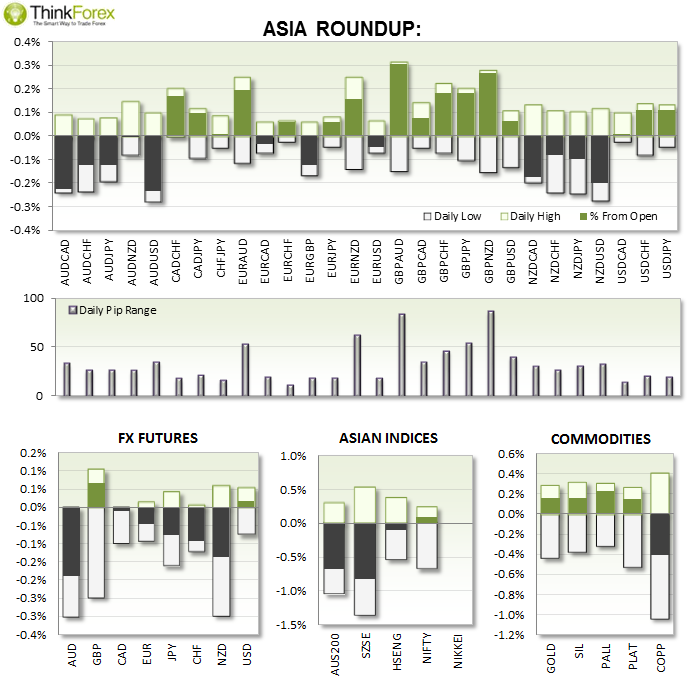

NZD: Current Account returns to deficit and below expectations at -1.07bn; Global Dairy Prices remain stable at 0%;

AUD: Leading indicators suggest consumers are more likely to to pay off debts and save instead of spend over coming years.

CNY: China injects $81bn (500 bn Yuan) into Banking system

TECHNICAL ANALYSIS:

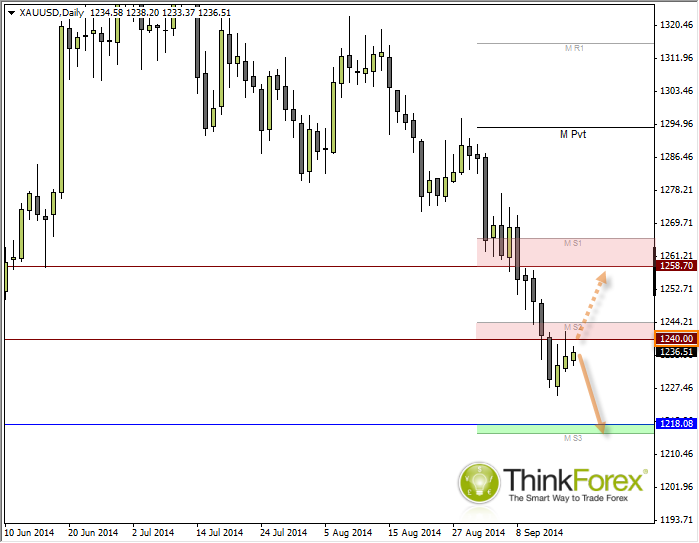

Gold: $1240 is the key level to watch

Whilst this analysis may seem overly-simplistic, from a price point of view it is a very simple setup. Bullish above $1240 and bearish below. We just need the FED to make or break the Greenback tonight to provide the directional bias for Gold (and anything else in USD).

Yesterday's Shooting Star Reversal saw a high at the resistance zone and price now hovers around the midway point of yesterday's range. Leading up to tonight's FOMC / FED meetings if we see clear USD strength then we can expect $1240 to cap as resistance.

A clear break above $1240 would open up $1258 as a bullish target.

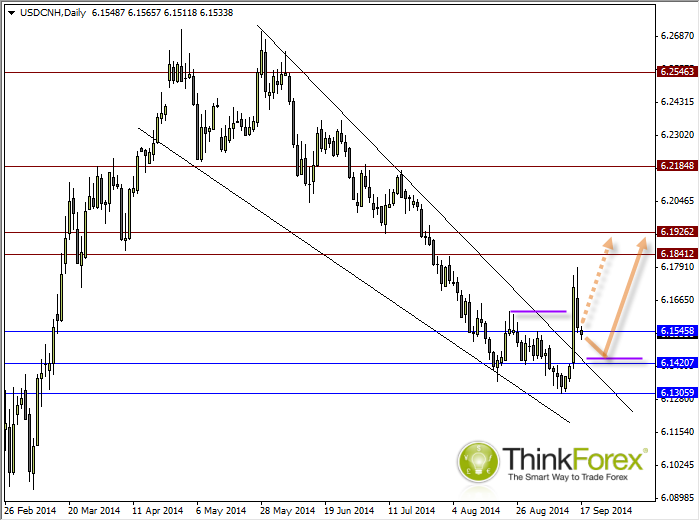

USD/CNH: Breakout confirmed; Seeking buy setups

This was originally highlighted on Monday's Daily Insight, just prior to the bullish breakout of the potential bullish wedge.

If you missed it do not fret, as I tend to find breakouts more reliable to enter following the breakout itself. We can see that price has closed with a Dark Cloud cover to suggest a deeper retracement may be on the cards. However because the initial breakout was well clear of a prior swing high (purple lines) I am assuming we are at the beginning of a new trend and seeking to enter long if I see bullish setup at support levels.