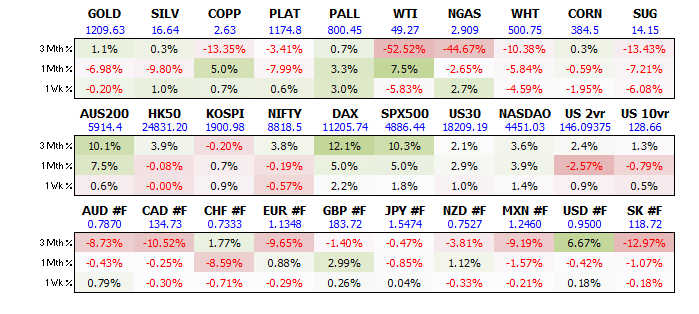

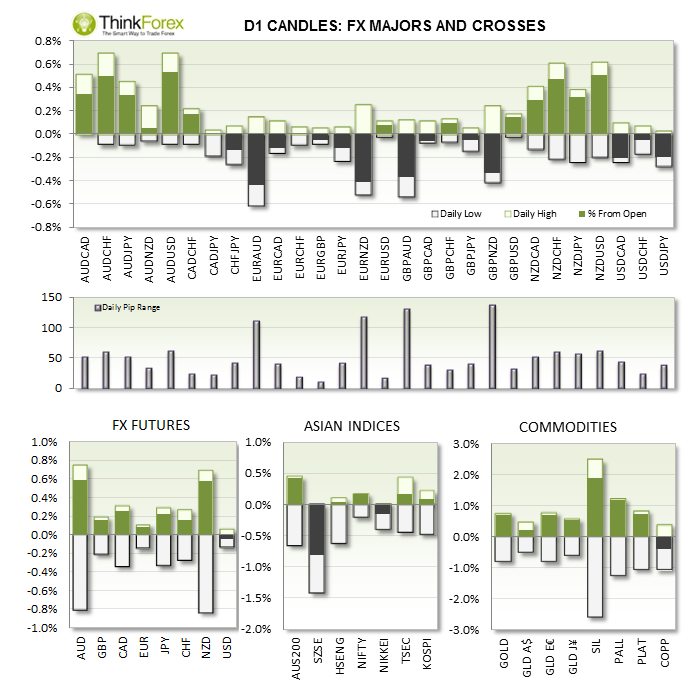

MARKET SNAPSHOT:

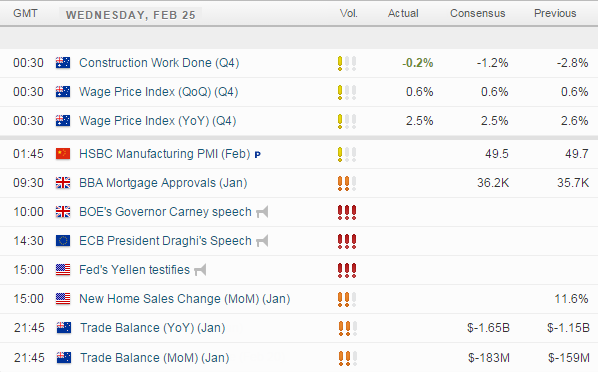

UP NEXT:

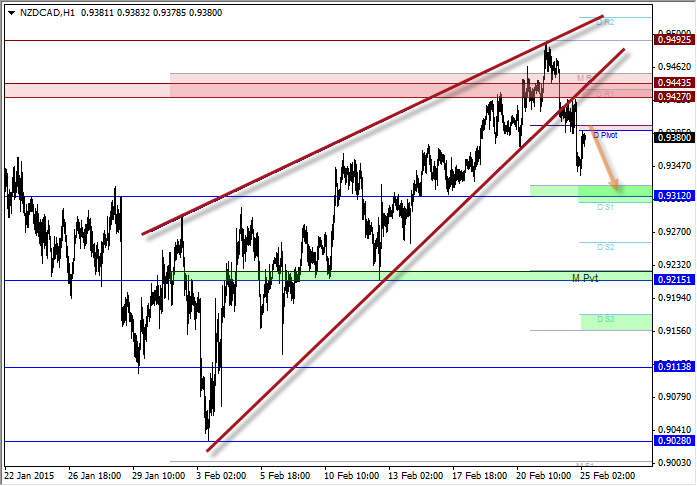

TECHNICAL ANALYSIS:

NZD/CAD: Confirms Bearish Wedge at highs

If history is anything to go by do not expect precise levels of S/R to be respected, or the pattern to hit the eventual target back at the 0.9020 lows in a nice and clean manner (assuming it does).

That said the intraday price action is setting up for a potential swing short beneath the daily pivot. Always allow room for market 'noise' around pivots, especially when trading commodity crosses such as NZD/CAD.

- 0.9312 is the initial target with a break below then targeting 0.9232.

- A break above 0.940 could target 0.9427-45

If there is any chance of CAD strength tonight it will be from BoC Poloz reducing expectations of a seconds rate cut for Canada.

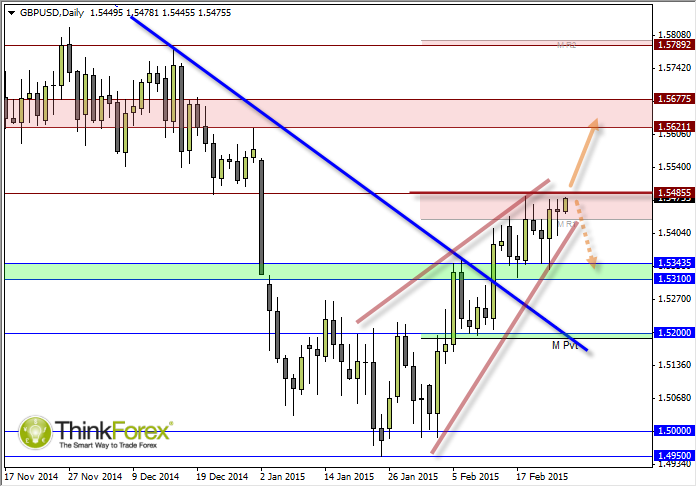

GBP/USD: 1.548 is the level to watch

We appear only a few pips away form a bullish breakout on Cable as we approach Yellen's 2nd testimony. A repeat of yesterday could indeed give it that final push up through the Dec '14 low to target 1.5620-70 zone.

The Bearish Wedge is beginning to look more unlikely as it approaches the December low but even if it continues to hold as resistance then 1.5310-40 and 1.520 are zones of support likely to scupper its chances of completing the pattern back by the lows.