ASIA ROUNDUP:

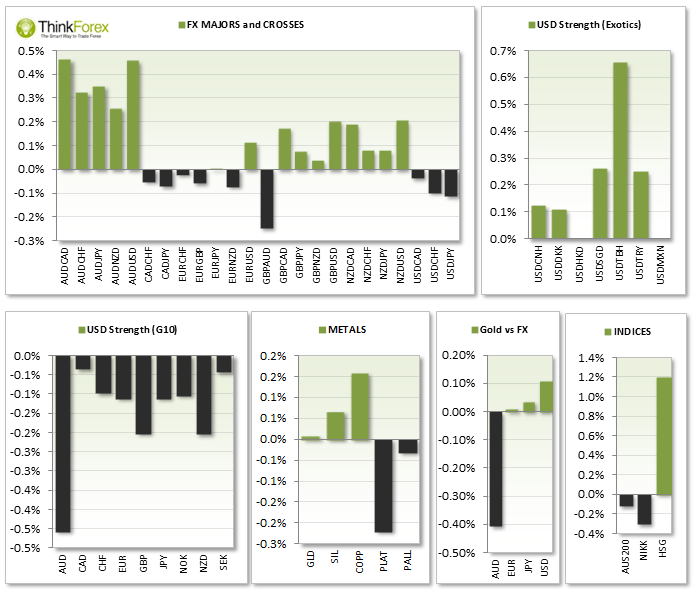

- AUD saw the most action against the crosses throughout Asia to see a bullish continuation on AUD/USD and strengthen the argument for a run up to 0.945

- The Greenback suffered the most, selling off against all G10 currencies, however a pullback is to be expected after so many consecutive bullish closes, and weaker US data last night.

- NZD retail sales fell short at 0.7% vs 0.9% expected. RBNZ Gov Wheeler has suggested mortgage curbs will stay in place for now but likely to be phased out, not removed completely at one. Currently these curbs help reduce house price pressure, with an increase in interest rates helping ease these pressure whist the curbs are phased out. Earliest curbs would likely be removed late in the year. He also added that slowdown in China growth would have significant impact on the economy.

- China's central bank have requested major lenders to prioritise 1st time buyers to reduce concerns over a slower property market

- AUS200 looks set to close up for the day but just below 5494 resistance. The Index, whilst continuing to create higher high/lows is also forming a suspect bearish wedge formation on D1

TECHNICAL ANALYSIS:

- With AUD pairs looking very strong in the closing hours of Asia, be aware that whilst intraday charts look very appealing on AUD/CHF and AUD/CAD, they are approaching resistance levels so may be due a retracement.

- AUDUSD is on track for the 0.945 target and ideal for H4 and H1 swing trades above levels of support.

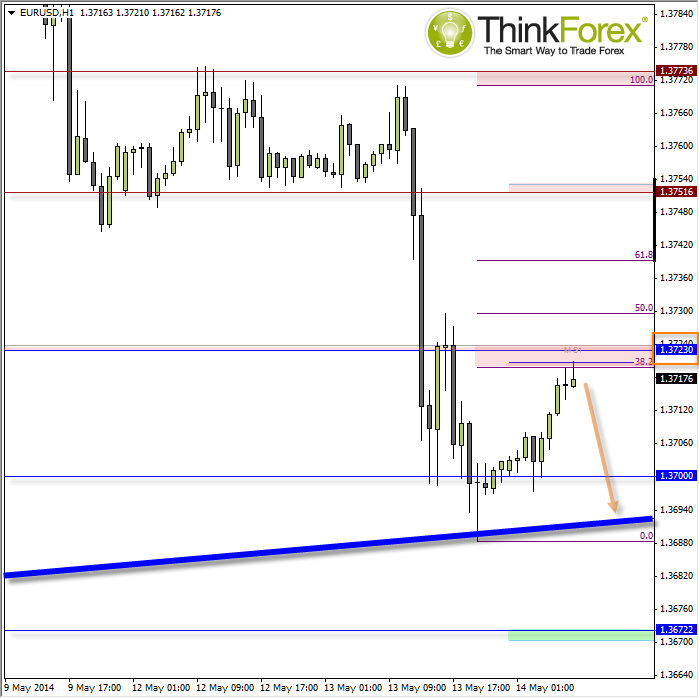

EUR/USD: Targeting lower trendline for intraday short positions

Not a trade to 'outstay your welcome on' but we have rejected the 1.70 support level (and yesterday's 2nd target) and retraced toward s a string confluence of resistance. H1 has already produced a Rikshaw Man Doji to warn of pending weakness, and ideally we will lcose the latest H1 candle with a reversal to support this weakness view.

If you look at D1 and H4 you will see how momentum is clearly bearish, so we are looking for another leg lower. However keep in mind the trenline which may well act as support again, so my preference is to target 1.70 (again) for 'one last hoorah'.

If we break below the trendline then next target becomes 1.3673.

A break above the resistance zone invalidates the analysis.