EUR/USD

The euro continues to trade within 3-week range, holding neutral tone of near-term technicals. Yesterday’s rally that ended day in Hammer candlestick could be a bullish signal in case of close above pivotal 1.1450 high, ceiling of narrower 1.1320/1.1450 range, reinforced by daily Kijun-sen line, to open key near-term resistance at 1.1532, 03 Feb high and the upper boundary of 1.1260/1.1532 range and signal resumption of recovery rally from 1.096 low. Otherwise, expect prolonged directionless trade, with increased risk of return to the range floor, seen on a break below 1.1350, daily 20SMA.

Res: 1.1450; 1.1497; 1.1532; 1.1565

Sup: 1.1390; 1.1350; 1.1332; 1.1320

EUR/JPY

The cross trades around the midpoint of near-term 136.68/133.92 range, with neutral tone dominating in near-term studies. Immediate support was found at daily Tenkan-sen-line at 135.05, protecting pivotal supports at 134.35, daily 20SMA and 133.92, 17 Feb low and consolidation floor. Daily technicals are mixed and no clear direction to be seen while range boundaries hold. Contracting daily 20d Bollingers support extended near-term range trading.

Res: 135.90; 136.22; 136.68; 137.00

Sup: 135.05; 134.70; 134.35; 133.92

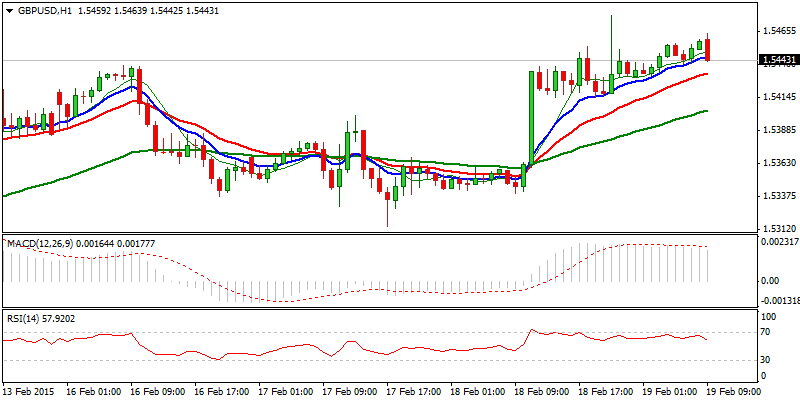

GBP/USD

Yesterday’s fresh rally that broke above previous high at 1.5438 and also cleared Fibo 76.4% barrier at 1.5460, ended day in long green candle, confirming resumption of recovery rally from 1.4950 low. Strong bullish setup on all timeframes keeps the upside in focus, with fresh extension higher targeting 1.5526, daily Ichimoku cloud top, with break here, expected to open 1.5607/18, daily 100SMA, pivotal lower top of 31 Dec 2014. Corrective dips should be contained by ascending daily 10SMA and daily Tenkan-sen line at 1.5330 zone.

Res: 1.5478; 1.5500; 1.5526; 1.5585

Sup: 1.5414; 1.5375; 1.5330; 1.5315

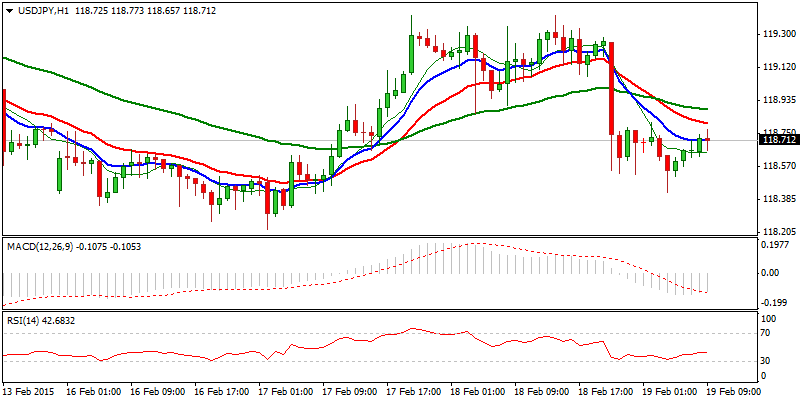

USD/JPY

Near-term structure remains weak, with yesterday’s fresh acceleration lower, leaving temporary platform at 119.40 zone. However, key near-term supports at 118.37/25, daily 20SMA / 16/17 Feb lows / Fibonacci 61.8% of 116.86/120.46, stay intact for now, suggesting extended consolidation, as positive tone still exists on daily studies. Break above 119.40 platform and near-term consolidation top, is required to confirm higher low at 118.25 and re-focus 120.00/46 targets. Otherwise, completion of 4-hour H&S pattern and fresh acceleration higher, could be expected on sustained break below 118.25 handle and 118.15, daily Kijun-sen line.

Res: 119.00; 119.40; 119.60; 120.00

Sup: 118.37; 118.25; 118.15; 117.71

AUD/USD

The pair dipped from fresh high at 0.7841 and probed below 0.78 handle, after news of possible Australia’s credit rating downgrade was released. Yesterday’s Doji and close below daily 20SMA, keep the upside attempts limited for now, despite still positive tone of near-term studies. Close above 20SMA is required to open pivotal 0.7874 barrier, high of 06 Feb, to end near-term consolidative phase and trigger stronger correction. Otherwise, expect prolonged sideways trade, as setup of larger timeframes studies remains negative.

Res: 0.7829; 0.7841; 0.7874; 0.7900

Sup: 0.7772; 0.7740; 0.7723; 0.7700

AUD/NZD

The pair remains under pressure, with fresh acceleration through previous low at 1.0327 and completion of near-term 1.0327/1.0390 consolidative phase and testing psychological 1.03 support. Overall negative structure keeps the downside focused, with loss of 1.03 handle and 1.0285, low of 1997, expected to target parity level in the near-term. Consolidation top, also week’s high after gap-lower opening, marks strong support and should limit corrective attempts.

Res: 1.0327; 1.0357; 1.0390; 1.0425

Sup: 1.0300; 1.0285; 1.0250; 1.0200

XAU/USD

Spot Gold left bullish Hammer yesterday, after cracking strong 1200 zone support, on extension to fresh low at 1197. Quick recovery that made the break short-lived and daily close well above 1200, keep ascending daily Ichimoku cloud top intact and acting as strong support. Fresh recovery tested initial barrier at 1216, former low / daily 100SMA. Sustained break here to confirm near-term recovery and open descending daily 10SMA, currently at 1224, close above which to mark near-term bottom. However, negative setup on daily studies, keeps larger downtrend intact for now, with current rally seen as corrective phase, before fresh leg lower. Only regain of 1236 lower top would neutralize larger bears and signal stronger correction.

Res: 1217; 1224; 1229; 1233

Sup: 1210; 1205; 1200; 1197

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Daily Market Outlook: EUR/USD, EUR/JPY, GBP/USD

Published 02/19/2015, 04:15 AM

Updated 02/21/2017, 08:25 AM

Daily Market Outlook: EUR/USD, EUR/JPY, GBP/USD

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.