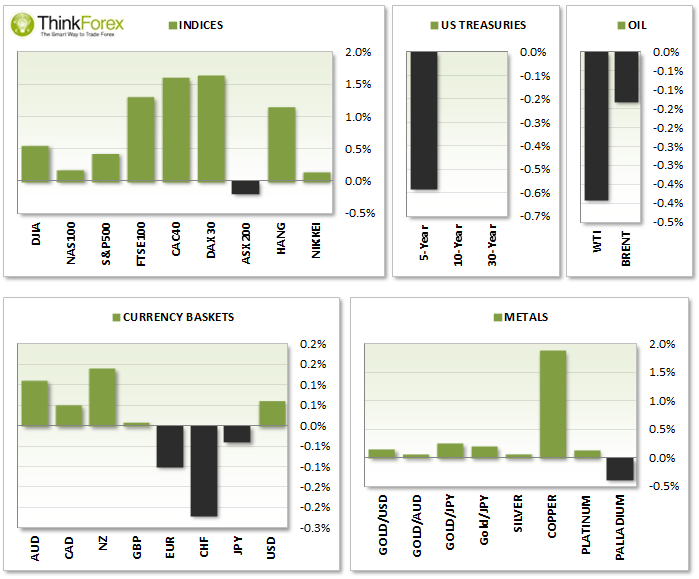

MARKET SNAPSHOT:

ASIA HANDOVER

Rumours of a bank run in China forced the PBoc to calm the panic today as the rumour began to spread. Hundreds of depositors line up at Jiangsu Sheyang Rural Commercial Bank to withdraw cash upon hearing of the banks supposed insolvency.

The RBA released their bi-annual FSR (Financial Stability Review) which hinted that whilst they are comfortable with the increased housing prices there is room for the situation to get worse.

FX:

- Narrow ranges across the majors but the Kiwi has seen the strongest demand throughout the session and tested yesterday's highs against the Greenback.

- AUD/USD tested 0.917 handle - see today's video for more info;

- AUD/NZD broke beneath yesterday's low temporarily which produced a Shooting Star reversal at yesterday's close.

- USD/CNH trades at a 2-day high following yesterday's Doji

- NZD/JPY trades to a 3-day high

INDICES:

- AUS200 up 0.5% at 9-day high

- Hang Seng up 0.8% to a 4-day high

- Sideways trading Nikkei 225 for 4th consecutive session

COMMODITIES:

- Narrow range on WTI futures following 3 failed attempts to break above 100 resistance

- Brent up 0.3% but within yesterday's range

- Copper appears to be testing $3.00 resistance again - it broke through this level yesterday so bullish momentum appears to be building

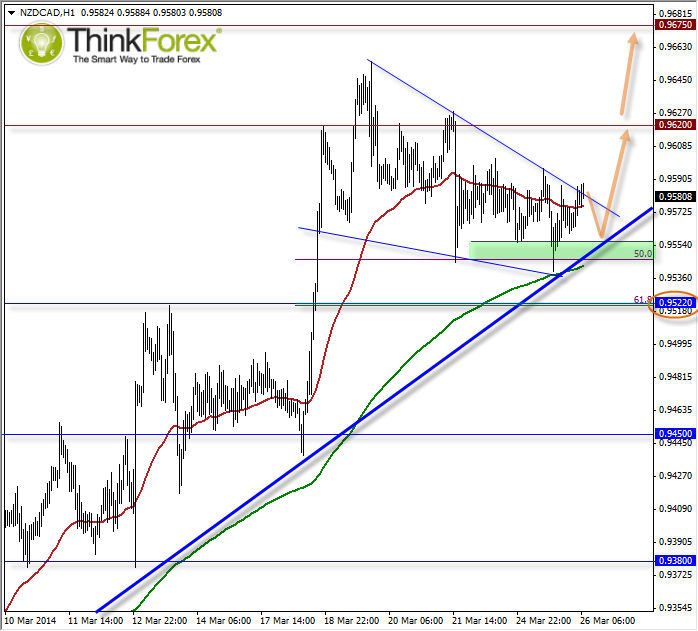

CHARTS OF THE DAY:

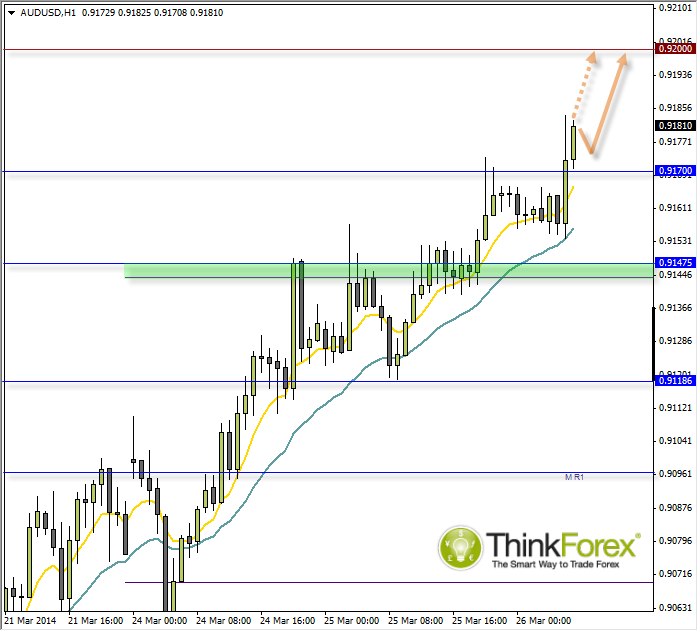

AUD/USD: Above 0.917 targets 0.9200

This pairs (similar to NZD/USD) has provided multiple long entries with repeated patterns between messy, sideways correction followed by clean and fast upside break. However notice that each time this occurred we have also seen an aggressive downside move before the eventual spring board to the next target.

Taking into account the strong trend and positive data from NZD I do fancy the support zone holding.

However a break below 0.9250 could confirm a change in sentiment.

AUD/USD: Above 0.917 targets 0.9200

We finally saw the upside break of 0.917 (since I recorded today's video) so as long as we stay above this level I suspect London may target this level, after their obligatory spikes of course....

General Advice Disclaimer: Trading in the Foreign Exchange market involves a significant and substantial risk of loss and may not be suitable for everyone. You should carefully consider whether trading is suitable for you in light of your age, income, personal circumstances, trading knowledge, and financial resources. Only true discretionary income should be used for trading in the Foreign Exchange market. Any opinion, market analysis or other information of any kind contained in this email is subject to change at any time. Nothing in this email should be construed as a solicitation to trade in the Foreign Exchange market. If you are considering trading in the Foreign Exchange market before you trade make sure you understand how the spot market operates, how Think Forex is compensated, understand the Think Forex trading contract, rules and be thoroughly familiar with the operation of and the limitations of the platform on which you are going to trade.

A Financial Services Guide ( FSG) and Product Disclosure Statements (PDS) for these products is available from TF GLOBAL MARKETS (AUST) PTY LTD by emailing compliance@thinkforex.com.au. The FSG and PDS should be considered before deciding to enter into any Derivative transactions with TF GLOBAL MARKETS (AUST) PTY LTD. Please ensure that you fully understand the risks involved, and seek independent advice if necessary. Also, see the section titled “Significant Risks” in our Product Disclosure Statement, which also includes risks associated with the use of third parties and software plugins. The information on the site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. 2013 TF GLOBAL MARKETS (AUST) PTY LTD. All rights reserved. AFSL 424700. ABN 69 158 361 561. Please note: We do not service US entities or residents.