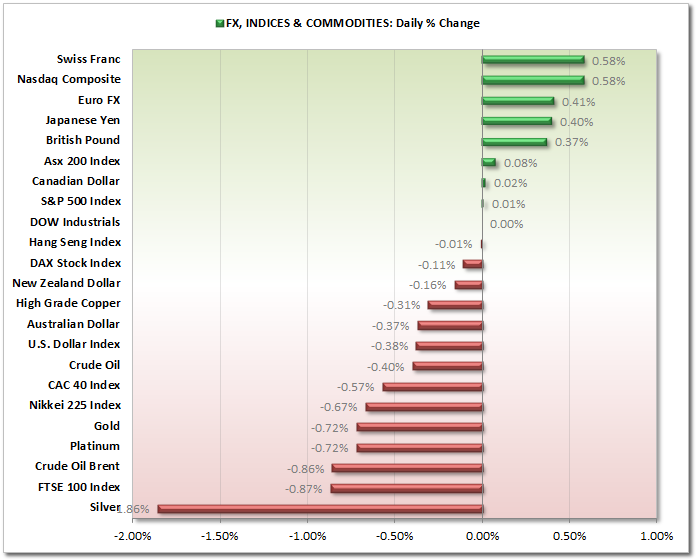

Market Snapshot:

Silver was quick to write off any gains seen the day previously, trading back below 20. However the intraday charts do raise the potential for a bottoming pattern to start forming, having since broken the descending trendline and testing this level of support. Contrarian traders may be interested in trading this back up to the 20.26 resistance. Others may just want to sit on their hands and wait for an actual trend to develop.

WTI continues to trade within a 30 point range sandwiched between the Monthly S1 pivot and 95.90 resistances.

Platinum is now near a previous cycle low around 1370 so there is potential for loss of bearish momentum. Regardless the trend is clearly down.

DAILY:

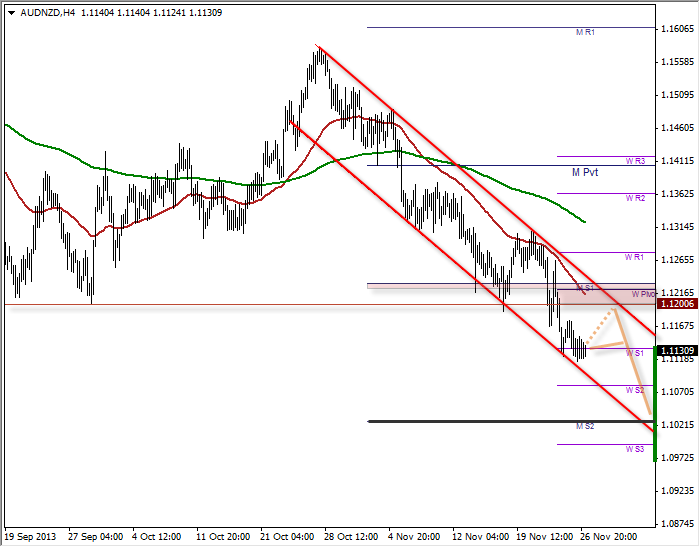

AUD/NZD: Next Target: 1.1

With the AUD being very much unloved recently the larger picture does not look at all good (for AUD bulls, that is...). The AUD/NZD is now trading at 5yr lows with increasingly bearish momentum.

The bearish channel is both narrow and well respected. Channels do tend to be wider in breadth but similar patterns can be seen throughout AUD crosses, however this particular one is more prominent than others and also provides good levels to target.

Judging by the bearish momentum, whilst a bullish retracement is possible, I find it hard stretched to see it reaching 1.20 any time soon.

