EUR/USD

The euro returned above 1.05 handle, on profit-taking rally, following last Friday’s weakness that posted fresh 12-year low at 1.0461. Strong bearish tone remains in play, confirmed by long red candles on daily / weekly charts, keeping focus at the downside and showing so far no signals of reversal, despite oversold daily studies. Corrective rally is expected to find ideal barrier at 1.06 zone, former hourly base and Fibonacci 61.8% of 1.0682/1.0461 downleg, before fresh attempts lower. Break below 1.0461 to open 1.0420, Fibonacci 138.2% projection of the downleg from 1.0682, then 1.0376, Fibonacci 161.8% projection, ahead of 1.0335, Jan 2003 low and 1.0206, July 2002 high, with parity level already in sight. Only break above last week’s high at 1.0682, also 50% retracement of 1.0905/1.0461 descend, would sideline immediate bears and look for stronger corrective rally.

Res: 1.0565; 1.0638; 1.0682; 1.0700

Sup: 1.0500; 1.0461; 1.0420; 1.0376

EUR/JPY

The pair bounces on profit-taking action off last Friday’s fresh low at 126.89, after bears cracked psychological 127 support. Daily/weekly close in red, maintains strong bearish tone, as weekly close below Fibonacci 38.2% retracement of larger 94.10/149.76 rally, signals fresh extension of corrective pullback from 149.76, Dec 2014 peak. Corrective rally is expected to ideally reverse at 128.22, Fibonacci 61.8% of 129.05/126.89 downleg, for fresh attempts lower. Only close above lower platform at 129.05, would delay immediate bears and signal stronger correction.

Res: 128.00; 128.22; 128.55; 129.05

Sup: 127.30; 127.00; 126.89; 126.23

GBP/USD

Cable remains under strong pressure, as last Friday’s acceleration lower took out strong support zone at 1.4830/12, 2013 lows, with fresh weakness closing the day in long red candle at 1.4730, after 1.47 support was cracked. Also, the second strong weekly bearish close, confirms overall negative sentiment. The pair focuses next target at 1.4371, Fibonacci 76.4% retracement of 1.3501/1.7189, 2009/2014 ascend. Corrective rally on oversold near-term studies, looks limited for now. Initial barriers lay at 1.4822/48, Fibonacci 38.2% retracement of 1.5025/1.4697 downleg / former low of 12 Mar, while only extension above 1.49, double Fibonacci barrier and former hourly lower platform, would extend near-term corrective rallies and put immediate bears on hold.

Res: 1.4800; 1.4822; 1.4848; 1.4900

Sup: 1.4746; 1.4697; 1.4650; 1.4600

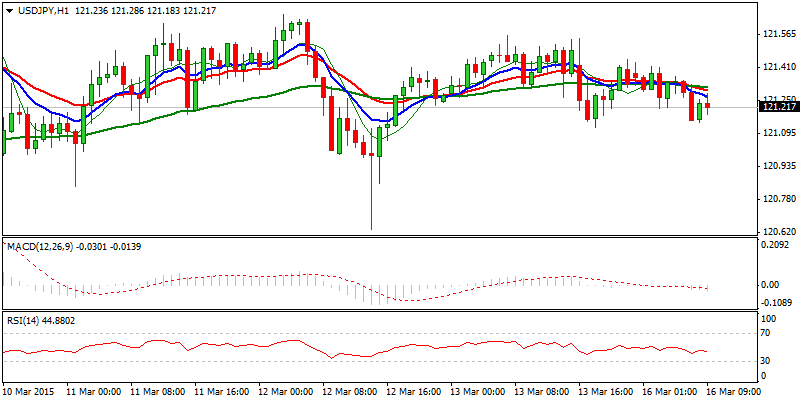

USD/JPY

The pair remains in consolidative mode, with near-term studies holding neutral tone and Friday’s trade ended in Doji candle. Former high at 121.83, marks strong barrier for now and caps rallies, as several attempts higher, so far failed to close above here. However, overall bulls remain firmly in play and keep the upside in focus, with consolidative phase being for now contained at strong 120.60 support, Fibonacci 38.2% of 118.29/122.01 upleg, reinforced by ascending daily 10SMA/Tenkan-sen line and only losing this support would signal corrective action. Initial support lies at psychological 121 level, also 4-hour Ichimoku cloud top, while extension below 120.60 handle is expected to open former high at 120.46/25, ahead of psychological 120 support, also Fibonacci 38.2% of 116.86/122.01 rally, reinforced by daily Kijun-sen line. On the upside, rally through initial barrier at 121.83/122.01, to signal resumption of larger uptrend that focuses 124.14, June 2007 high.

Res: 121.65; 121.83; 122.00; 122.50

Sup: 121.00; 120.60; 120.46; 120.00

AUD/USD

The pair remains at the back foot, following Thursday’s corrective rally rejection at 0.7730 and Friday’s fresh weakness that ended in red, with upside attempts being capped at 0.7708, by descending daily 10SMA and sideways-moving Tenkan-sen line, levels that mark initial layers of resistance and near-term breakpoints. Overall tone remains bearish, with near-term studies further weakening on Friday’s fall to 0.76 zone, keeping the downside in focus for eventual return to key 0.7558 support, low of 11 Mar. Completion of 0.7558/0.7730 corrective phase, to signal resumption of larger downtrend.

Res: 0.7666; 0.7691; 0.7730; 0.7740

Sup: 0.7608; 0.7600; 0.7558; 0.7500

AUD/NZD

The cross comes under pressure after bounce from 1.0352, low of 12 Mar, stalled at 1.0450 and subsequent weakness loses 1.04 handle and approaches pivotal 1.0352 support. Near-term studies are regaining bearish tone, with Friday’s close in red and today’s slide below daily 20SMA, confirming negative stance. Daily bearish momentum is building, signaling further acceleration lower, with close below pivotal 1.0352 low and temporary support, expected bring key near-term support at 1.0279, low of 04 Mar. On the upside, session high at 1.04 zone, reinforced by daily Tenkan-sen, marks initial barrier, while close above Friday’s high at 1.0450 is required to shift near-term focus higher.

Res: 1.0400; 1.0432; 1.0450; 1.0500

Sup: 1.0352; 1.0300; 1.0279; 1.0250

XAU/USD

Spot Gold trades in near-term consolidative mode off fresh low at 1147, with rallies being for now capped at 1166, Fibonacci 38.2% retracement of 1197/1147 downleg. Hourly studies hold neutral tone, suggesting extended consolidative phase, before fresh attempts lower, as daily/weekly studies maintain strong bearish tone. Weekly close in red confirm negative stance. Fresh weakness through 1147 low to open 1142/37, 01 Dec 2014 low / Fibonacci 261.8% projection of the downleg from 1223, ahead of key med-term support at 1131, low of 07 Nov 2014. However, extension above 1166 high, would delay and expose pivotal 1175 barrier, lower top of 09 Mar and Fibonacci 38.2% retracement of 1223/1147 descend.

Res: 1164; 1166; 1170; 1175

Sup: 1158; 1153; 1147; 1142

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Daily Market Outlook: EUR/USD, EUR/JPY, GBP/USD, USD/JPY

Published 03/16/2015, 05:14 AM

Updated 02/21/2017, 08:25 AM

Daily Market Outlook: EUR/USD, EUR/JPY, GBP/USD, USD/JPY

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.