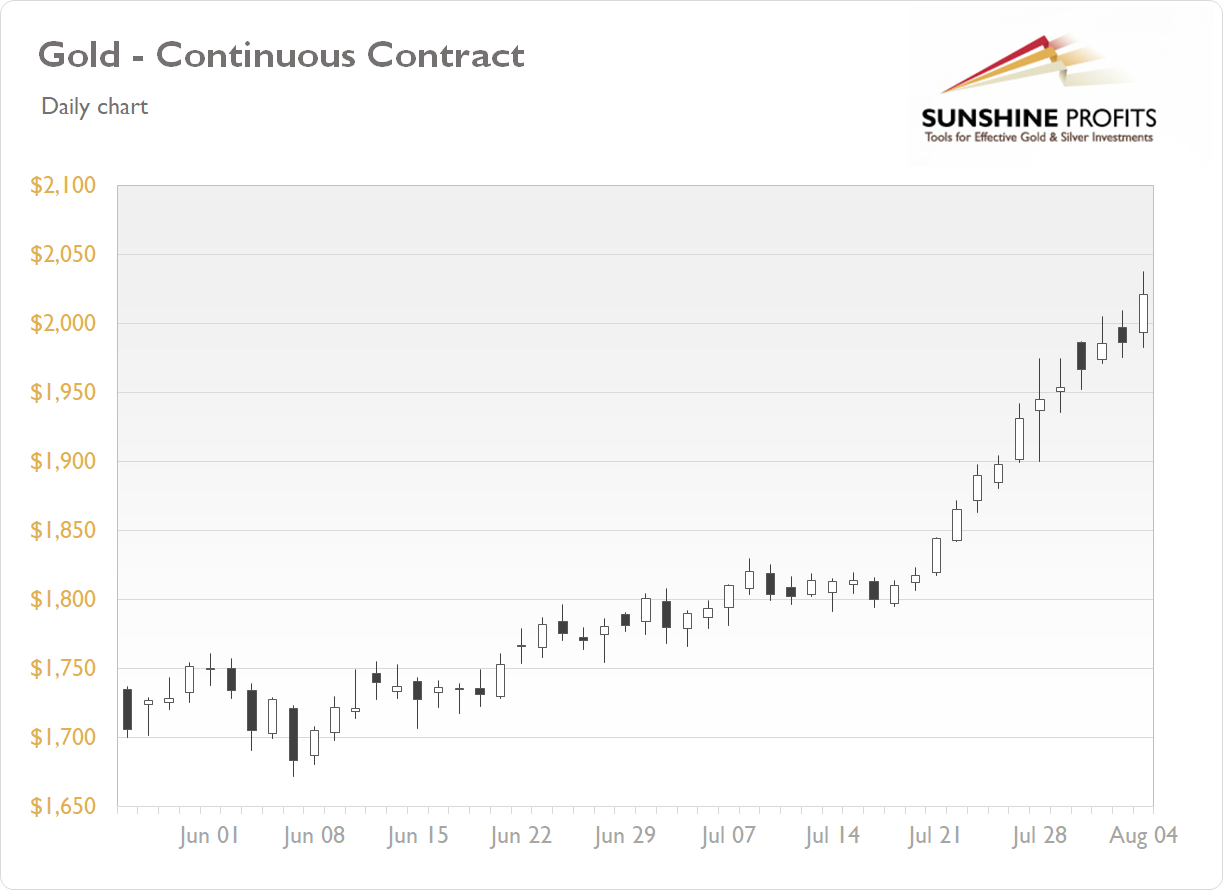

The gold futures contract has accelerated its long-term uptrend on Tuesday following the recent short-term consolidation along $2,000 mark. The market reached new record high at the level of $2,037.70 yesterday and it closed 1.75% above Monday's closing price. Gold price remains the highest in history following U.S. dollar sell-off, among other factors.

Gold is 1.64% higher this morning, as the market is further extending the uptrend following breaking above $2,000. What about the other precious metals? Silver rallied 6.60% on Tuesday and today it is 3.6% higher. Platinum gained 2.59% and today it is 2.6% higher. Palladium gained 1.45% yesterday and today it's 1.6% higher. So precious metals are further extending their uptrend this morning.

Yesterday's Factory Orders release has been better than expected at +6.2%. Today we will get the ADP Non-Farm Employment Change release at 8:15 a.m. We will also get the ISM Non-Manufacturing PMI at 10:00 a.m. And the markets will be waiting for the important monthly jobs data release on Friday.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Wednesday, August 5

- 8:00 a.m. Japan - BOJ Governor Kuroda Speech

- 8:15 a.m. U.S. - ADP Non-Farm Employment Change

- 8:30 a.m. U.S. - Trade Balance

- 9:45 a.m. U.S. - Final Services PMI

- 10:00 a.m. U.S. - ISM Non-Manufacturing PMI

- 5:00 p.m. U.S. - FOMC Member Mester Speech

Thursday, August 6

- 7:30 a.m. U.S. - Challenger Job Cuts y/y

- 8:30 a.m. U.S. - Unemployment Claims

- 10:00 a.m. U.S. - FOMC Member Kaplan Speech

- 9:30 p.m. Australia - RBA Monetary Policy Statement

- Tentative, China - Trade Balance, USD-Denominated Trade Balance