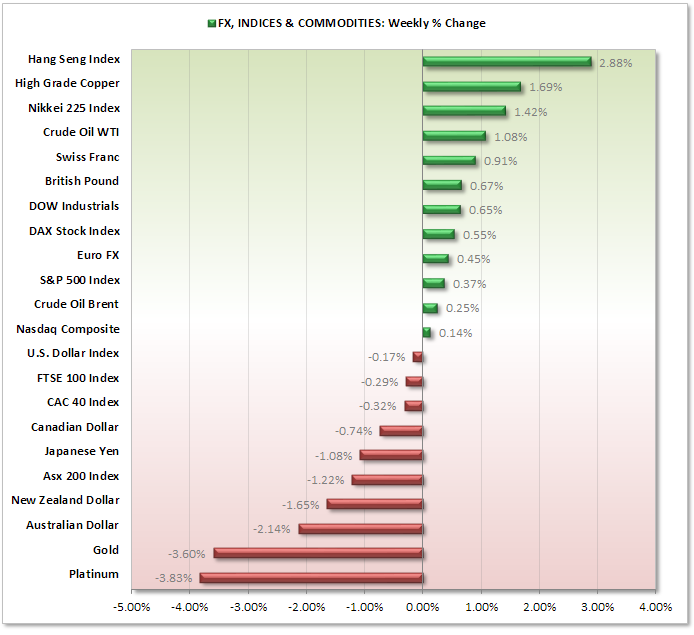

Market Snapshot:

Disparity was seen amongst the FX markets last week as the greenback continues to sit between a fine line of bullish and bearish.

Whilst AUD, EUR and CAD bearish momentum increased we saw demand for GBP and EUR increase. This resulted with GBP/AUD sitting at its highest level since April 2010 and EUR/JPY breaking to its highest since Jan 2011.

As the Fed considers paying banks lower interest rates on their reserves, the bank's retort is to threaten to charge company and consumers a fee for depositing (this is on top of their near-zero deposit rates btw...).

The banks are arguing the interest rate cut will force them to seek riskier ways of making money, to cover the short-fall they incur if they do not charge a depositing fee.

Recent meetings are strongly hinting at the 'tapering' of its $85bn asset purchase program, which have so far provided the markets the fuel to see them at record highs.

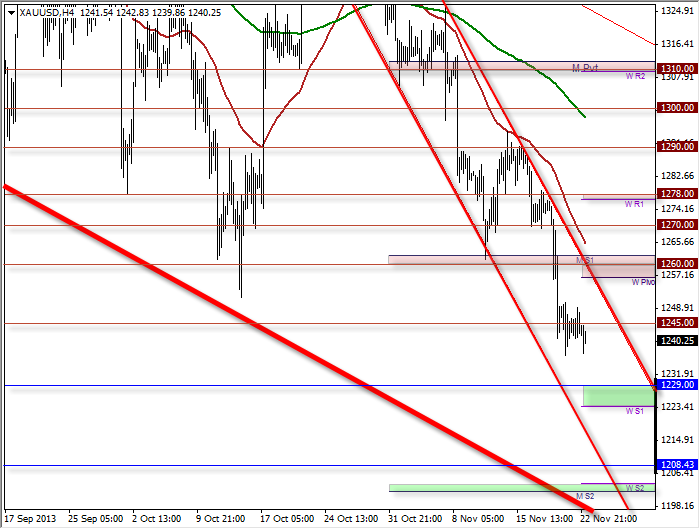

GOLD H4:

Please refer to Wednesday's report for the previous analysis of Gold.

So far that has all gone pleasantly well. The bearish channel within the bearish channel remains to be (of all things) bearish. The support levels have all been respected, for short periods of time, before being broken so these levels now apply as resistance for any bullish gains. However taking into consideration the bearish momentum then I shall see any such gains as merely a retracement, with more losses to follow.

Now we are beneath the 1250-60 range my eventual target is now 1180.

However next target is around 1223-29 support zone. Any bullish retracements towards 1260 could be seen as 'better' prices to get short (assuming bearish setups appear near these resistance levels, of course).  XAU/USD" title="XAU/USD" height="635" width="694">

XAU/USD" title="XAU/USD" height="635" width="694">

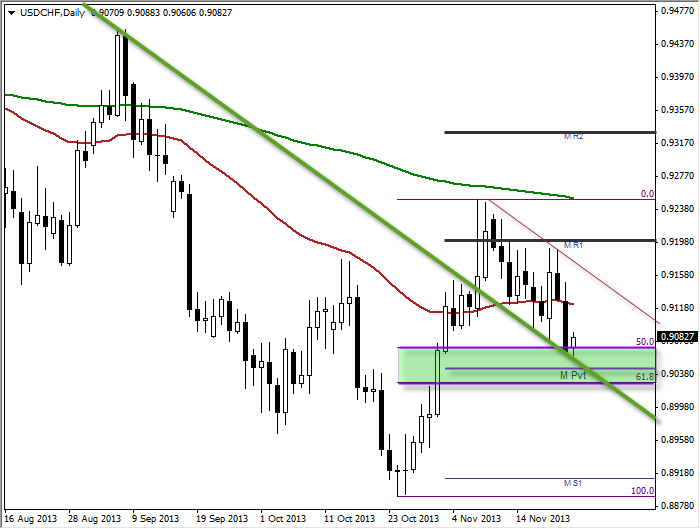

USD/CHF D1:

Please refer to Wednesday's report for the previous analysis of USD/CHF.

To Quote: "If we see a bullish close today then this could be assumed to be a swing low to initiate long positions. Only a clear break beneath the support zone would make me reconsider this view"

Originally this analysis did indeed perform very well after rejecting the 50% fibs level to finish the day back near the MR1, so the swing low had been assumed. Then it came crashing back down again....

However due to the nature of the bullish run from 24th Oct low I still believe the current decline to be corrective (so we are seeking another high).

As long as we remain above the green zone (and broken trendline) I will keep the bullish bias. However until we get a clearer buy signal you may be safer keeping to intraday trading within the bearish channel (which runs parallel to the broken trendline).  USD/CHF" border="0" height="529" width="700">

USD/CHF" border="0" height="529" width="700">

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Daily Insight: GBP/AUD, EUR/JPY Hitting Highs

Published 11/25/2013, 03:06 AM

Updated 08/22/2024, 06:01 PM

Daily Insight: GBP/AUD, EUR/JPY Hitting Highs

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.