UP NEXT:

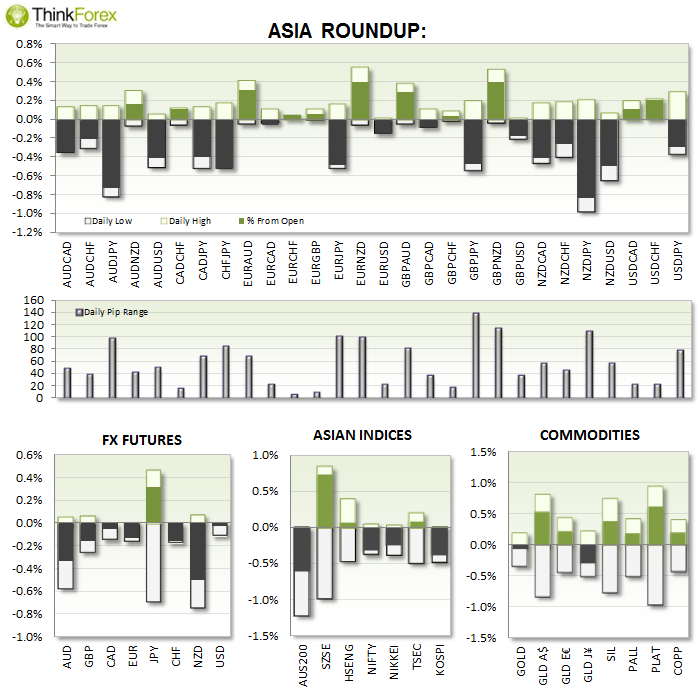

You may have noticed how well EUR crosses performed last night on the Business Confidence alone. This would have been triggered by nervous bears but also acts as a warning of what to expect if we see any strength in European data (more short covering to support EUR crosses).

It will then be over to the US where we have Core PCE (the Fed's preferred inflation indicator) along with GDP. When you consider the FED have been warning of softer inflation, then even coming in on or just below target would probably be a USD bullish signal to the markets and bring further pressure on EURUSD.

TECHNICAL ANALYSIS:

EURCAD: Testing neckline

This pair has been well documented recently so this is an alert to notify you we have now retraced towards the neckline.

This could suit a quick and dirty entry with a stop above the neckline and to walk away to let the market do it's thing. There is plenty of data form Europe and Canada to get some movement here and only time will tell how directional that move may be.

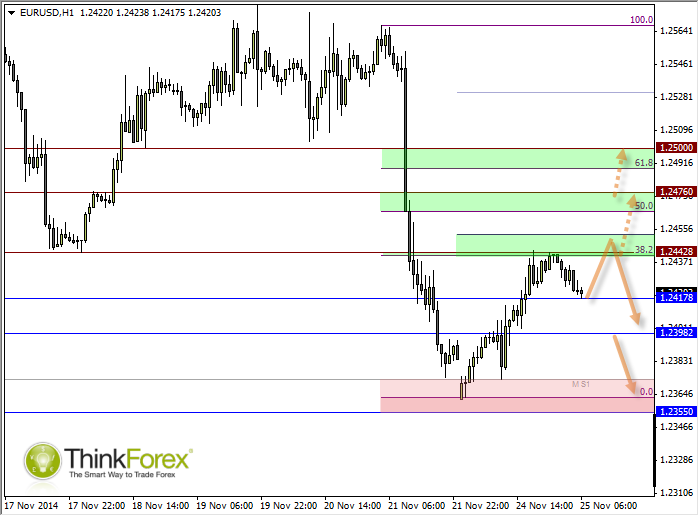

EUR/USD: Overall bearish but with upside potential

Nice and easy today as not a single level needs adjusting from yesterday. The only thing I will add is that the 1.24428 resistance zone is now the level to choose between bullish or bearish setups.

With data from Europe and US tonight we can expect positions to be taken before the event, with any softness in numbers creating even bigger moves.