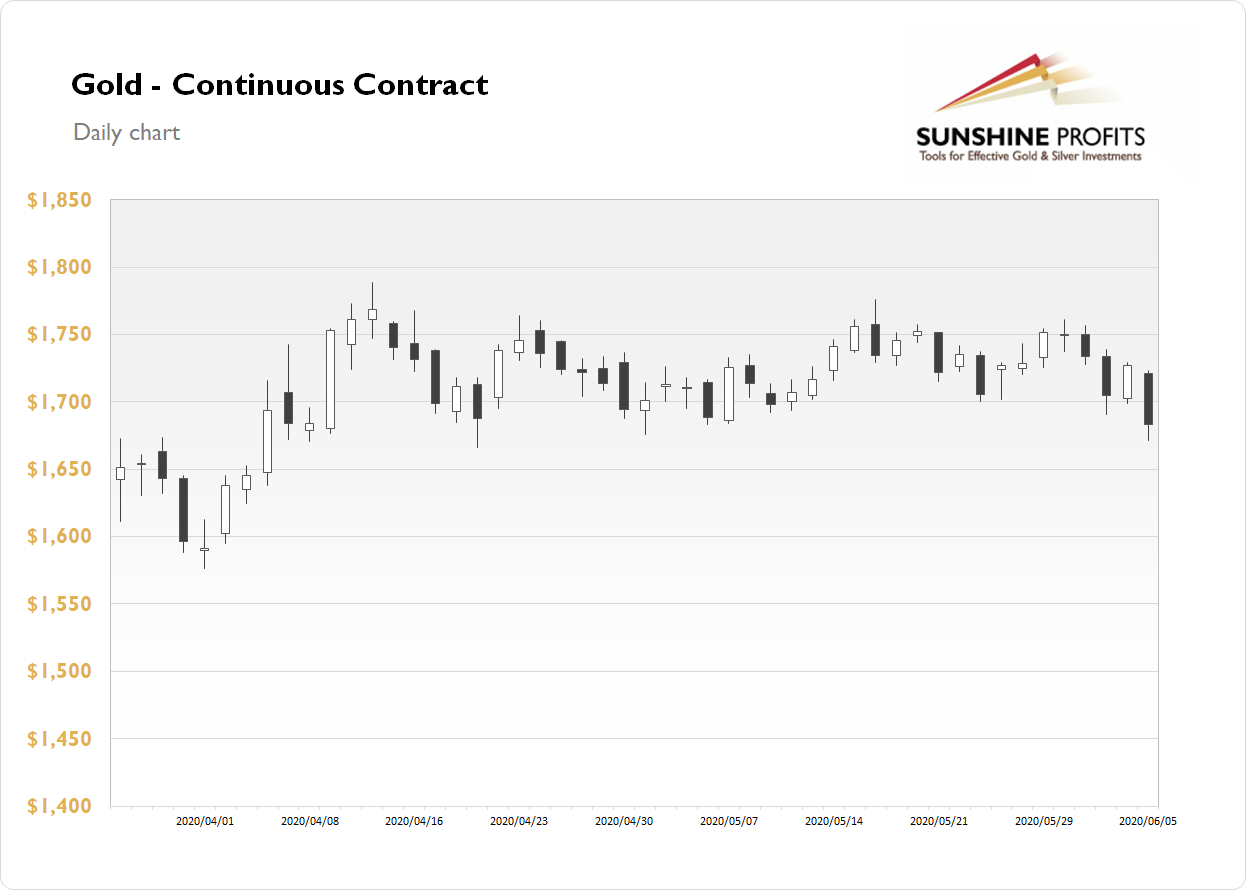

The Gold Futures contract lost 2.57% on Friday following much better than expected U.S. monthly jobs data release. Global markets went risk-on and gold has sold off as a safe-haven asset. On Monday a week ago the price has reached slightly above $1,760 and Friday's daily low fell at $1,671.70. Gold is trading at the bottom of its medium-term consolidation, as we can see on the daily chart:

Gold is gaining 0.78% this morning, as it retraces a fraction of its Friday's decline. Financial markets remain in risk-on mode, as stocks continue to hover along their medium-term highs. What about the other precious metals? Silver lost 3.22% on Friday and today it is 2.28% higher. Platinum lost 4.00% and today it is gaining 3.5%. Palladium gained 1.55% on Friday and today it is 0.28% higher. So precious metals retrace some of their Friday's decline today.

The recent economic data releases have been confirming negative coronavirus impact on global economies. However, Friday's U.S. monthly jobs data came out much better than expected. And the Nonfarm Payrolls number has been positive. But will we get more positive surprises this week? Today the markets will certainly pay attention to the European Central Bank's President Lagarde speech at 9:45 a.m. And tomorrow we will get the U.S. Wholesale Inventories data.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Monday, June 8

- 9:45 a.m. Eurozone - ECB President Lagarde Speech

Tuesday, June 9

- 10:00 a.m. U.S. - Final Wholesale Inventories m/m, JOLTS Job Openings

- All Day, Eurozone - ECOFIN Meetings