ASIA ROUNDUP:

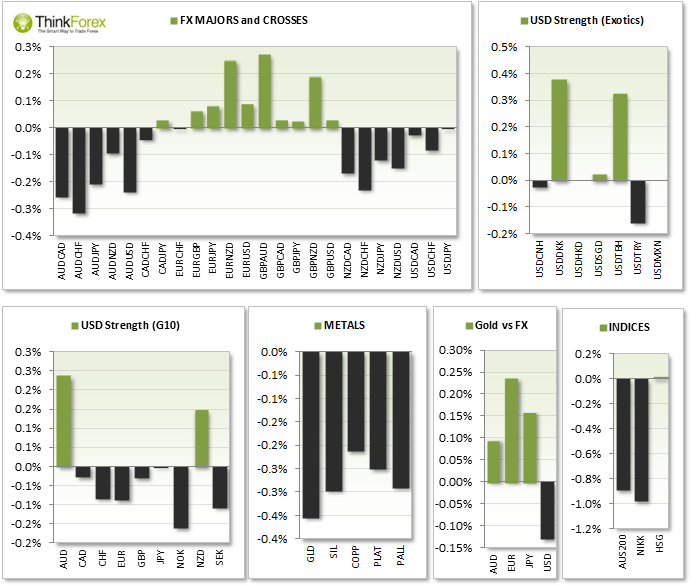

- NZD exports are at their highest since May 2011, however it wasn't enough to see the Kiwi Dollar retreat from yesterday's lows. Whilst exports have been up dairy prices have decline to balance it out.

- AUS200 breaks below 5510 support and down -1.7%

- AUD and NZD continued to depreciate against the Greenback whilst EUR gains bullish attention in the lead-up to CPI today

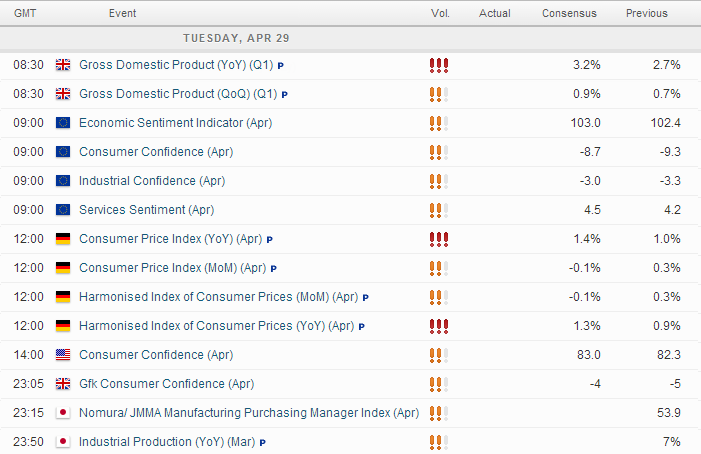

- UK GDP is forecast to come in at a 6-month high so any shortcoming could see GBP take a knock. It is released at the same time as EUR Money Supply y/y so expect some volatility on EUR/GBP.

- German CPI will be closely watched by the ECB as they continue to weigh up options for the Eurozone and possible QE. As one of the stronger EU countries, any signs of weakness from Germany could increase pressure for the ECB to finally take action.

Pairs to Monitor: EUR/GBP, AUD/USD, EUR/USD, AUD/CAD, USD/JPY, GBP/USD, GBP/JPY

TECHNICAL ANALYSIS:

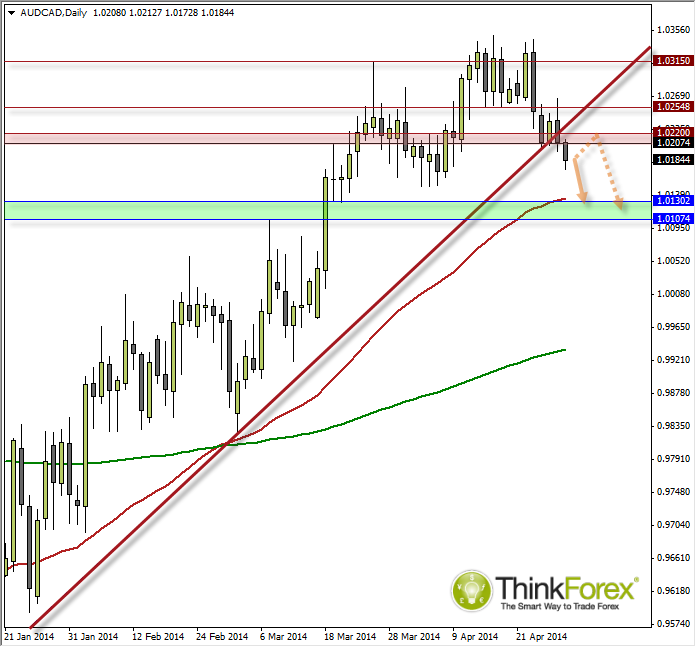

AUD/CAD: Trendline break confirmed; 1.013 beckons

This trade was discussed yesterday and it clearly took the bearish route. The high of the day was the 1.0255 resistance (our bullish line in the sand) to close the day with a bearish outside day and just below the trendline.

Asia trading wasted no time to continue the bearish sentiment and the next primary target is around 1.013 (50eMA).

Those wishing to jump on board can monitor lower timeframes to seek bearish setups down towards the eventual target.

In the event we see a retracement then bearish setups below 1.020-22 can be considered.

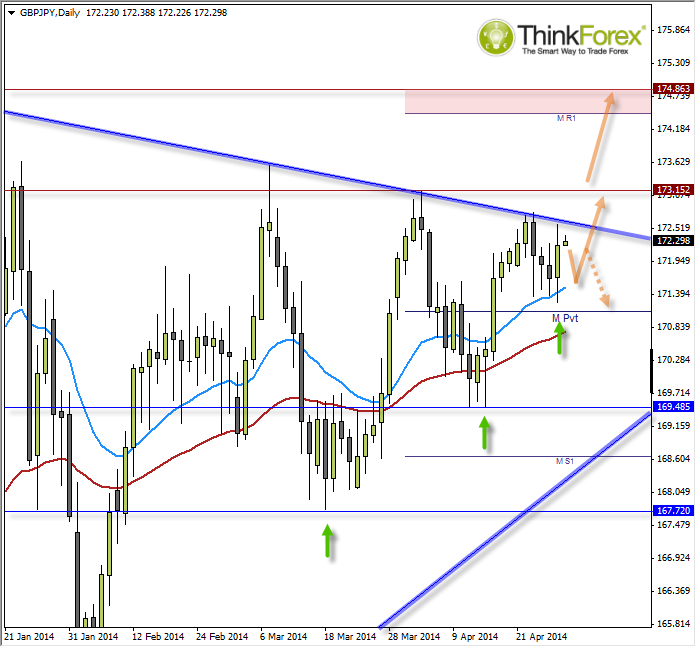

GBP/JPY: Pivotal low in place? Awaiting bullish breakout

Please view previous analysis for a larger picture view

Yesterday's bullish engulfing candle above support may have provided the clue the [anticipated] bullish breakout is near-by. The eventual target is around 179 but I doubt it will get there in a straight line. But with any luck it will present decent bullish rallies to trade on the way up.