First-time claims for U.S. unemployment benefits showed a notable decrease in the week ended February 4th, according to a report released by the Labor Department on Thursday. The report showed that initial jobless claims fell to 358,000 from the previous week's revised figure of 373,000. While, Wholesale inventories in the U.S. increased by much more than anticipated in the month of December, according to a report released by the Commerce Department on Thursday, with the report also showing a notable increase in wholesale sales. The report showed that wholesale inventories increased by 1.0 percent in December after coming in unchanged in November.

An index measuring prices for corporate goods in Japan increased at a slower pace in January, data from a survey by the Bank of Japan showed Friday. The corporate goods price index for the domestic market increased at a slower rate of 0.5 percent in January than the previous month's 1.2 percent growth, which was revised down from 1.3 percent. On the other hand, China’s exports fell and imports slid more than forecast in January, the first declines in two years, as a weeklong holiday disrupted trade and commodity prices dropped. Overseas shipments decreased 0.5 percent from a year earlier, the customs bureau said on its website today. Imports dropped 15.3 percent that left a greater-than-forecast trade surplus of $27.3 billion, a six-month high, the data showed.

The European Central Bank left its record low interest rate unchanged for the second month in a row given the weaker economic outlook and the protracted debt crisis as well as the upcoming second offering of long-term loans at the end of the month. The Governing Council led by ECB President Mario Draghi decided to maintain the main refi rate at 1 percent following its meeting in Frankfurt.

European finance ministers held back a rescue package for Greece in a rebuff that left lawmakers in Athens under government pressure to endorse a newly minted austerity plan or exit the euro. “In short: no disbursement without implementation,” Luxembourg Prime Minister Jean-Claude Juncker said in Brussels late yesterday after chairing emergency talks of euro-area policy makers. He set another extraordinary meeting for Feb. 15, according to an article published by Bloomberg Friday.

EUR/USD: The pair reached a peak of 1.3318 intra trade Thursday, after the ECB has decided to keep its key lending rate unchanged for another month and after news of an agreement between Greek political parties. However, later on the American trading session, news came out that EU leaders will not approve more bailout funds until the deal is ratified by the Greek Parliament and the pair started to decline. Today, EUR/USD is trading at 1.3260 at the time of writing and is more likely to continue its decreasing trend to test the support level of 1.3214 as EU leaders said the Troika will not approve more bailout funds until the deal is ratified by Greek Parliament, sending signal of doubts on the market. Investors should keep an eye on the release of the U.S trade balance figures at 13:30 GMT and the speech of the Fed Chairman Bernanke scheduled at 17:30 GMT, where positive figures and news might drag the pair down. The resistance level is at 1.3318 and the support level is at 1.3214. Prudence recommended. EUR/USD:" title="EUR/USD:" width="613" height="295">EUR/CAD: Trading on the pair was very sticky Thursday, as uncertainties surrounding the Greek debt deal and lack of fundamentals pushed investors to adopt a wait and see approach. Today, the pair is trading in narrow range of 1.3227 - 1.3208 in Asia. It seems that the pair will keep fluctuating within the resistance level of 1.3238 and the support level 1.3181, ahead of the release of the trade balance figures in Canada scheduled at 13:30 GMT. The trade balance figure is expected to come at 0.7 billion compared to a previous reading of 1.1 billion. A higher than expected reading should be taken as positive for the CAD, while a lower than expected reading should be taken as negative for the CAD. With regards to Euro, selling pressure are being noted across the markets on the currency following the comments of EU leaders, that they will not approve more bailout funds until the deal is ratified by the Greek Parliament, sending signal of doubts on the market. The resistance level is at 1.3238 and support level is at 1.3181. Investors should remain cautious.

