ASIA ROUNDUP:

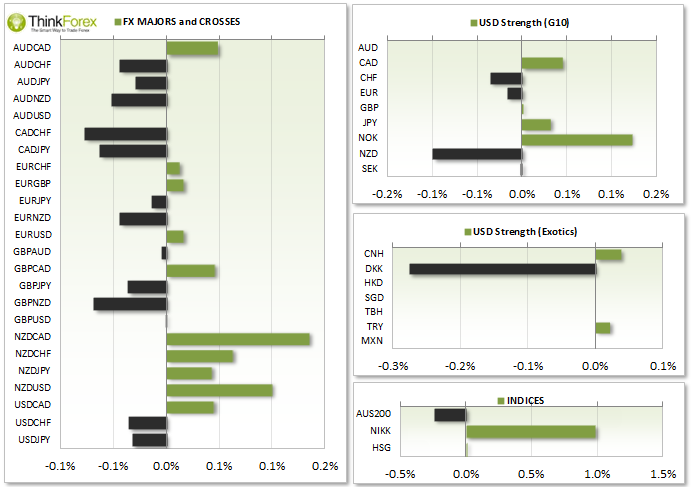

- NZD Current Account is at its highest on over 10 years to show how in demand the Kiwi Dollar is right now. Overall we remain bullish on Kiwi Dollar across the board.

UP NEXT:

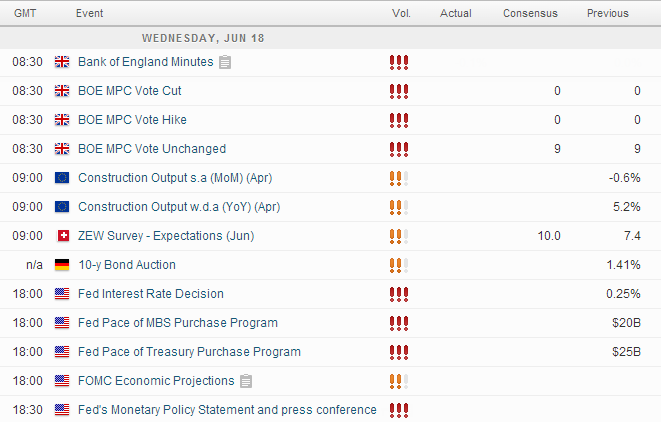

- GBP Rate Vote tonight will grab a lot of attention from traders world-wide following Carney's recent remarks of interest rates being "raised sooner than later". An increase is GBP bullish, but I expect that if rates remain on hold for this to be bearish as traders dump Sterling who bought in anticipation of a rate rise.

- FED Interest Rate is highly unlikely to change and Tapering is also expected to remains an 10bn. It would cause more of a stir if the FED did not taper (which is unlikely).

- FOMC Economic Projections and FED Statement are likely ot be tonight's market movers as traders look for clues on the timing of interest rate hikes, and / or readjustment to economic forecasts.

TECHNICAL ANALYSIS:

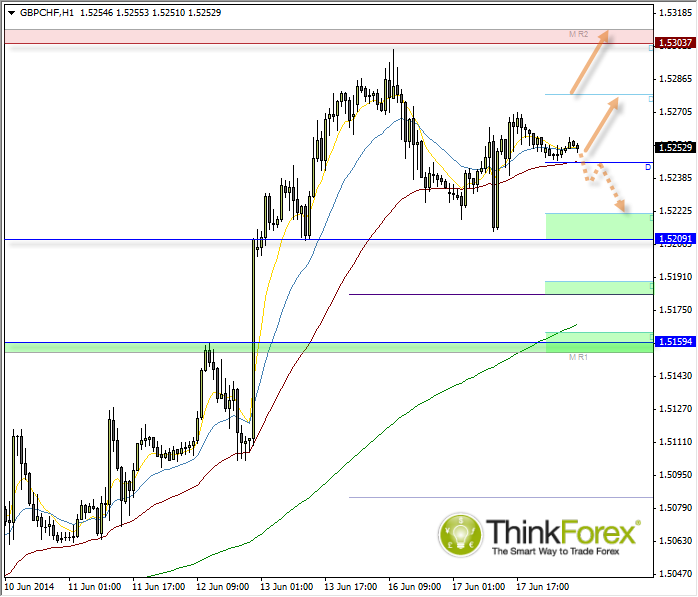

GBP/CHF: TBias is to break to new highs

Since breaking to the highest level since November 2011 2 days ago, GBP/CHF has now consolidated in a sideways correction with another upper thrust expected soon. Today we trade above the daily pivot and 50 hour eMA which is the basis for the bullish intraday bias.

As we approach 1.530 we have several techical resistance levels which may be hard to crack. A break above 1.5301 confirms continuation of the daily bullish trend.

However a break below the daily pivot could be taken as a near-term short signal and to trade down to Daily S1 (yesterday's lows).

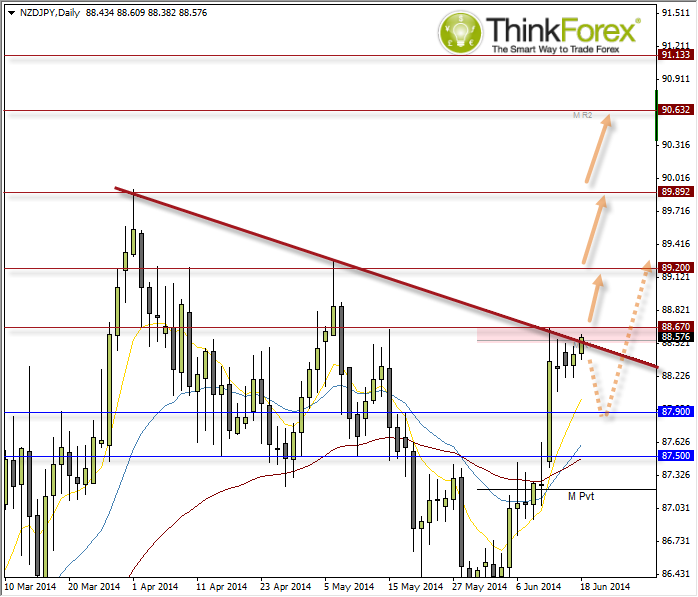

NZD/JPY: Is a bullish breakout imminent?