Investing.com’s stocks of the week

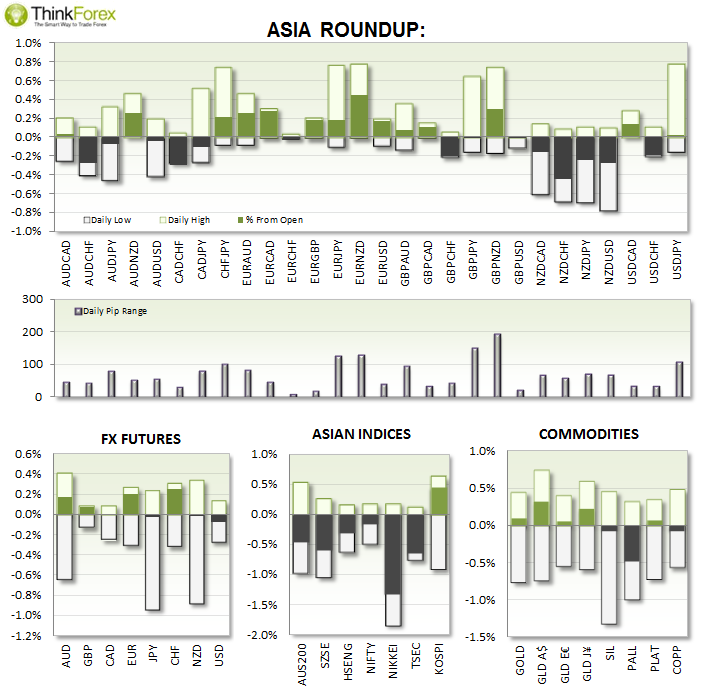

UP NEXT:

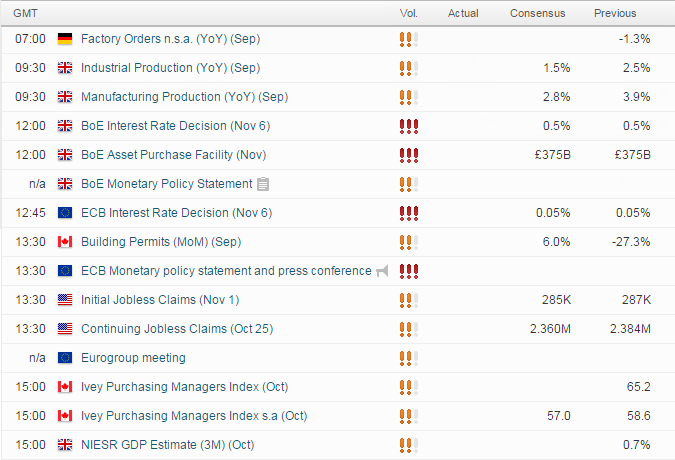

TECHNICAL ANALYSIS:

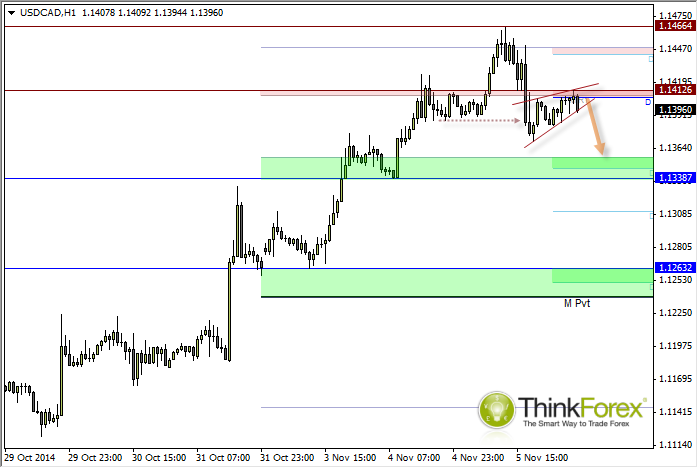

USDCAD: Looking weak at the highs

Whilst yesterday's bullish signal worked out quite well, we now find ourselves in a situation where we think the short-side may be the most opportunistic over the next few hours. The decline from the 1.147 highs was hard and fast and broke the prior swing low to suggest a change in trend, and price has since drifted up towards the 1.141 resistance zone to suggest a swing trade short to target 1.1338-40 support zone.

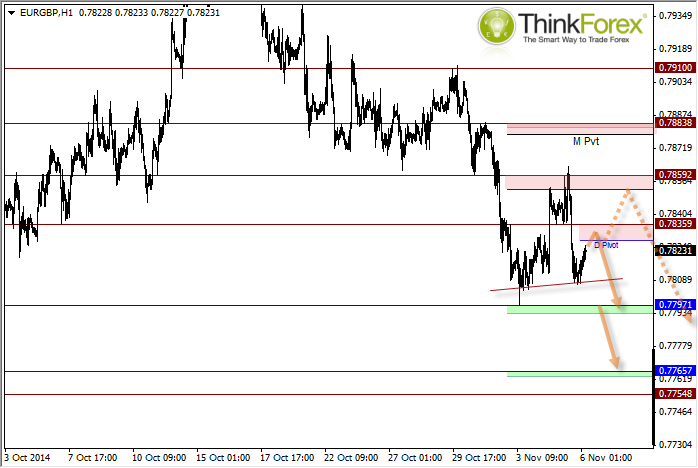

EURGBP: BoE vs ECB

The current intraday bullish run allows for a potential right shoulder to form as part of a Head & Shoulders pattern, to target the recent lows and beyond.

Due to both the BoE and ECB providing market action tonight we can expect volatility, hopefully we will also see a sustained direction.

NZDJPY: Correction not quite over (yet)

As long as we see a return to risk-on (and Indices continue their upwards trajectory) then NZDJPY is one to keep in your bullish watchlists.

The decline form the highs appears to be corrective , so is now a case of trying to identify the bottom of the correction and jumping back on board the bullish trend to take advantage of JPY weakness.