 0.7740, would keep alive hopes of fresh recovery attempts.

Res: 0.7700; 0.7740; 0.7806; 0.7845

Sup: 0.7650; 0.7600; 0.7558; 0.7537

AUD/NZD

The cross closed in red yesterday’s, offsetting positive signals of previous day’s Outside day pattern. Fresh attempts at the lower boundary of near-term congestion at 1.0322, low of 17 Mar, increase risk of retest of 1.0279 low and fresh attempts lower, as near-term studies are negative. The notion is supported by bearish daily studies and only close above daily 20SMA, currently at 1.0390, would delay immediate downside risk. Close above yesterday’s high at 1.0435, would neutralize near-term bears and signal fresh recovery attempts.

Res: 1.0390; 1.0415; 1.0435; 1.0500

Sup: 1.0337; 1.0300; 1.0279; 1.0250

XAU/USD

Spot Gold rallied to 1177 high yesterday, to neutralize immediate downside risk, seen on recent extension to 1142 low and cracked former range’s upper boundary at 1175. The rally turned near-term studies positive and shifted focus higher. Corrective easing is expected to ideally find support at 1165, 16 Mar former lower top and Fibonacci 38.2% of 1142/1177 rally, before fresh attempts higher. Yesterday’s high at 1177, marks initial resistance, ahead of daily 20SMA, currently at 1181, close above which is required to confirm recovery. Alternatively, fresh weakness and close below 1159, daily 10SMA / previous high of 17 Mar, to signal an end of recovery attempt and shift focus lower.

Res: 1173; 1177; 1181; 1189

Sup: 1165; 1159; 1156; 1150

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Thursday's Daily Market Outlook: Euro Reverses Off Fresh Highs

Published 03/19/2015, 04:46 AM

Updated 02/21/2017, 08:25 AM

Thursday's Daily Market Outlook: Euro Reverses Off Fresh Highs

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.