Investing.com’s stocks of the week

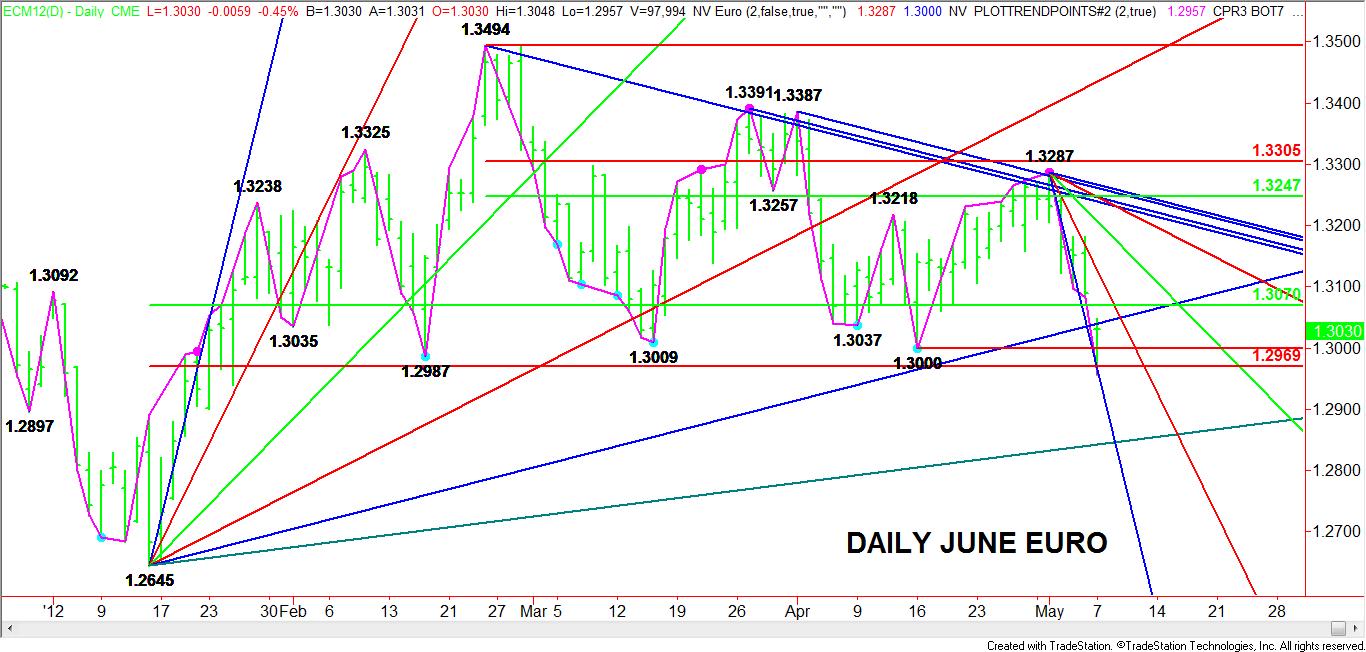

The June Euro briefly broke through three bottoms on the daily chart at 1.3000, 1.3009 and 1.2987 last night, but failed to trigger the wave of sharp selling pressure that many had anticipated when the key 1.3000 psychological level was violated.

Short-term oversold conditions were probably the main reason for the failure since the Euro has been dropping at a rate of .008 per day since topping at 1.3287. In addition, the main range is 1.2645 to 1.3494. This range created a major support zone at 1.3070 to 1.2969. Both the downtrending Gann angle at 1.2967 and the Fibonacci level at 1.2969 factored favorably in the Euro’s early morning turnaround.

On the upside, the 50% price level at 1.3070 is likely to be resistance today. This is followed by downtrending resistance at 1.3127. Since the main trend is down, both level are likely to attract fresh selling pressure if tested.

With sentiment shifting to the downside, it seems like it is only a matter of time before the support near 1.3000 fails. Once bearish shorts can gain control of the Euro and push it through support then this price is likely to become new support. The charts indicate that there is room to the downside with an uptrending Gann angle at 1.3040 the next likely downside target.