- AUD: 2Q inventories beat expectations to to grow 0.8%. Inflation gauge is flat; Company profits q/q down -6.9%, its lowest since Nov 2009.

- CNY: Manufacturing PMI falls to 51.1 in August, down from 51.7 previously. HSBC Final Manufacturing revised slightly lower to 50.2, down 0.1.

- JPY: Final PMI at 52.2; Domestic Auto Sales down 5% in August

- NZD: Terms of Trade data smashed expectations of 3.5% to rise 12.5% on the year, and at a 40-year high.

UP NEXT:

- AUD Commodity Prices y/y have been in decline since May 2012, yet the AUD remains relatively strong. Therefore if we did see an improvement from last month's -12.1% this could help support A$ above 93c to target 0.937 swing high.

- GBP Manufacturing PMI is forecast slightly lower at 55.1 vs 55.4 last month, but take note that GBP has held up against USD - so any good numbers form the UK could see GBPUSD brerak above last week's highs.

- EUR: Several releases from Germany, France and Italy covering GDP and PMI, but as these are secondary and final revisions are not likely to be markets movers unless we diverge from expectations in a drastic fashion

TECHNICAL ANALYSIS:

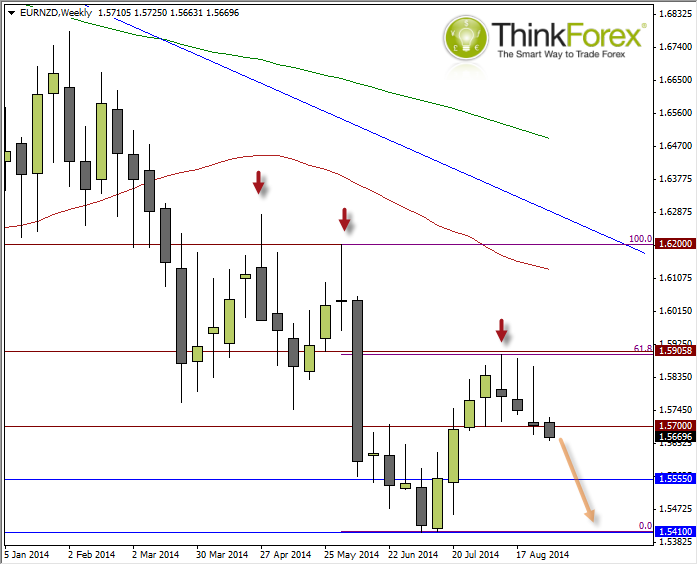

EURNZD: Bears relinquishing control

We have seen an intraday break below 1.57 which could provide selling opportunities if we retrace towards this level and produce bearish signals.

If you compare the previous weekly candles we can see it can whipsaw over 180 pips ranges which can make entering on D1 or smaller very tricky. However also take note that when a trend does unfold it can very quickly see 500+ pip moves (as seen in the drop following the 2nd arrow).

If we remain below 1.57 for any length of time then we may see a more substantial bearish move happen this week. We certainly have enough data for some volatility - hopefully we can take advantage of this move.

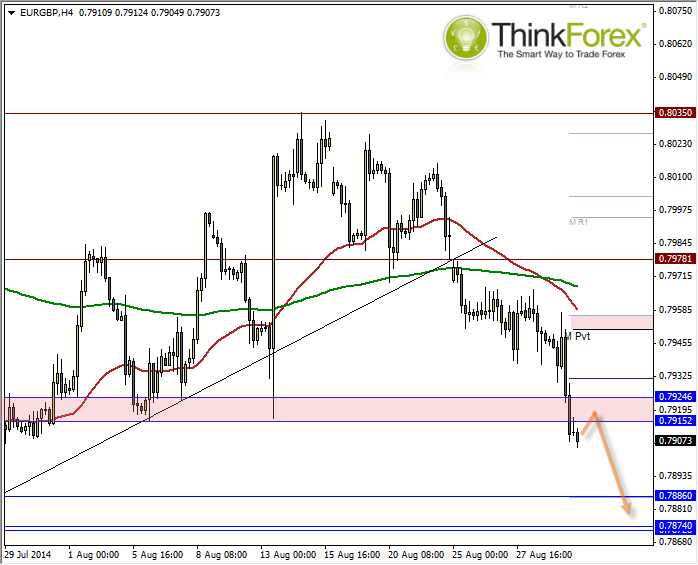

EURGBP: Selling into rallies

Sticking with 'sell the euro' theme EURGBP could provide decent bearish swing trades. Here I am seeking to sell into any rally towards the sell-zone and target 2014 lows.

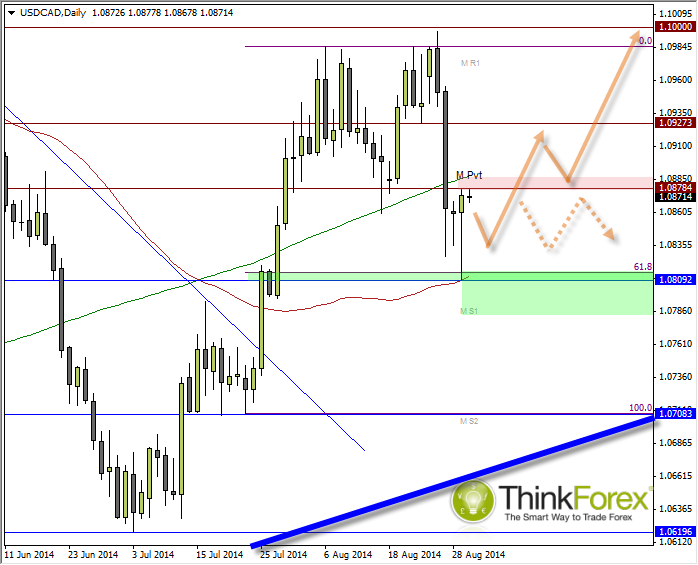

USDCAD: Buying any dips

The Bullish Hammer shows there is some strong support around 1.080-81. However we are also below several resistance levels which have capped any further gains. Whilst I suspect we will break back above this resistance zone I am considering buy set-ups within the range of the Hammer to anticipate the break above Friday's high.

Hopefully I can enter at a better price before Friday's NFP (both US and CAD release employment data) and be rewarded with strong employment data from US and Hawkish comments from FOMC members this week.