EUR/USD

The euro return to directionless mode after past two days bumpy ride and consolidates around 1.14 handle. The pair rallied yesterday, after Monday’s fall found support above 1.13 level and subsequent bounce cracked pivotal 1.1443 barrier, high of 13 Feb. Neutral near-term mode is expected to persist, while the price holds within narrowed 1.1319/1.1449 amplitude, keeping the wider range of 1.1260 and 1.1532 intact. Contracting 20d Bollingers support the scenario, with break of either side required to define near-term direction. Greece remains in focus and is expected to be the main driver of the pair.

Res: 1.1425; 1.1449; 1.1497; 1.1532

Sup: 1.1380; 1.1365; 1.1337; 1.1319

EUR/JPY

The cross bounced from 134 zone, where temporary support was found, keeping daily 20SMA as good support. Yesterday’s rally to 136.22 high, averts risk of further easing, with near-term focus being shifted towards the upside. Near-term technicals regained traction for possible attack at pivotal 136.68 high, posted on 11 Feb, break of which to resume recovery rally from 130.13 low, towards next breakpoint at 137.63, lower top of 20 Jan, also Fibonacci 38.2% of 149.76/130.13 descend. On the other side, upside rejection would signal extended consolidative phase. Conversely, loss of 134 handle would complete failure swing and risk stronger weakness.

Res: 136.22; 136.68; 137.00; 137.63

Sup: 135.44; 135.00; 134.77; 134.40

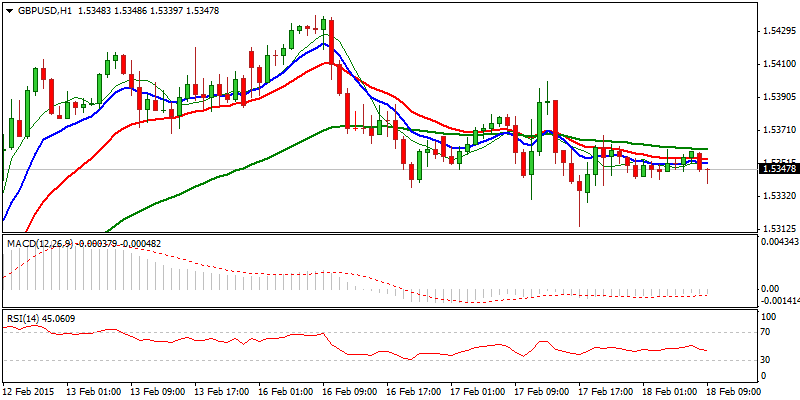

GBP/USD

Near-term picture shows the pair still under pressure and keeps in play risk of attempt through pivotal 1.53 level, as the price action remains under descending daily cloud base. However, overall positive tone and yesterday’s Doji, suggest further consolidation above 1.53 handle would likely precede fresh attempts higher. Return above yesterday’s high at 1.54 level, is required to open 16 Feb high at 1.5438, for resumption of recovery rally from 1.4950 low. Alternatively, fresh weakness below 1.5315, yesterday’s low and daily Tenkan-sen line and 1.5295, Fibonacci 61.8% retracement of 1.5207/1.5438 upleg / former high of 11 Feb,, would signal further easing and re-focus pivotal 1.52 higher base.

Res: 1.5367; 1.5400; 1.5438; 1.5460

Sup: 1.5315; 1.5395; 1.5262; 1.5207

USD/JPY

The pair left near-term base at 118.25, where daily 20SMA contained pullback, after yesterday’s strong rally broke above daily cloud top and peaked at 119.40. Consolidation under fresh high so far holds above daily cloud top, keeping the upside in near-term focus. Positive tone of daily studies supports the notion, however, caution is required, as near-term studies are positive/neutral and fresh penetration of cloud top would risk return to 118.25 base, break of which to complete 4-hour H&S pattern and risk further easing. Conversely, holding above the cloud top, would keep upside targets in focus, with break above 119.40 high, to confirm near-term bulls for attack at psychological 120 barrier and pivotal 120.46, high of 11Feb.

Res: 119.40; 119.60; 120.00; 120.46

Sup: 118.86; 118.66; 118.25; 118.15

AUD/USD

Near-term tone remains positive, as the pair gradually extends recovery rally off 0.7642 higher low and consolidates above psychological 0.78 level, which now acts as initial support. Yesterday’s positive close supports near-term bulls, however, close above descending daily 20SMA is required to confirm bulls and open pivotal 0.7874, high of 06 Feb. Break here to confirm double-bottom formation and signal correction. Otherwise, prolonged consolidative phase is expected to precede fresh push lower, as overall tone remains bearish.

Res: 0.7829; 0.7874; 0.7900; 0.7958

Sup: 0.7800; 0.7740; 0.7723; 0.7700

AUD/NZD

The pair continues to trade in near-term consolidative phase, off fresh low at 1.0327, posted on 16 Feb, with neutral hourly studies and week’s high at 1.0390, limiting the range for now. Studies of 4-hour chart remain negative, as overall picture is bearish, suggesting further weakness, after completion of consolidative phase. Low of 1997 at 1.0285 is seen as immediate target, with extension to parity level, viable in the near-term. Extended consolidation, with stronger upticks, could be expected in case of filling Monday’s gap.

Res: 1.0390; 1.0400; 1.0425; 1.0450

Sup: 1.0350; 1.0327; 1.0300; 1.0285

XAU/USD

Spot Gold consolidates above daily cloud top at 1202, the upper part of strong support zone between 1202 and 1198, after yesterday’s acceleration lower and loss of previous low and daily 100SMA at 1216. Yesterday’s long red candle signals further easing, as overall tone remains bearish and widening 20D Bollingers suggest further easing. Key support zone: Daily Cloud top / Fibonacci 76.4% of 1167/1307 and Fibonacci 61.8% of 1131/1307, is seen as a trigger for further retracement of the rally from 1131, with higher base at 1170 zone, seen as next target on acceleration lower. Near-term consolidative phase should be ideally capped at 1216 barrier, while extended rallies are expected to face next strong barrier at 1228, former low and daily 10/55SMA’s bear cross.

Res: 1211; 1216; 1224; 1228

Sup: 1206; 1202; 1200; 1198