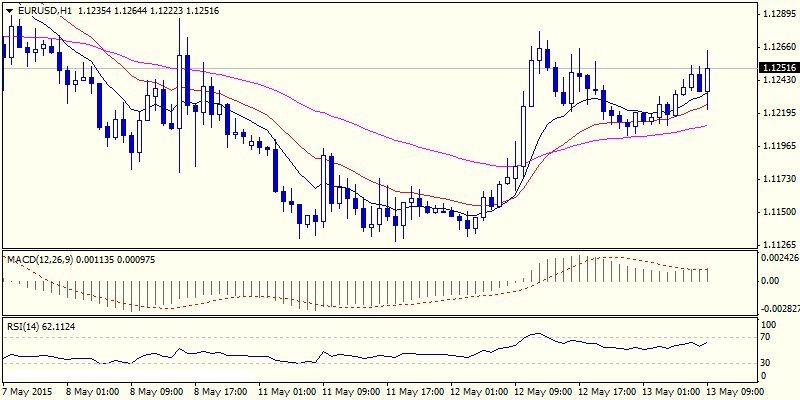

EUR/USD

Today’s upside attempts from late NY’s hourly higher base at 1.1205, reinforced by daily 10/100SMA bull-cross, and so far holds below initial resistance at 1.1277, yesterday’s high, keeping intact breakpoint at 1.1290, Fibonacci 61.8% retracement of 1.1390/1.1130 pullback and lower top of 08 May. Neutral near-term technicals see scope for prolonged consolidation, before larger bulls re-assert for final attack at key 1.1390/1.1450 barriers. Initial sup/res lay at 1.1205/1.1290, with loss of 1.1200 handle, expected to expose pivotal higher base at 1.1130, while sustained break above 1.1290 opens 1.1390, 07 May peak.

Res: 1.1200; 1.1216; 1.1230; 1.1290

Sup: 1.1205; 1.1185; 1.1165; 1.1130

EUR/JPY

The cross formed hourly base at 133.47, where yesterday’s weakness found support, averting immediate risk of testing breakpoint at 133.09 higher low of 05 May, below which to trigger stronger correction of 126.08/135.98 rally. Price action remains underpinned by rising daily Tenkan-sen at 133.64, with daily 100SMA containing today’s price action. Overall tone remains bullish, with fresh acceleration higher and regain of minimum 135 barrier, Fibonacci 61.8% of 135.98/133.47 downleg, required to confirm near-term bulls for further recovery.

Res: 134.72; 135.00; 135.33; 135.98

Sup: 134.22; 134.00; 133.74; 133.47

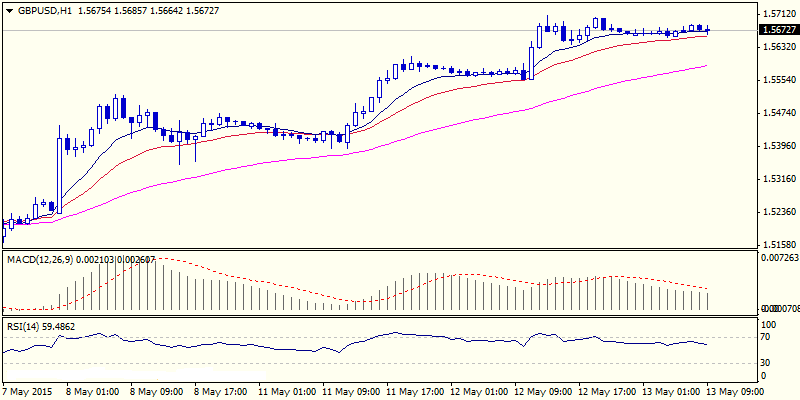

GBP/USD

Cable remains well supported and extended rally from 1.5088 trough, to finally break and close above daily 200SMA and crack 1.5700, round-figure resistance. Strong bullish tone dominates on all timeframes and favors further upside, with fresh attempts higher, to be preceded by consolidation, as near-term studies are overbought. Session lows at 1.5657 mark immediate support, ahead of daily 200SMA at 1.5627 and former peak / yesterday’s low at 1.5551/55, expected to contain. Otherwise, deeper pullback could be expected on sustained break here, as daily studies are overbought, however, no reversal signal being generated yet.

Res: 1.5709; 1.5728; 1.5750; 1.5800

Sup: 1.5650; 1.5627; 1.5551; 1.5520

USD/JPY

Failure to sustain break above psychological 120 barrier and subsequent pullback that closed below, maintain weak/neutral near-term tone and favor further range trading, as short-term price action remains entrenched within 118.50/120.83 range. Fresh dips so far hold above pivotal 119.57/50 support are, higher low of 08 May / Fibonacci 61.8% of 119.04/120.26 rally and daily 20SMA, loss of which to weaken near-term structure. On the upside, 120 marks initial resistance, ahead of yesterday’s 120.26 peak and 120.50 lower top. Renewed attempts and close above 120 level, are needed to give positive signals.

