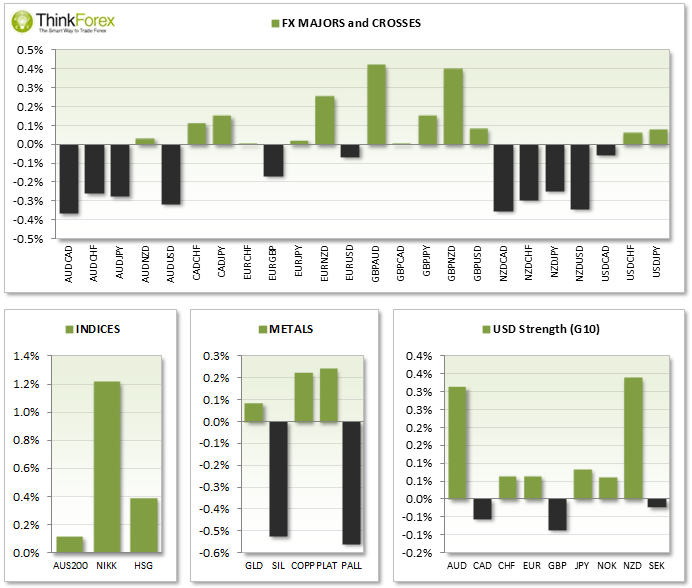

MARKET SNAPSHOT:

ASIA ROUNDUP:

- AUD RBA Governor Glenn Stevens expects unemployment to edge up further; Boeing plans to cut Autsralian contractors;

- CNY Hong Kong PMI at 7-month low of 49.9 to suggest industry contraction whilst China Non-Manufacturing PMI is still healthy at 54.5; Fund Managers have puled money out of the Yuan at the fastest rate in 9-months during March as investor unease continues;

- NZD Kiwi Dollar continues to look vulnerable as the unwinding continues during Asia, particuarly against GBP, CAD, EUR and AUD.

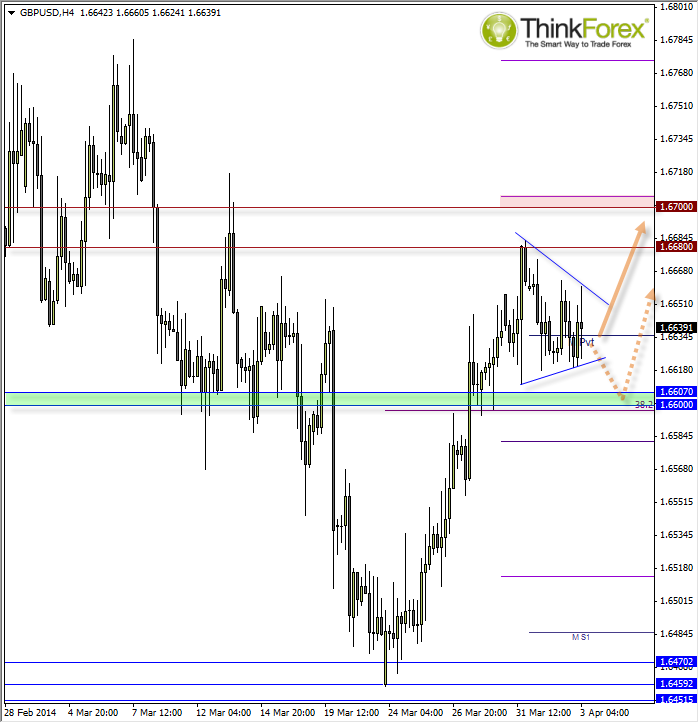

GBP/USD: Messy, but bullish

We do appear to be coiling up within either a falling wedge or pennant (may as well leave room for a bull flag too). The fact I cannot pigeon hole it so easily is a testament to how messy these patterns can be. However they do provide potential likely direction in the event of a breakout.

The advance into the correction was done with brute force, which is the main driver for the bullish bias. We are currently meandering around the Monthly Pivot so price has paid little respect to this level so far. However the R1 may be a more reliable target for any bullish run as this is also around 1.67 resistance.

I do prefer the bed of support around 1.6600-70 and any retracement towards these levels could entice further buying, so monitor these levels for bullish setups on lower timeframes. A break below this level invalidates the analysis.

Whilst we remain within the messy correction there is no telling how long we can remain in there - however note that we do have UK data tonight which could provide the catalyst required to break out of the pattern.

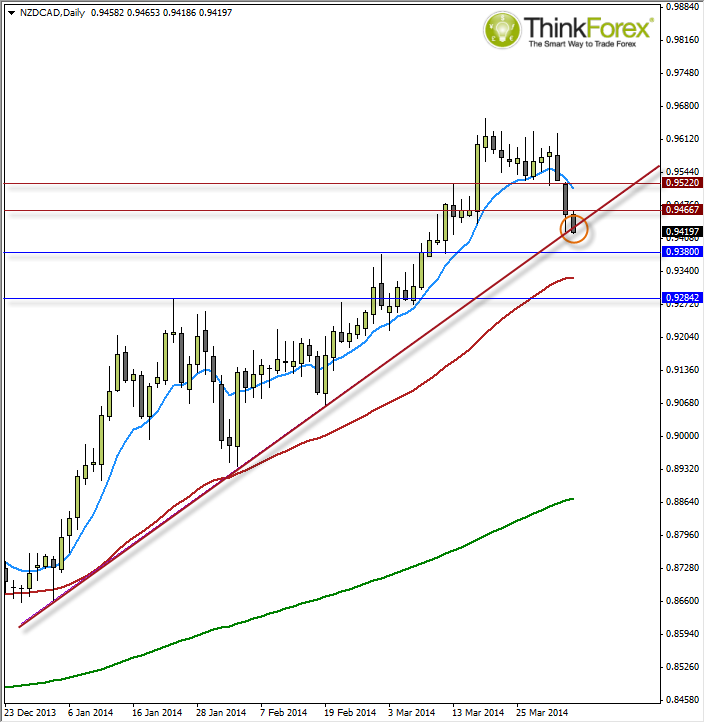

NZD/CAD: Clinging on to the trendline - for now...

Not too long ago this was a bullish candidate in a 'vanilla trend trade'. We have since confirmed and completed a double top and now close to breaking down through the trendline. If you miss the break do not fret - my favoured strategy is to wait for a retracement towards the trendline before taking a short position, as this allows the potential for greater reward/risk ratio.

You also run the risk of missing the trade all together so make sure you are happy with that scenario if you play the patient approach.