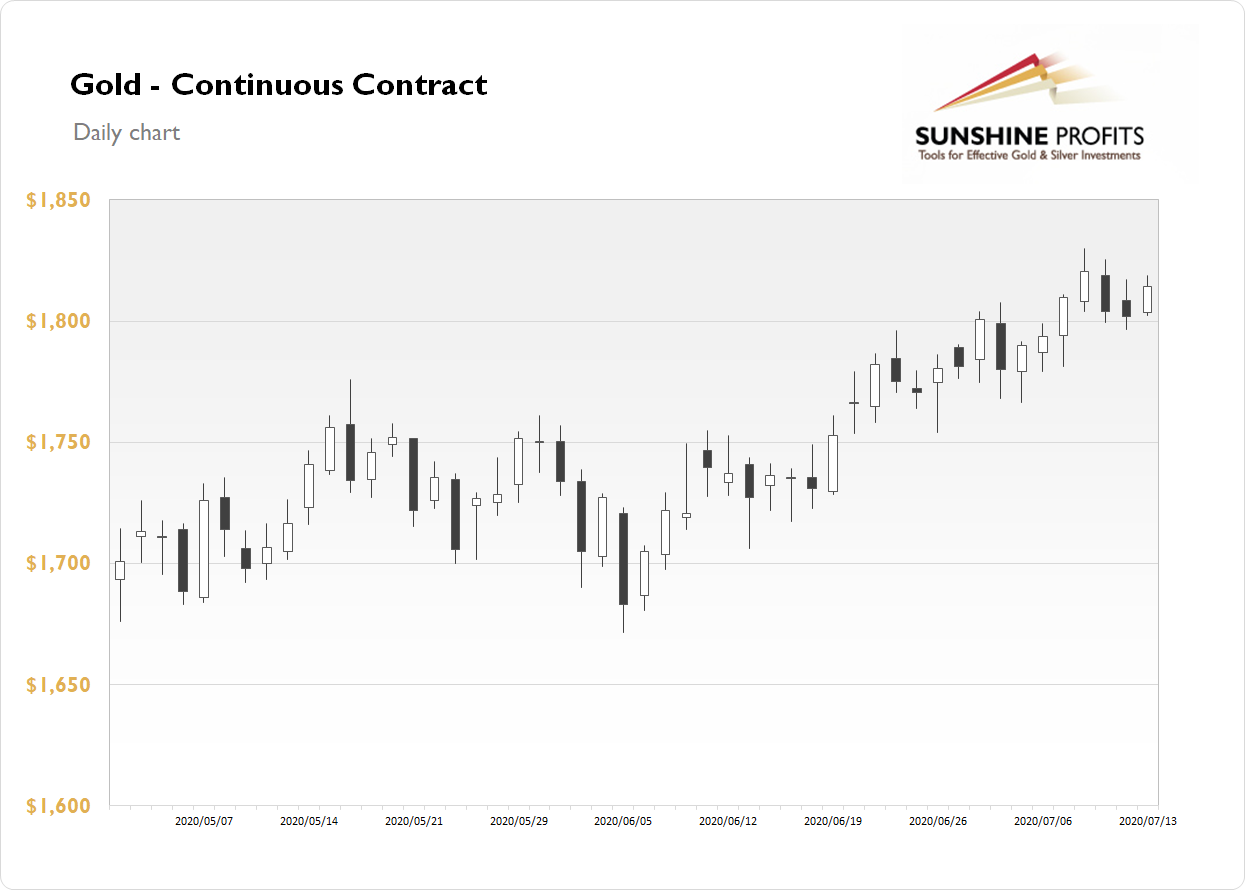

The Gold Futures contract gained 0.68% on Monday, as it retraced some of late last week's downward correction following Wednesday's advance to new long-term high of $1,829.80. The recent economic data releases have been better than expected and financial markets went risk-on last week. But yesterday the stock market has reversed its intraday rally before closing lower. Gold broke above medium-term local highs in June, as we can see on the daily chart:

Gold is 0.4% lower this morning, as it is extending a short-term consolidation along $1,800 price level. What about the other precious metals? Silver gained 3.86% on Monday and today it is trading 1.5% lower. Platinum gained 2.02% yesterday and today it is 2.1% lower, Palladium gained 2.33% and today it is 1.5% lower. So precious metals are in red this morning.

Investors will now wait for today's economic data releases. We will get the U.S. Consumer Price Index at 8:30 a.m. Then in the evening Monetary Policy Statement from Bank of Japan will be released.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Tuesday, July 14

- 5:00 a.m. Eurozone - German ZEW Economic Sentiment

- 6:00 a.m. U.S. - NFIB Small Business Index

- 8:30 a.m. U.S. - CPI m/m, Core CPI m/m

- Tentative, Japan - BOJ Outlook Report, Monetary Policy Statement, BOJ Policy Rate

- All Day, Eurozone - French Bank Holiday

Wednesday, July 15

- 8:30 a.m. U.S. - Empire State Manufacturing Index, Import Prices m/m

- 9:15 a.m. U.S. - Industrial Production m/m, Capacity Utilization Rate

- 10:00 a.m. Canada - BOC Monetary Policy Report, BOC Rate Statement, Overnight Rate

- 2:00 p.m. U.S. - Beige Book

- 9:30 p.m. Australia - Employment Change, Unemployment Rate

- 10:00 p.m. China - GDP q/y