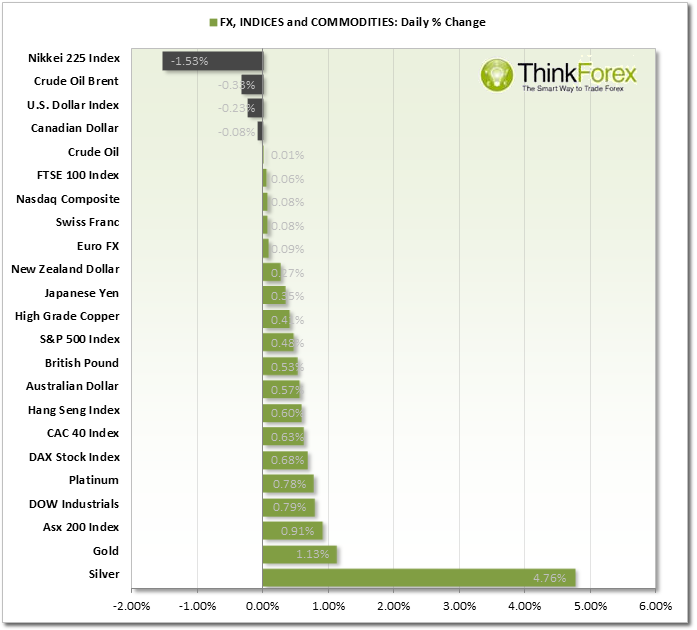

MARKET SNAPSHOT:

AUD: Today New car sales were down -3.5% versus 1.4% expected, the lowest in 6 months, to denote a lack in consumer confidence.

CAD: Manufacturing sales were down 0.9% versus 0.2% expected, is lowest level since June 2013. It is a relatively quiet week for the Canadian Dollar until Friday's Core CPI and Retail Sales.

EUR: German ZEW Economic Sentiment is due out today with a consensus of 61.3. A reading above 0 suggests increased confidence, which has been rising since Dec 2012.

JPY: GDP came in at 0.3%, much lower than the 0.7% expected.

NZD: Both Retail and Core Retail sales came in less than expected today but the market quickly shrugged these off as the Kiwi continues to appreciate against the major currencies.

USD: Bank holiday in US to celebrate Presidents' Day which may result in lower trading volume for the NYLON session and late US session.

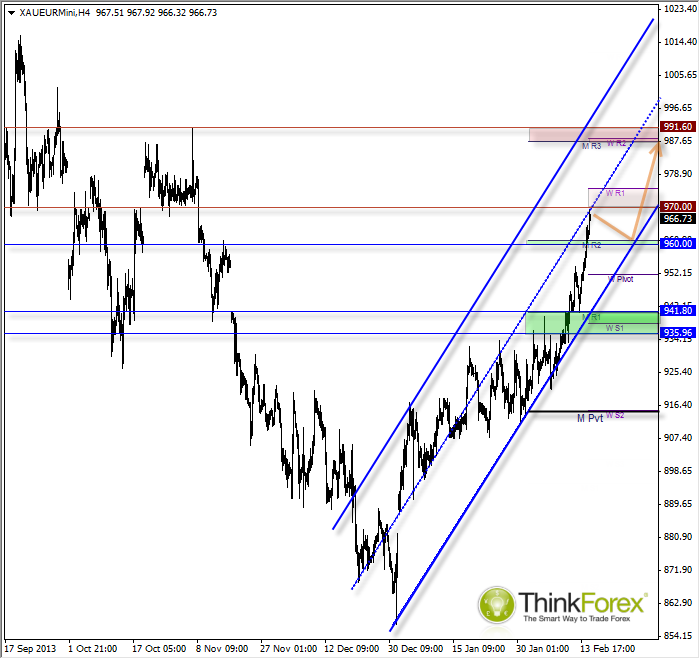

Charts Of The Day:

XAU/EUR: Above 1260, targets 988 XAU/EUR Hourly Chart" title="XAU/EUR Hourly Chart" width="474" height="242">

XAU/EUR Hourly Chart" title="XAU/EUR Hourly Chart" width="474" height="242">

In light of recent Gold strength and to make you aware of our new Mini-Metal contracts I thought it would be appropriate to cover the XAU/EURchart today.

After breaking up through 942 resistance a bullish channel can be seen, which we are currently trading just beneath the midway point near 1970 resistance. Due to this my bias is for a modest pullback prior to a resumption of to the clearly bullish uptrend.

960 is a likely support area as this comprises of Monthly R2 resistance and a pivotal S/R level.

Due to the increasingly bullish momentum and weaker USD across the board my next target beyond 1270 is 988.00

Only a break back below the 1235-42 support zone puts us back into bearish territory on the daily timeframe.

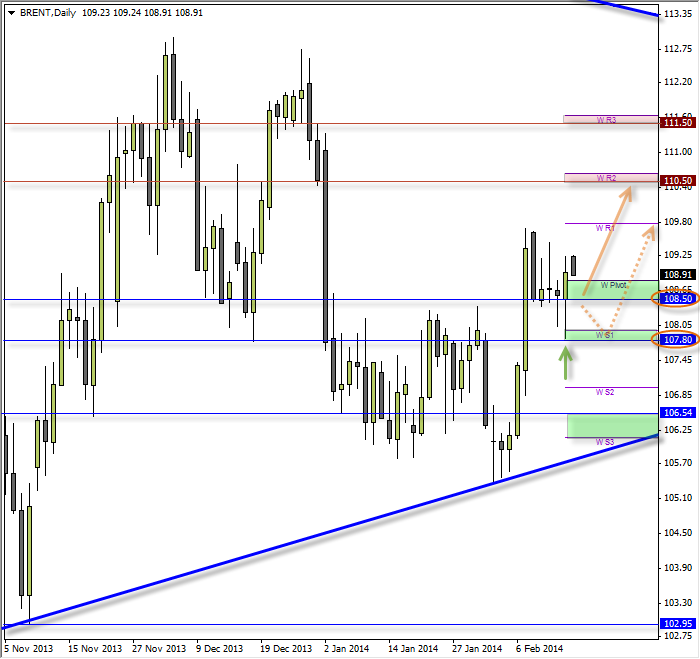

Brent: Bullish Pinbar suggests bullish flag breakout

Friday tested but failed to break 107.80 support and closed the day with a bullish pinbar. Seeing as the original bias was for a bullish flag to be forming this provides further clues towards a pending bullish breakout and for a run up to 110.50 / 111.50.

In the event we break beneath Friday's low of 107.80 then next likely support is around 106.50. However keep in mind this is the lower trendline of a larger triangle which may provide good support. However should this break to the downside then we can expect a more significant move to 103 and 100. However due to the USD weakness across the board this is a less likely scenario, so favour the run up to 110.50.