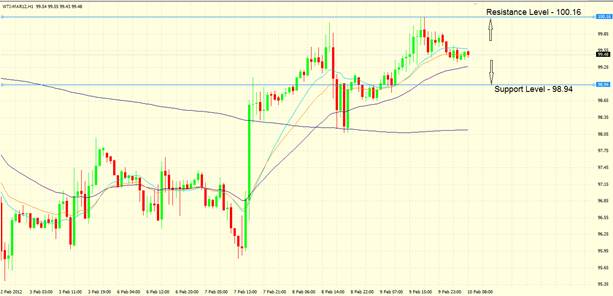

EUR/USD:" title="EUR/USD:" width="613" height="295">EUR/CAD: Trading on the pair was very sticky Thursday, as uncertainties surrounding the Greek debt deal and lack of fundamentals pushed investors to adopt a wait and see approach. Today, the pair is trading in narrow range of 1.3227 - 1.3208 in Asia. It seems that the pair will keep fluctuating within the resistance level of 1.3238 and the support level 1.3181, ahead of the release of the trade balance figures in Canada scheduled at 13:30 GMT. The trade balance figure is expected to come at 0.7 billion compared to a previous reading of 1.1 billion. A higher than expected reading should be taken as positive for the CAD, while a lower than expected reading should be taken as negative for the CAD. With regards to Euro, selling pressure are being noted across the markets on the currency following the comments of EU leaders, that they will not approve more bailout funds until the deal is ratified by the Greek Parliament, sending signal of doubts on the market. The resistance level is at 1.3238 and support level is at 1.3181. Investors should remain cautious. EUR/CAD:" title="EUR/CAD:" width="613" height="295">Oil: The price of oil moved up to $100.16 a barrel intra trade, as an austerity agreement in Greece and a decline in U.S. jobless claims waved hopes of greater demand for oil. However, after the comments of EU leaders, that they will not approve more bailout funds until the deal is ratified by the Greek Parliament, sending signal of doubts on the market, the commodity dropped and gave up parts of earlier gains. Today, oil is trading at $99.49 a barrel and is most likely to trade within the resistance level of $100.16 - $98.94 a barrel today, as markets are waiting for the latest developments in the Euro Zone and fundamental news in the U.S.

EUR/CAD:" title="EUR/CAD:" width="613" height="295">Oil: The price of oil moved up to $100.16 a barrel intra trade, as an austerity agreement in Greece and a decline in U.S. jobless claims waved hopes of greater demand for oil. However, after the comments of EU leaders, that they will not approve more bailout funds until the deal is ratified by the Greek Parliament, sending signal of doubts on the market, the commodity dropped and gave up parts of earlier gains. Today, oil is trading at $99.49 a barrel and is most likely to trade within the resistance level of $100.16 - $98.94 a barrel today, as markets are waiting for the latest developments in the Euro Zone and fundamental news in the U.S. DOW: U.S. stocks traded higher and touched a peak of 12887.9points Thursday, as Greek leaders agreed on an austerity plan in order to qualify for international economic rescue funds. However, the comments of EU leaders, that they will not approve more bailout funds until the deal is ratified by the Greek Parliament, sending signal of doubts on the market, drag the index down to 12837.6points. The index is continuing its downward trend and is trading at 12795.7points at the time of writing. The Index is likely to fluctuate within the resistance level of 12826.8points and the support level of 12774.7points as Investors are waiting French industrial production, Switzerland’s consumer price inflation, U.K’s producer price inflation, and in the U.S., the trade balance and consumer sentiment schedule to release later today.

DOW: U.S. stocks traded higher and touched a peak of 12887.9points Thursday, as Greek leaders agreed on an austerity plan in order to qualify for international economic rescue funds. However, the comments of EU leaders, that they will not approve more bailout funds until the deal is ratified by the Greek Parliament, sending signal of doubts on the market, drag the index down to 12837.6points. The index is continuing its downward trend and is trading at 12795.7points at the time of writing. The Index is likely to fluctuate within the resistance level of 12826.8points and the support level of 12774.7points as Investors are waiting French industrial production, Switzerland’s consumer price inflation, U.K’s producer price inflation, and in the U.S., the trade balance and consumer sentiment schedule to release later today.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Daily Market Analysis: Currency Report

Published 02/10/2012, 04:08 AM

Updated 03/09/2019, 08:30 AM

Daily Market Analysis: Currency Report

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.