- NZD Trade balance: In deficit for the 1st time this year, and at its lowest level since Sep 13. This resulted in both AUD and NZD selling off across the board with AUDUSD trading to a 3-day low and NZDUSD testing 0.83 support.

- US Durable Goods: The bulk of today's data news comes from the US and covers manufacturing, housing and consumer. Whilst Durables (nor core) are listed as red news item the market may pay closer attention to ex-transportation reading as this number is less volatile. That said, Durables are expected to come in much higher at 7.5% so if this come sin or above target then we can expect Greenback to continue its strength.

- US New home sales: Fell short of expectations yesterday, so we really need new home sales to come in strong to remove the fear of a new trend beginning.

- US Consumer Confidence: The overall trend is clearly bullish to show rising confidence, so it shouldn’t be a major impact if we com in less than last month, which was a multi-year high anyway.

TECHNICAL ANALYSIS:

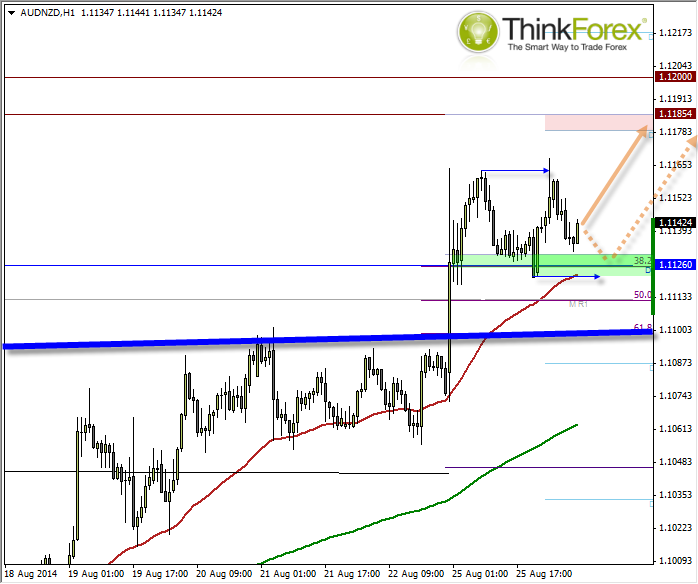

AUDNZD H1: One more attempt to 1.112?

Following today's Trade Balance from NZ the cross has settled above support after trading to a fresh 8-month high intraday. Due to the continued bullish momentum then it would not be unreasonable to expect another attempt towards 1.12, however we have a zone of resistance around 1.117-18 which may make a more reliable target. In the event we do trade up to 1.12 I do not expect this important level to break first time (if at all).

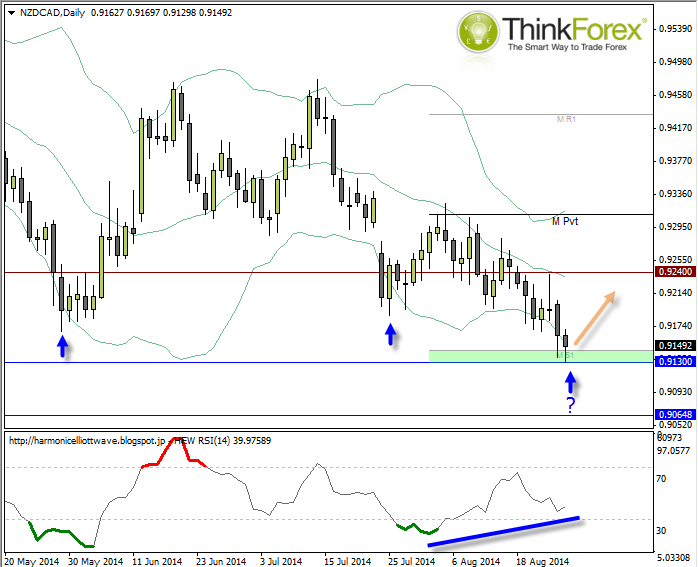

NZDCAD D1: Daily

Whilst market participants continue to seek trends it can also be beneficial to keep an eye on mean reversion strategies. NZDCAD has been grinding lower and I suspect will be due a bottom at some point. However it has provided several entries to trade against the trend when it breaks (intraday) outside the lower Bollinger Band.

Price has tested a support zone following very poor Trade Balance figures. The fact it failed to break it may provide further evidence of a retracement from current lows.

Whilst D1 may only provide a 1:1 reward to risk ratio you can go to lower timeframes to fine-tune the entry and target the 20 period MA (or H4 20 MA).