However what I have also observed is the messy price action around the 1.11 weekly pivot and how we are creeping down the lower trendline. This raises the distinct possibility of sideways price action and to slowly drift towards the upper channel line. In some ways this is more favourable as this may provide a better opportunity to re-join the bearish trend.  AUD/NZD" title="AUD/NZD" height="547" width="700">

AUD/NZD" title="AUD/NZD" height="547" width="700">

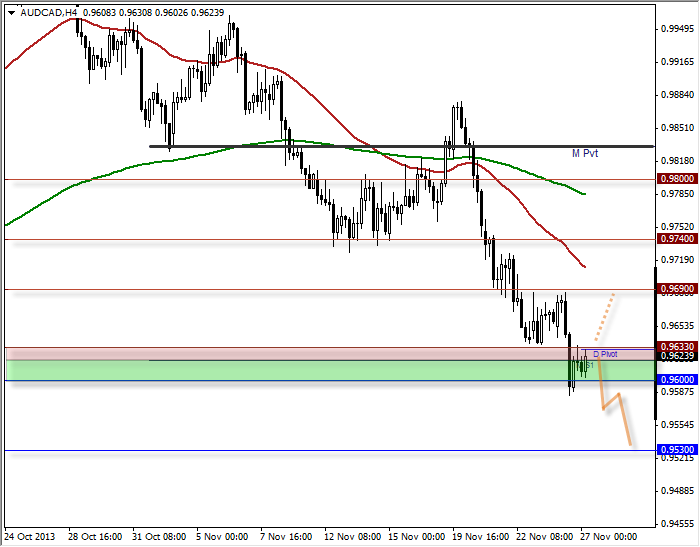

AUD/CAD: Target 0.9530

Yet another AUD cross with increasingly bearish momentum. However what makes this interesting is the how price is now sticking at an S/R zone which provides 2 clear plans of action.

In the event we break to the upside this will confirm a double bottom reversal and open up 0.960. Even if this does happen I will still deem the trend to be bearish and see selling opportunities with an increased reward/risk ratio.

However, a more likely scenario in my opinion is to stay beneath the daily pivot and to target the 0.953 support (or fractionally above).

The price action we are now seeing could in fact turn out to be a bear flag or pennant, which would at around this level.  AUD/CAD" border="0" height="547" width="700">

AUD/CAD" border="0" height="547" width="700">

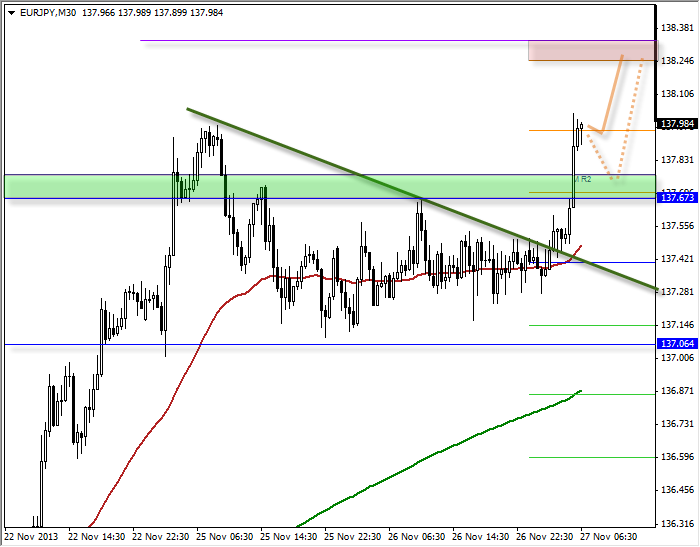

EUR/JPY: Target 138.2-3 (and beyond)

The bullishness of this pair just cannot be denied. With clear runs and little evidence or retracements, the plan with this pair should be crystal clear.

In the event we do see any bearish retracements we have plenty of support between 137-137.7 EUR/JPY" border="0" height="547" width="700">

EUR/JPY" border="0" height="547" width="700">

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Daily Insight: Silver Writes Off Gains, AUD Remains Unloved

Published 11/27/2013, 04:28 AM

Updated 08/22/2024, 06:01 PM

Daily Insight: Silver Writes Off Gains, AUD Remains Unloved

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.