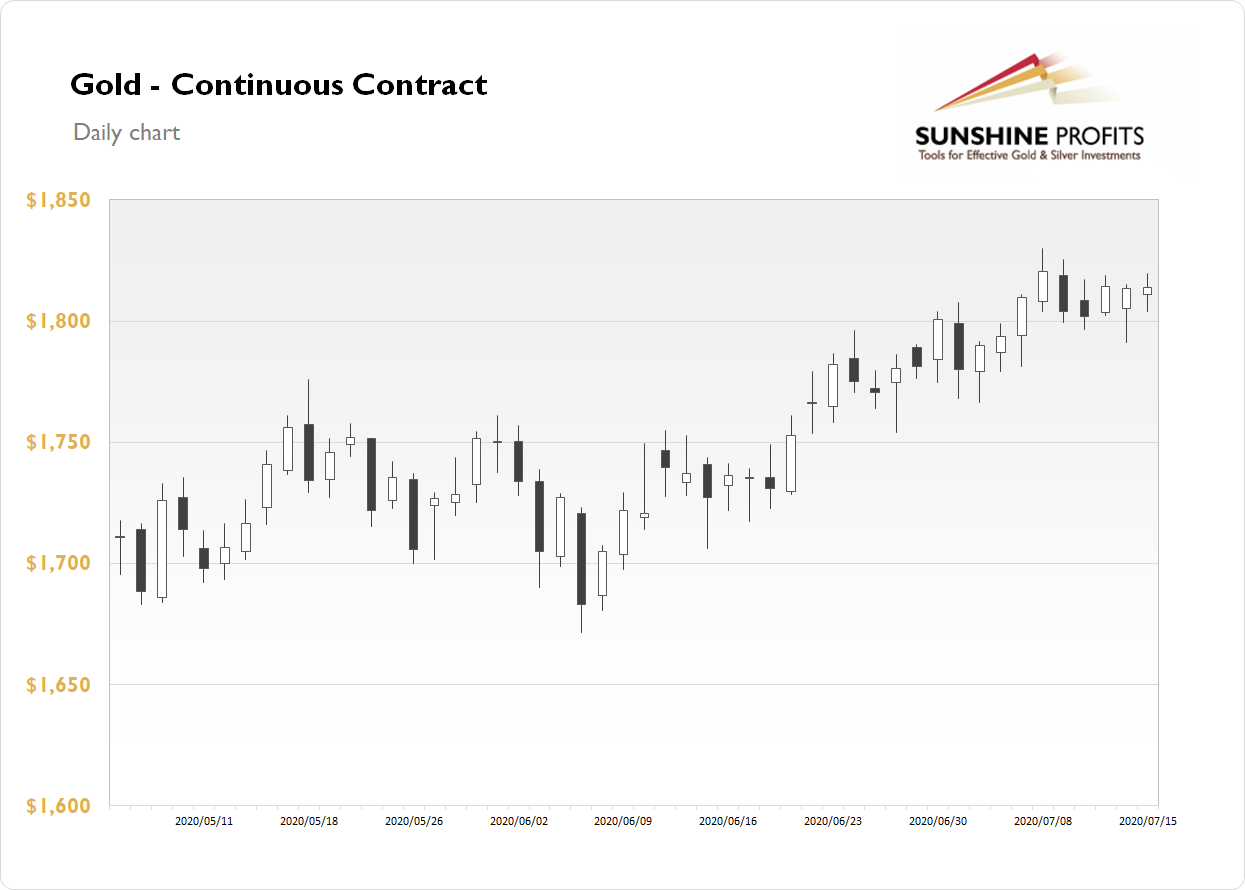

The Gold Futures contract gained 0.02% on Wednesday, as it further extended a short-term consolidation following last week's Wednesday's advance to new long-term high of $1,829.80. The recent economic data releases have been better than expected. Gold broke above medium-term local highs in June, as we can see on the daily chart:

Gold is 0.4% lower this morning, as it continues to trade close to $1,800 price level. What about the other precious metals? Silver advanced 1.18% on Wednesday and today it is trading 1.1% lower. Platinum gained 0.76% and today it is 0.7% lower. Palladium gained 1.23% and today it is 0.75% lower. So precious metals' prices are going down this morning.

Yesterday's U.S. Industrial Production and China's GDP releases have been better than expected. Today the markets are waiting for the Retail Sales number release at 8:30 a.m., among others.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Thursday, July 16

- 7:45 a.m. Eurozone - Main Refinancing Rate, Monetary Policy Statement

- 8:30 a.m. U.S. - Retail Sales m/m, Core Retail Sales m/m, Unemployment Claims, Philly Fed Manufacturing Index

- 8:30 a.m. Eurozone - ECB Press Conference

- 8:30 a.m. Canada - ADP Non-Farm Employment Change

- 10:00 a.m. U.S. - Business Inventories m/m, NAHB Housing Market Index

- 11:10 a.m. U.S. - FOMC Member Williams (NYSE:WMB) Speech

Friday, July 17

- 8:30 a.m. U.S. - Building Permits, Housing Starts

- 10:00 a.m. U.S. - Preliminary UoM Consumer Sentiment