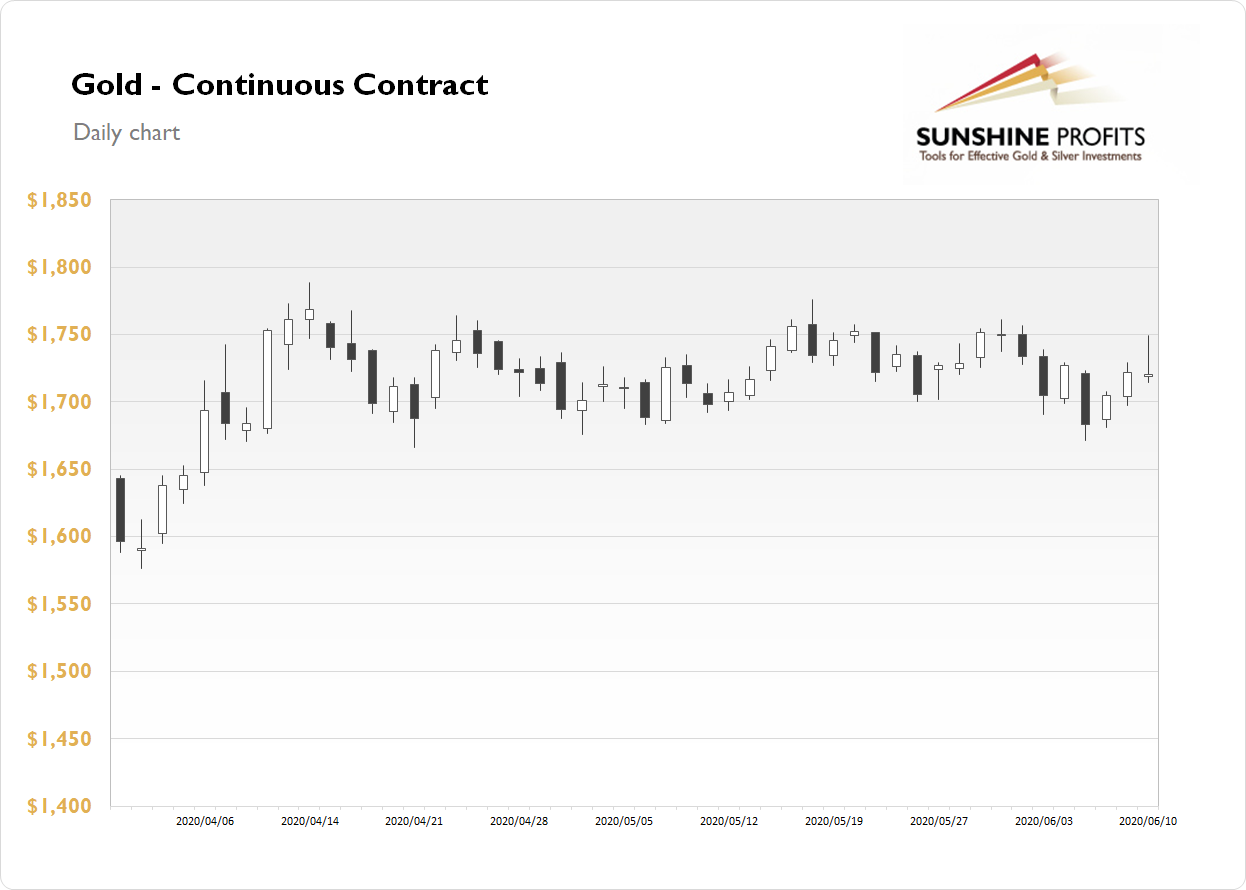

The gold futures contract lost 0.07% on Wednesday following an intraday advance to $1,750 price level. Global markets went risk-on and gold has been selling off as a safe-haven asset recently. However, yesterday's FOMC Statement came out as a short-term game-changer. Stock prices reversed lower and gold spiked higher before closing virtually unchanged. It is still trading within a medium-term consolidation, as we can see on the daily chart:

Gold is up 0.62% as it retraces more of the recent advance. And financial markets decline following yesterday's Fed-talk. What about the other precious metals? Silver was unchanged on Wednesday and today it is 1.13% higher. Platinum lost 1.70% and today it is 2.1% lower. Palladium lost 1.85% yesterday and today it is 0.5% up.

The recent economic data releases have been confirming negative coronavirus impact on global economies. However, last Friday's U.S. monthly jobs data came out much better than expected. And the Nonfarm Payrolls number has been positive. Today we will get some more important U.S. economic data releases - Producer Price Index along with the Unemployment Claims at 8:30 a.m.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Thursday, June 11

- 8:30 a.m. U.S. - PPI m/m, Core PPI m/m, Unemployment Claims

- All Day, Eurozone - Eurogroup Meetings

Friday, June 12

- 10:00 a.m. U.S. - Preliminary UoM Consumer Sentiment