ASIA ROUNDUP:

- NZD QDP fall short at 1% vs 1.2% expected which saw the Kiwi Dollar edge lower from yesterday's highs. However the number itsef is still string and bias remains bullish for Kiwi pairs due to capital inflows.

- Market consensus is for NZ to hike rates again in July

- BoJ member Morimoto: "Inflation expectations likely to strengthen"

- Australian exporters forecast higher export prices, according to Citi Group

- AUS200 posts biggest day gain in 2 months folllowing positive equity sentiment from US.

- {{178|Nikkei 225}} breaks to a 15-week high which could bring upwards pressure in USD/JPY

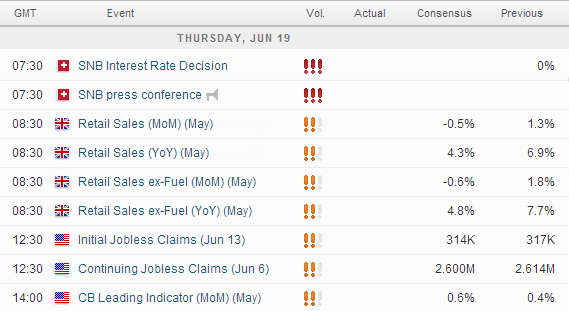

UP NEXT:

- SNB rate decision is likely to remain at -0.25%, but the press conference should provide extra volatility across CHF pairs. With USD/CHF looking heavy below 0.90 this is a pair to consider, but also AUD/CHF and NZD/CHF could provide bullish opportunities as money continues to support AUD and NZD.

- GBP Retail sales is forecast to be down and at a 4-month low, so if we see sales up (over 0%) we could see GBP/USD pop above 1.70. Poor sales could see GBPUSD retrace towards 1.697

TECHNICAL ANALYSIS:

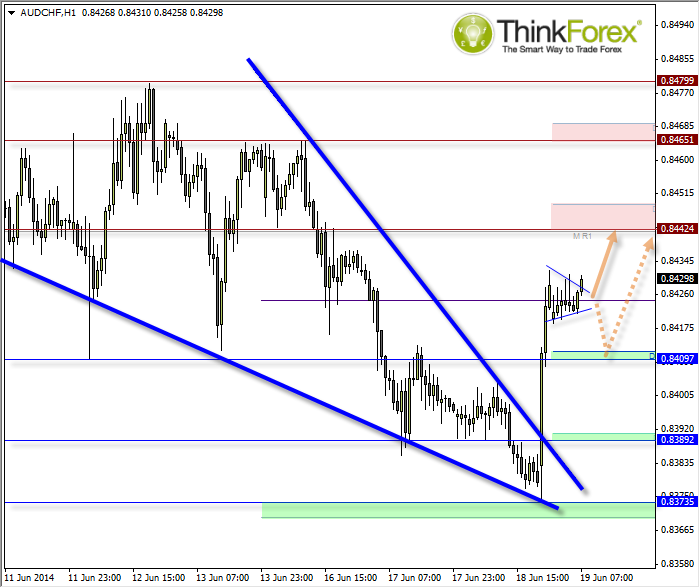

AUD/CHF: Bullish Wedge breakout presents intraday Bull Flag

With CHF red news out tonight, any signs of weakness from the Swiss should play into the bullish hands of AUD and NZD.

AUD/CHF has produced a potential bullish flag; in line with the bullish wedge it broke out of yesterdays to target the 0.848 highs.

In the event of a retracement (which would invalidate the bullish flag) then bullish setups could be considered above the daily pivot.

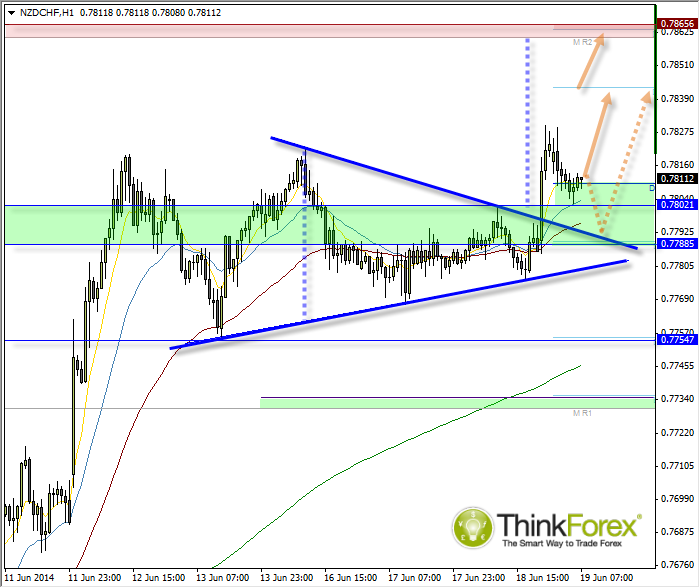

NZD/CHF: Symmetrical Triangle targets 0.7865 highs

NZD/CHF broke out of a symmetrical triangle to target 0.786, with intraday price action forming a potential swing low above the daily pivot.

If we see a deeper retracement then we may retest the upper trendline of the triangle (around Daily S1) but I would prefer to only consider intraday bullish setups above the daily pivot.