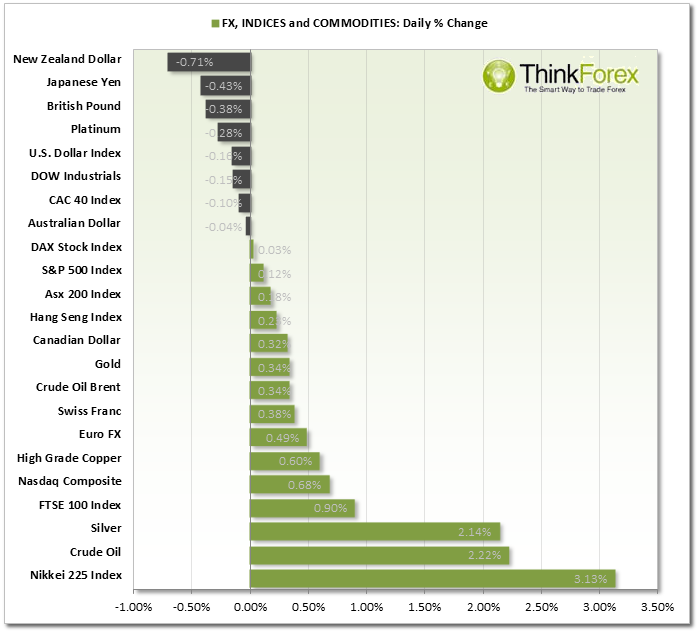

Market Snapshot:

EUR: The German ZEW economic indicator suggested a softening of confidence as it came in less than expected and at a 4 month low of 54.6.

GBP: CPI came in at 1.9% and less than the 2% expected to see Cable drop back below 1.67 and EURGBP back up at 0.825. This is the 1st dip below BoE target in over 4 years.

USD: New York manufacturing and US Housing data disappointed yesterday to see the DXY trading back at weekly lows and EUR/USD back at 8 week highs.

COMMODITIES: Gold and Silver retreat from their highs and below key resistance levels following their strongest gains this year. WTI broke to 4-month highs and Brent hit our 110.50 target. Above 109.60 targets 111.50.

CHARTS OF THE DAY:

CAD/CHF: Below 0.8225 targets 0.799 and 0.789 CAD/CHF" title="CAD/CHF" height="242" width="474" />

CAD/CHF" title="CAD/CHF" height="242" width="474" />

We have a decent confluence of resistance around 0.8220-5 comprising of weekly and monthly pivots. Horizontal resistance and a series of high-test wicks respecting this resistance zone.

Additionally the cycle nature of this pair suggests we may soon be approaching a 'Phase 2' for short positions to target the 0.799 low and 0.78 support zone should we break beneath last week's lows.

Looking at the Canadian single currency we are in an established downtrend, albeit a bulish retracement. However I am looking for signs of weakness of this pullback and feel we may be approaching such a time, hence the bearish bias for CAD/CHF.

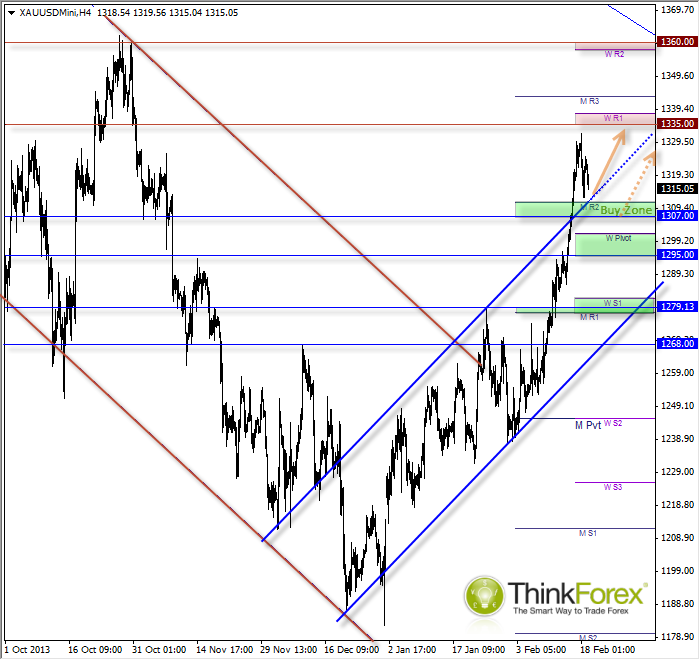

XAU/USD: Above 1307 targets 1335 and 1360 XAU/USD" title="XAU/USD" height="242" width="474" />

XAU/USD" title="XAU/USD" height="242" width="474" />

Technically this is a similar setup to yesterday's analysis of XAU/EUR. On that note I would like to highlight we have now seen the deeper retracement below 960 and seemingly targeting 950. Regardless the pair is still technically bullish on the daily timeframe, so we need to allow for a deeper pullback before a resumption of gains.

Back to XAU/USD - we are trading above the bullish channel where the upper channel line may provide support as price approaches it. However I find these 'trendlines' to be less reliable so I am merely suggesting this possibility, with more confidence in the support zone between 1307-10 providing any believable support.

As long as this level holds then the bias is for a run up to 1335 with possibility of an extension up to 1360.

In the event we break back below 1307 and 1300 we would be back within the bullish channel with additional support around 1280. Only below 1270 would seriously raise the question of a move back down to the 1180 lows.