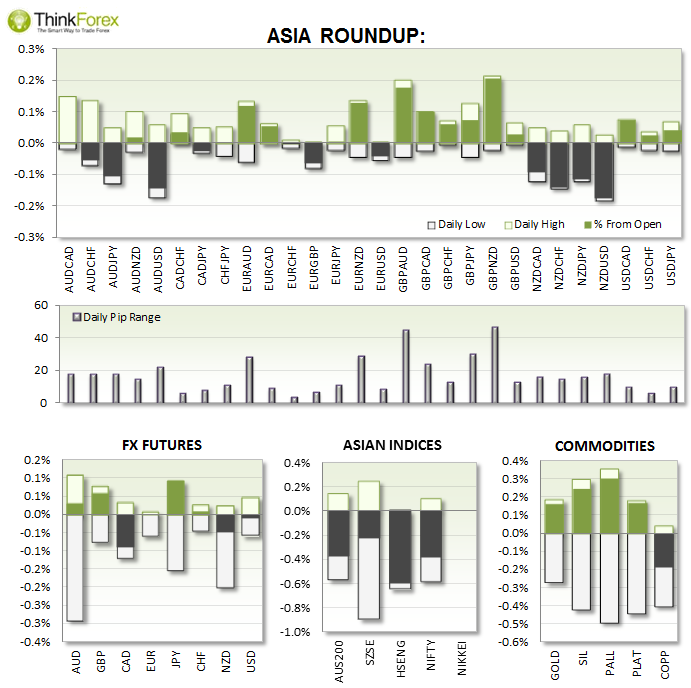

- AUDTrade deficit comes in slightly above expectations but still near 18-months lows at -1.7bn vs -2bn forecast. This shouldn't weigh down on the Q2 GDP and add further weight to the 'historically high' AUD

- RBA keep interest rates on hold at 2.5$

- China HSBC PMI remains flat but short of expectations at 50 vs 53.1

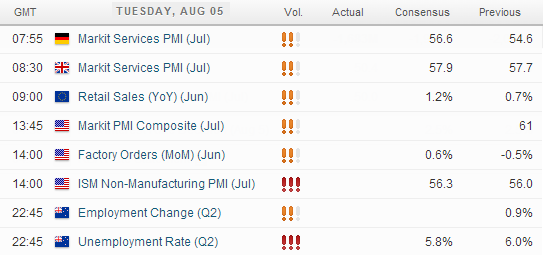

UP NEXT:

TECHNICAL ANALYSIS:

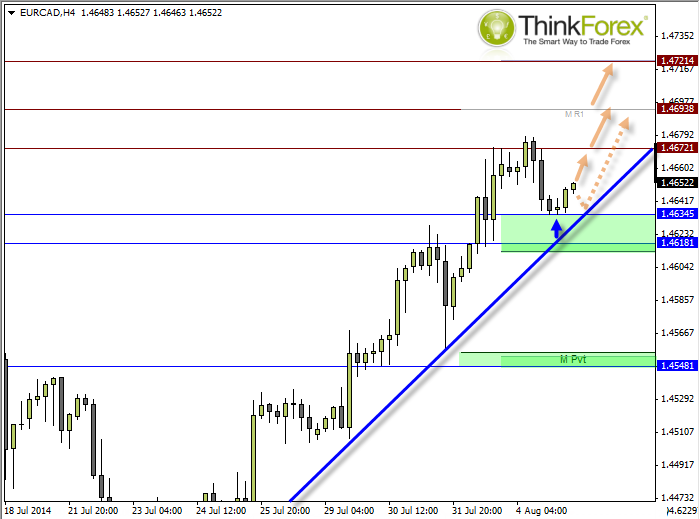

EURCAD: Deja Vous - same trade idea, new levels

You may have a slight deja vu moment with this chart as it does look almost identical to yesterdays. The only slight difference is we are now trading higher after creating another higher-high and higher low.

It took the direct gains route and did not pull back to support as hoped, but the opportunity today is almost identical.

Notice there is a Morning Star Reversal above 1.434 support so I favour this as a swing low and for direct gain. That said it does till leave room for a deeper pullback towards the trendline, which is successful, may provide a better price to enter long and increase potential reward/risk ratio.

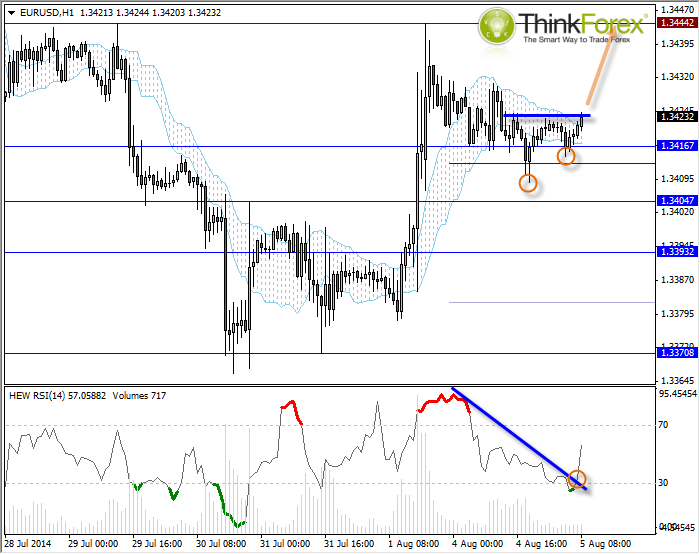

EURUSD: Same setup; Different Day

Here price has evolved to create a double bottom at support and the Rapid RSI has broken its own trendline to suggest potential for a bullish breakout.

If successful the higher low (of the double bottom) shouldn't be breached and may achieve a higher reward to risk ratio. For a more conservative approach then the lower swing low could be considered to place your stop behind.