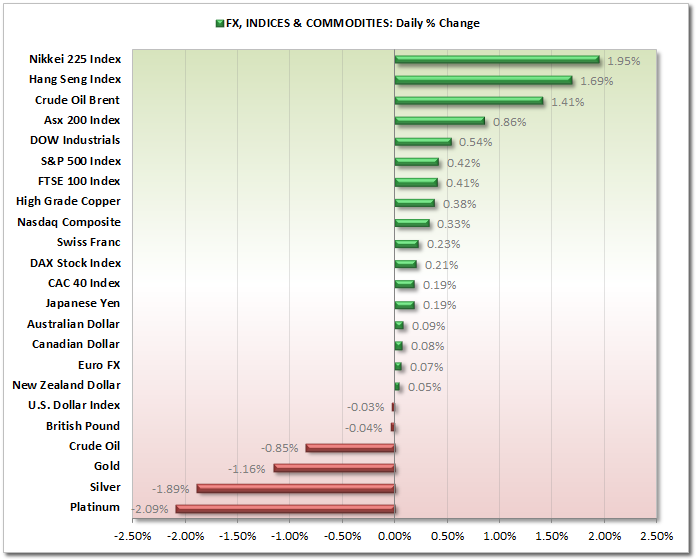

Market Snapshot:

JPY has been gaining strength throughout the Asian session today which has seen AUD, CAD, CHF, EUR, GBP, NZD and USD all depreciate and retrace against last week's gains. It is still too early to see if this is the beginning of something largetr, or merely corrective in nature, however intraday momentum is currently bullish for JPY.

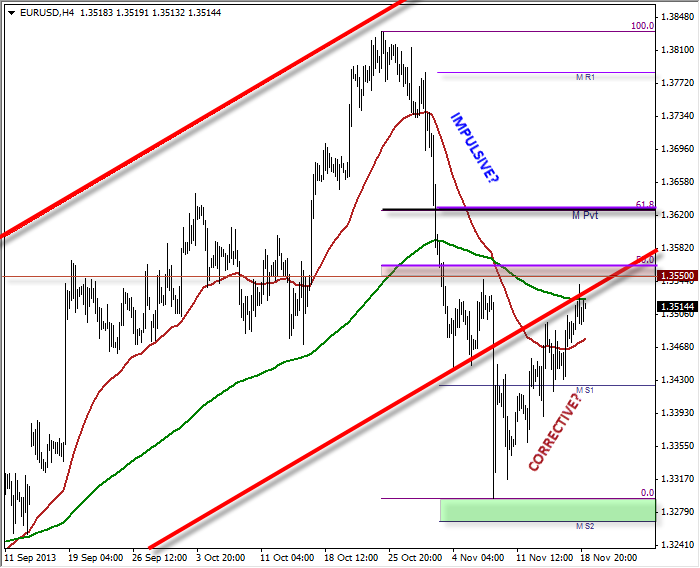

EUR/USD INTRADAY: Dead-Cat Bounce ready to drop?

To follow up on yesterday's chart we are still creeping up the broken trendline and I still favour a bearish swing trade and to seek a new low. However these particular setups can keep on grinding away, edging higher 1 tick at a time, then the second you turn your back to do something else down she goes! (Regardless of whether or not you haven't already sustained several losing trades trying to enter it....).

So whilst they can be very satisfying to trade when you get it right, they can be tricky to get right at all so trade this set up with caution.

On the plus side yesterday produced a Spinning Top Doji where the upper spike penetrated the broken trendline, only to close the day beneath it. So there is hope...

The main reason I like this setup (called Dead-Cat bounce) is because the run-up from the 1.33 lows appear corrective due to the overlapping nature of the swings, and the velocity in which we declined from 1.38 highs appears to be impulsive, hence the need for a new low!

Only above 1.355-56 would cause me to reconsider as this would be above the previous swing high and 50% retracement, resistance confluence.

SUMMARY:

- Dead-Cat Bounce (Short) is the preferred setup

- Above 1.356 begins to cause concern

- Above 1.362 will require a complete reassessment  EUR/USD" border="0" height="568" width="700">

EUR/USD" border="0" height="568" width="700">

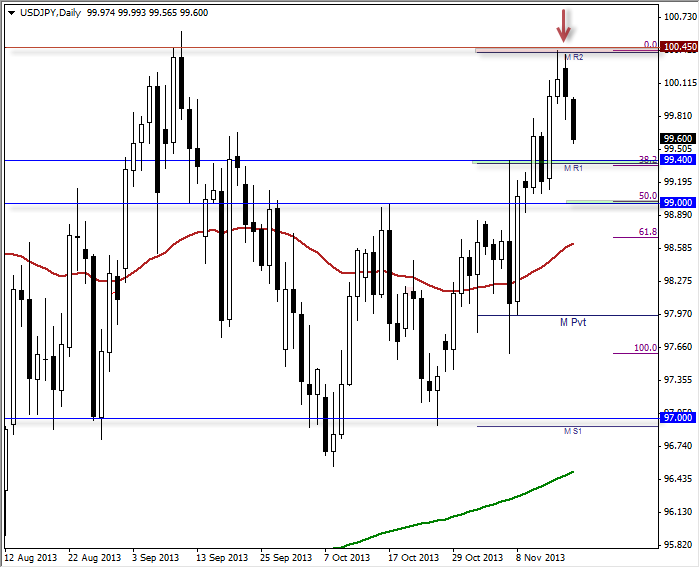

USD/JPY DAILY:

Intraday momentum today has been increasingly bearish and price is seemingly headed for the 99.40 support level. How price reacts at this level should provide further clues to the bullish trend which has (finally) broken to the upside of triangle which has been forming since April 2013.

Whilst there is a possibility that we may see bullish setups appear around 99.40 support to get back in line with the bullish trend, the candle formation (couple with intraday bearish momentum) does make me consider a deeper correction towards 99.0.

Friday's candle produced a Shooting Star and failed to trade above the September Swing High. This should be taken note of as it brings bearish connotations to a larger picture, and a recycling back into the triangle I thought we had broken out of....

Yesterday's candle had an engulfing bearish body and has so far continued to sell off. This adds weight to the argument that we have seen a swing high in place and

So to reiterate:

- 99.40 remains the next target

- If 99.40 holds as support look for bullish setups to hop on-board the daily bullish trend

- A break below 99.40 makes 99.00 the next likely target

- Below 99.00 starts to make the bullish trend a little too optimistic and for choppy price action to remain within the triangle USD/JPY" border="0">

USD/JPY" border="0">

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Daily Insight: EUR/USD - Dead-Cat Bounce Ready To Drop?

Published 11/19/2013, 04:38 AM

Updated 08/22/2024, 06:01 PM

Daily Insight: EUR/USD - Dead-Cat Bounce Ready To Drop?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.