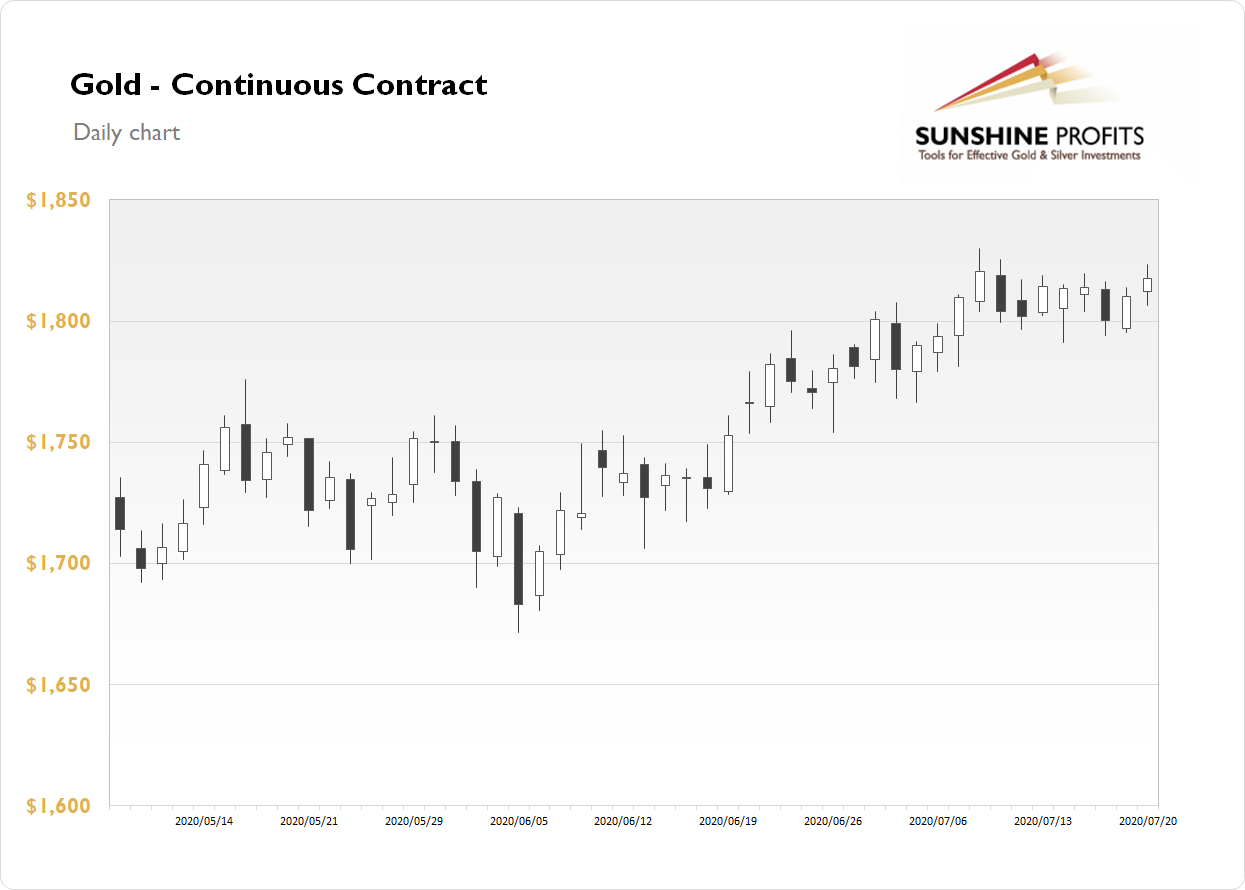

The gold futures contract gained 0.41% on Monday, as it extended its last Friday's advance of 0.5%. The market has retraced most of its relatively flat correction from new long-term high of around $1,830. The financial markets have been going risk-on following a series of better-than-expected economic data and quarterly corporate earnings releases. Last month gold broke above medium-term local highs in June, as we can see on the daily chart:

Gold is 0.98% higher this morning, as it is extending the uptrend. What about the other precious metals? Silver gained 2.17% on Monday and today it is gaining another 5.8%. Platinum gained 0.98% and today it is 3.2% higher. Palladium gained 1.82% and today it is gaining 3.8%. So precious metals are extending their uptrend this morning.

Last week's Friday's economic data releases have been mixed. Yesterday we didn't get any important economic data. However, the markets are reacting on the U.S. quarterly corporate earnings releases this week.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Tuesday, July 21

- 8:30 a.m. Canada - Retail Sales m/m, Core Retail Sales m/m

Wednesday, July 22

- 8:30 a.m. Canada - CPI m/m

- 9:00 a.m. U.S. - HPI m/m

- 10:00 a.m. U.S. - Existing Home Sales

- All Day, Japan - Bank Holiday