Res: 120.00; 120.26; 120.50; 120.83

Sup: 119.70; 119.50; 119.04; 118.50

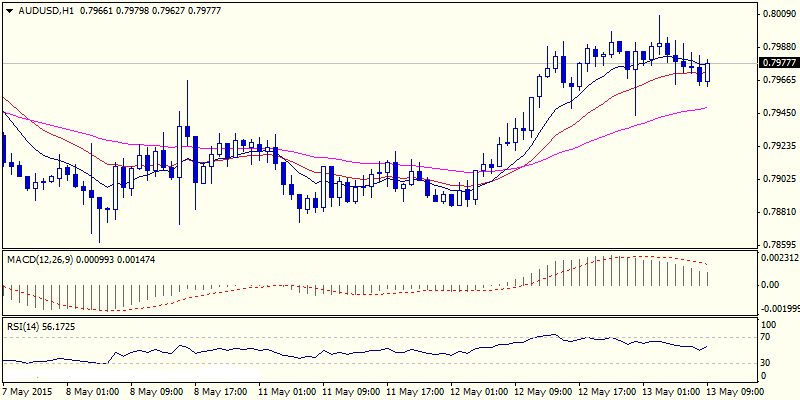

AUD/USD

The pair maintains positive near-term tone, following yesterday’s rally and today’s fresh extension higher that probed above psychological 0.80 barrier, Near-term price action consolidates within 0.7860/0.8008 range, with positively aligned near-term studies, favoring fresh attempts above 0.80 and attack at 0.8028, 06 May lower top, to open way for re-test of key short resistance ad range top at 0.8073, peak of 29 Apr. Bullish daily studies support the notion. Initial support lies at 0.7960, ahead of 0.7932, Fibonacci 61.8% of yesterday’s rally, loss of which would soften near-term tone.

Res: 0.8008; 0.8028; 0.8073; 0.8100

Sup: 0.7960; 0.7932; 0.7900; 0.7885

AUD/NZD

The cross enters near-term correction after yesterday’s fresh extension of larger uptrend that peaked at 1.0880. Quick pullback so far found footstep at 1.0765, keeping intact pivotal daily 200SMA at 1.0711. Overall strong bullish tone keeps the upside in focus, as yesterday’s rally closed above strong barriers at 1.0892, January’s former annual peak and 1.0810, Fibonacci 61.8% of larger 1.1301/1.0016 descend that gives positive signals for further acceleration. Pullback was triggered by overbought near-term studies and potential extension below 200SMA, should find next solid support at 1.0570, 07/08 May higher base / Fibonacci 38.2% of 1.0033/1.0880 rally.

Res: 1.0800; 1.0842; 1.0900; 1.0987

Sup: 1.0765; 1.0711; 1.0680; 1.0650

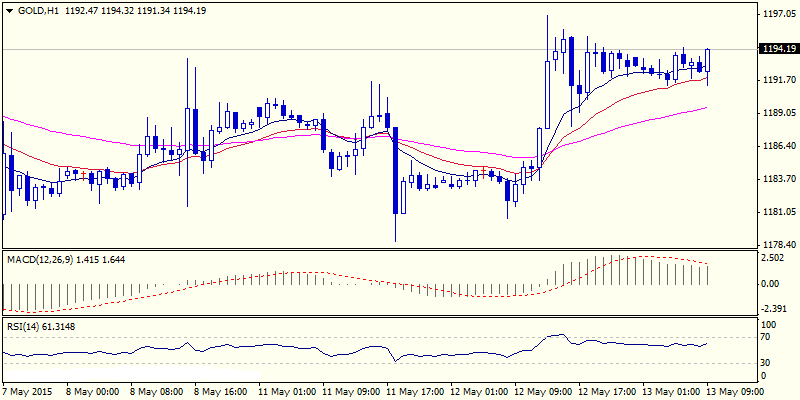

XAU/USD

Near-term structure shows signals of improvement, following yesterday’s rally that peaked at 1197 and closed at 1193, daily 20SMA. Immediate consolidation holds between 1191 and 1197 range, with fresh upside attempts to remain in play while 1191 support, also daily cloud base, holds. Attempts above psychological 1200 barrier are required to move daily indicators from neutral territory and signal further recovery. Otherwise, renewed weakness and holding below daily 20SMA, to confirm directionless mode, but to shift near-term risk lower. Higher base at 1178 offers initial support, ahead of short-term range bottom at 1170.

Res: 1197; 1200; 1207; 1215

Sup: 1191; 1188; 1183; 1180

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Cable Remains Well Supported And Extended Rally From 1.5088

Published 05/13/2015, 04:25 AM

Updated 02/21/2017, 08:25 AM

Cable Remains Well Supported And Extended Rally From 1.5088

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.