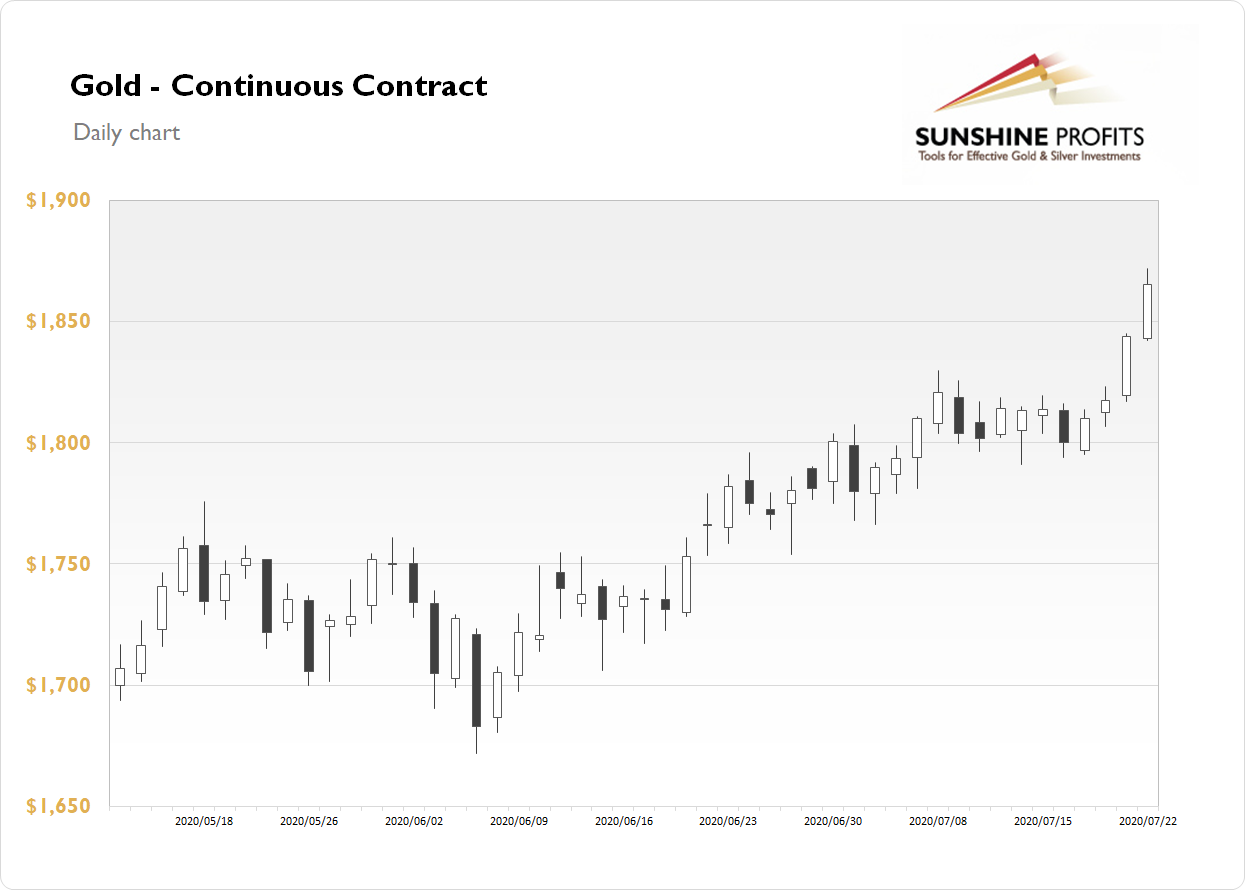

The gold futures contract gained 1.15% on Wednesday, as it accelerated its short-term uptrend following breaking above the recent trading range and $1,800 price level. The yellow metal has reached the highest since August-September of 2011. And silver has further extended its rally above $20 mark. The financial markets have been going risk-on following a series of better-than-expected economic data and quarterly corporate earnings releases. Last month gold broke above medium-term local highs along $1,750 price level, as we can see on the daily chart:

Gold is 0.5% higher this morning, as it is further extending the uptrend. What about the other precious metals? Silver rallied 7.36% on Wednesday and today it is 1.1% lower. Platinum gained 4.19% and today it is 1.1% lower. Palladium gained 1.86% and today it's 1.7% lower. So precious metals fluctuate following their recent advances this morning.

Yesterday's U.S. Existing Home Sales release has been as expected. Today we will get the Unemployment Claims number at 8:30 a.m. and the CB Leading Index at 10:00 a.m. The markets will also wait for more quarterly corporate earnings and tomorrow's PMI releases.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Thursday, July 23

- 8:30 a.m. U.S. - Unemployment Claims

- 10:00 a.m. U.S. - CB Leading Index m/m

- All Day, Japan - Bank Holiday

Friday, July 24

- 3:15 a.m. Eurozone - French Flash Manufacturing PMI, French Flash Services PMI

- 3:30 a.m. Eurozone - German Flash Manufacturing PMI, German Flash Services PMI

- 4:00 a.m. Eurozone - Flash Manufacturing PMI, Flash Services PMI

- 9:45 a.m. U.S. - Flash Manufacturing PMI, Flash Services PMI

- 10:00 a.m. U.S. - New Home Sales