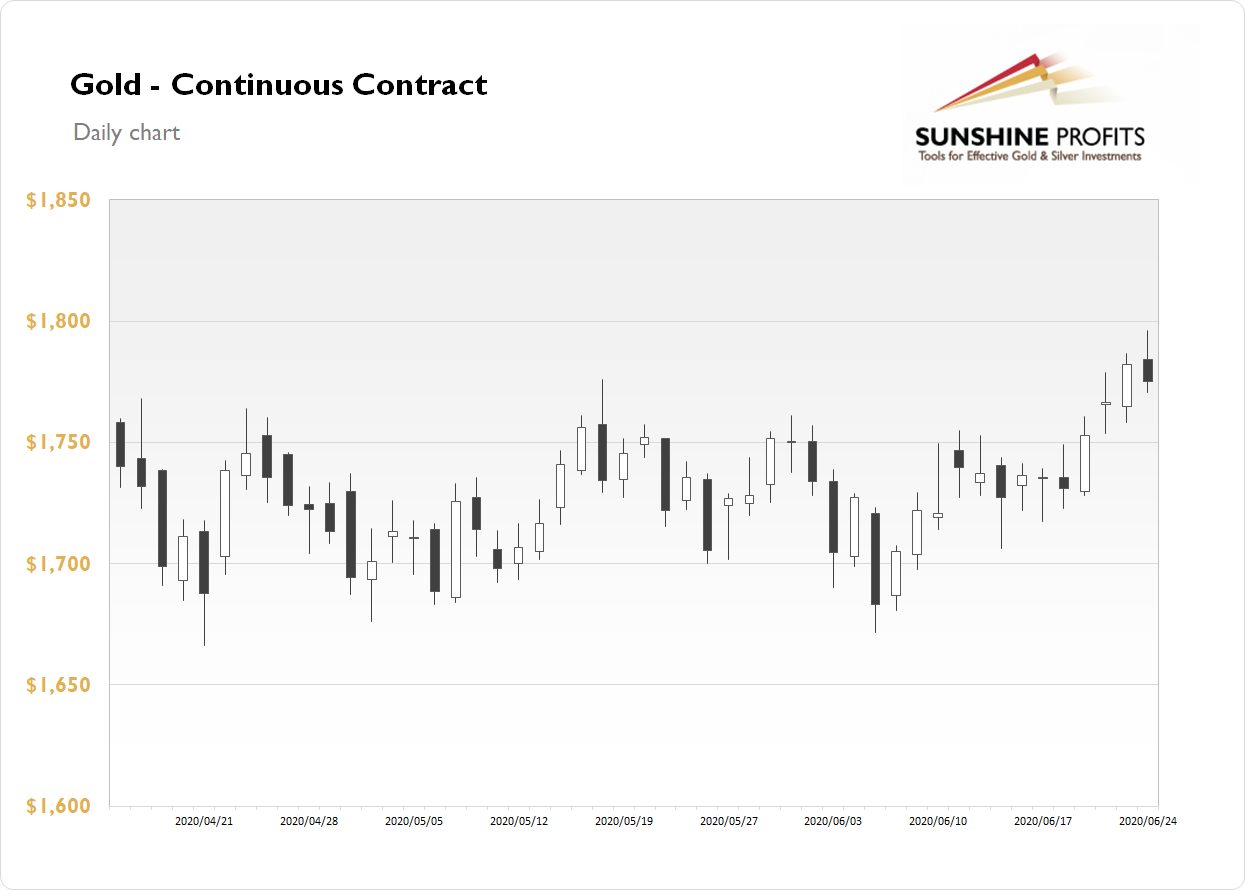

The gold futures contract lost 0.39% on Wednesday after reaching new long-term high of $1,796.10. The market got very close to $1,800 mark but then it has retraced the whole intraday advance. The recent economic data releases didn't bring any new surprises for the financial markets. However, gold broke above the recent highs, as we can see on the daily chart:

Gold is 0.2% lower this morning, as it is fluctuating along yesterday's closing price. What about the other precious metals? Silver lost 2.18% on Wednesday and today it is 0.44% lower. Platinum lost 4.94% and today it's down 0.2%. Palladium lost 3.21% yesterday and today it is 0.7% lower.

Financial markets went risk-off yesterday's despite better-than-expected German ifo Business Climate number release. Investors will wait for series of the U.S. economic data releases today. We will get the GDP number, Unemployment Claims and Durable Goods Orders at 8:30 a.m. The final GPD is expected to be at -5.0%. And the Unemployment Claims are set to remain well above 1 million.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Thursday, June 25

- 7:30 a.m. Eurozone - ECB Monetary Policy Meeting Accounts

- 8:30 a.m. U.S. - Final GDP q/q, Unemployment Claims, Durable Goods Orders m/m, Core Durable Goods Orders m/m, Preliminary Wholesale Inventories m/m, Goods Trade Balance

- 4:30 p.m. U.S. - Bank Stress Test Results

- All Day, China - Bank Holiday

Friday, June 26

- 8:30 a.m. U.S. - Personal Spending m/m, Personal Income m/m, Core PCE Price Index m/m

- 10:00 a.m. U.S. - Revised UoM Consumer Sentiment, Revised UoM Inflation Expectations