Investing.com’s stocks of the week

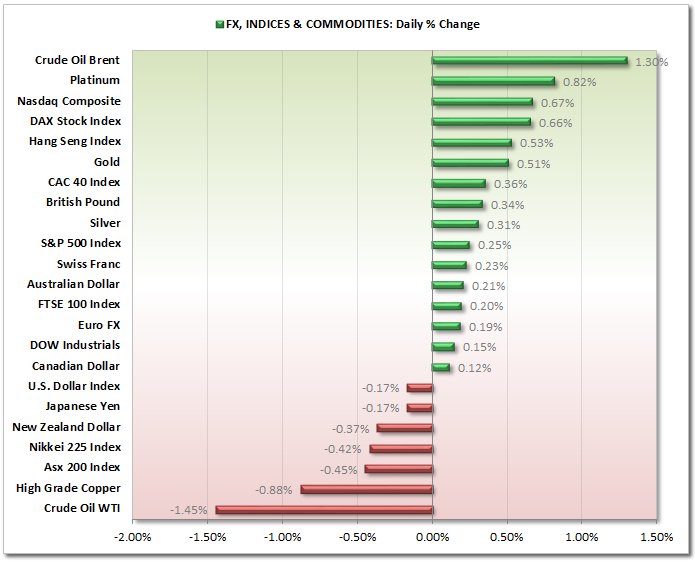

Market Snapshot:

WTI and Brent are behaving like opposite ends of a magnet as they appear as yesterday's biggest gainer and biggest loser.

The BoE made a shock decision yesterday to cease it's FLS (Funding for Lease Scheme) to no longer offer banks incentives for lending, to instead shift it's attention to encourage banks to lend to small firms. The decision was made due to the UK housing market making an incredible turnaround, and the fear of the scheme causing a housing bubble. House prices have risen at the fastest rate in over 3 years.

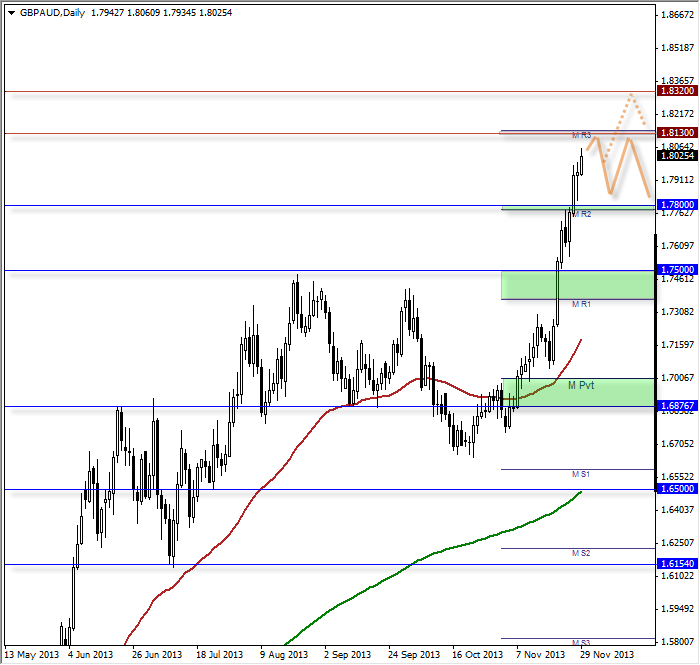

GBP/AUD:

GBP this week cannot go unnoticed and is currently trading at record highs against JPY, AUD and USD. However as the Asian market is now wrapping up for the weekend and the US is celebrating Thanksgiving, we can expect lower liquidity for the remainder of the week.

Additionally, GBP/AUD is trading around the 1.80 barrier and just beneath the Monthly R3 pivot. These have a tendency to be quite reliable as resistance, with the exception of when they are closer together due to a narrow-range previous month (like USD/JPY witnessed).

So taking all of the above into consideration my bias is for range trading to carry us over to next weekend. However this does not remove opportunities, it just changes the strategies we'd be looking to use.

With ranging markets you have well defined S/R levels to trade to and from, however you have to trade with the assumption we are not about to break out of that range. So tights stops would be my preference.  GBP/AUD" border="0" height="665" width="700" />

GBP/AUD" border="0" height="665" width="700" />

AUD/NZD:

This is to follow up from Wednesday's analysis and highlight how price followed the counter-bias for the delay. We have traded back up to the 1.12 resistance zone and looking at the bearish channel and the cycles, appears ready for another leg down.

It is just a shame we are now heading into the weekend.

This will remain in my watch list for next week to make sure there are no extreme gaps either side of the resistance zone. If we open near these levels and see bearish setups my targets remains 1.10

In the event we break above the resistance zone, I will only see this as a bullish correction as we are currently trading at 5yr lows with increasingly bearish momentum. However next target would be around 1.30 AUD/NZD" border="0" height="665" width="700" />

AUD/NZD" border="0" height="665" width="700" />

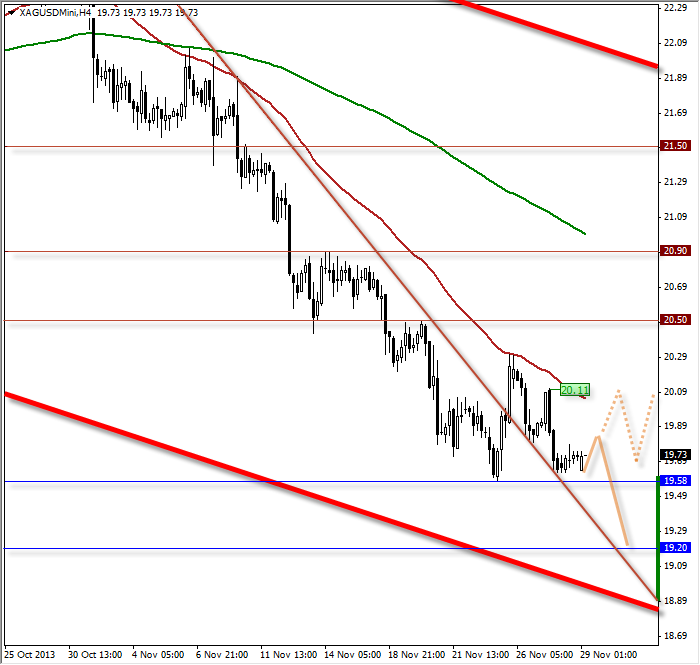

SILVER:

19.58 is just about managing to hold as support, however when you stand back and look at the bearish momentum that saw us trade down here there then it is hard to believe it will hold for too much longer. There is one line of defence though... reduced market hours due US Thanksgiving.

However this does not change the bearish trend either. Price has been trending nicely down the internal trendline, and whilst we did have an upper break which formed a swing high, we have now traded back to produce a swing low, and this leaves plenty of room for declines whilst keeping the trendline intact.

- Below 19.58 opens up 19.20

- Above 20.11 swing high opens up 20 / 20.50

- For remainder of the week ranging between 19.50-20.10 is the bias XAG/USD" title="XAG/USD" height="665" width="700" />

XAG/USD" title="XAG/USD" height="665" width="700" />