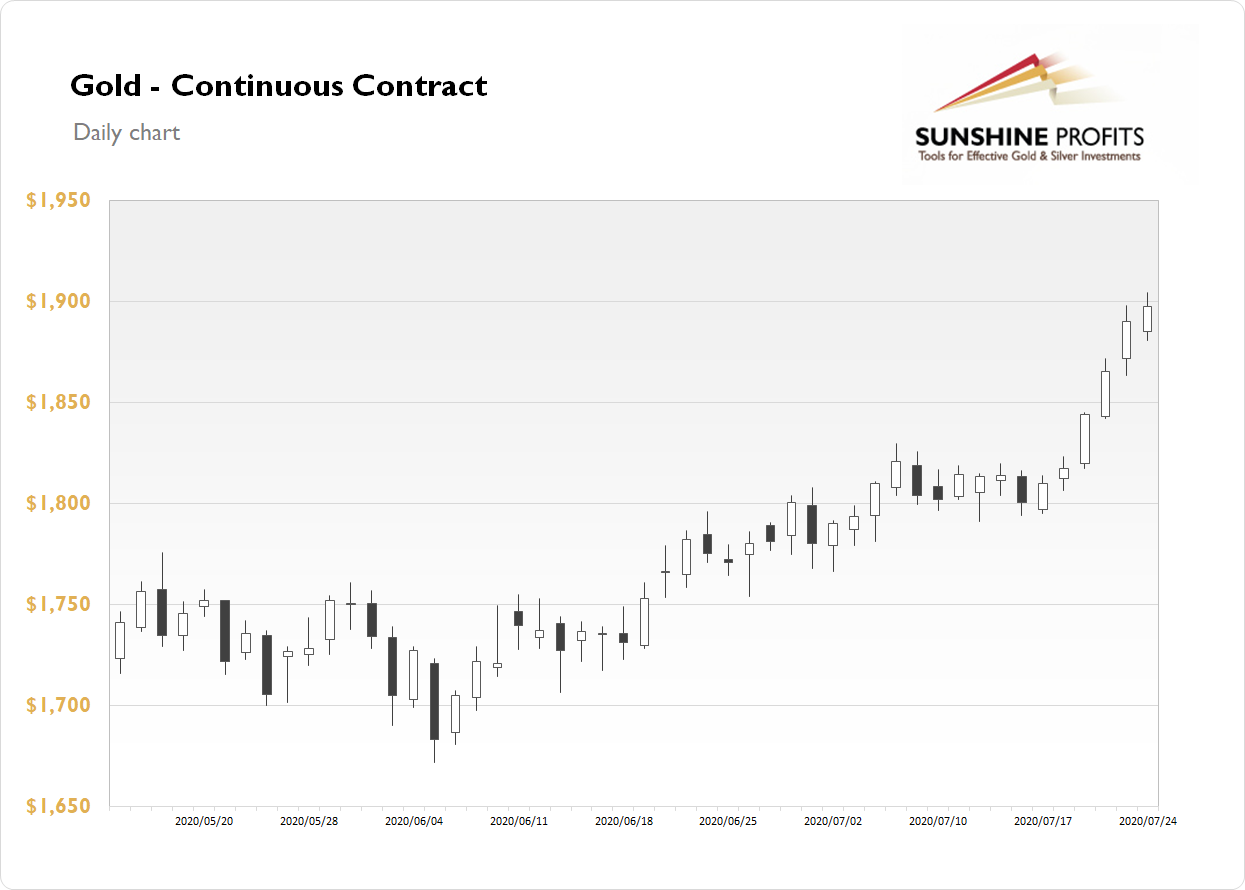

The gold futures contract gained 0.4% on Friday, as it extended its uptrend following a recent breakout above the short-term trading range and $1,800 price level. The yellow metal has reached the highest since August-September of 2011 once again following U.S. dollar sell-off, among other factors. Last month gold broke above medium-term local highs along the $1,750 price level, as we can see on the daily chart:

Gold is 2.2% higher this morning, as it is accelerating the uptrend. The market is at a new record high. What about the other precious metals? Silver lost 0.60% on Friday and today it is 7.7 % higher. Platinum lost 0.81% and today it's trading 3.1% higher. Palladium gained 2.42% and today it is 3.4% higher. So precious metals are extending their uptrend this morning.

Yesterday's U.S. Flash Manufacturing PMI/Flash Services PMI releases have been slightly worse than expected. Today we will get the Durable Goods Orders number at 8:30 a.m. But the markets will await Wednesday's FOMC Statement release and Thursday's U.S. Advance GDP number. The GDP is expected to decline by a stunning 35.0% q/q.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Monday, July 27

- 4:00 a.m. Eurozone - German ifo Business Climate

- 6:00 a.m. Eurozone - German Buba Monthly Report

- 8:30 a.m. U.S. - Durable Goods Orders m/m, Core Durable Goods Orders m/m

Tuesday, July 28

- 9:00 a.m. U.S. - S&P/CS Composite-20 HPI y/y

- 10:00 a.m. U.S. - CB Consumer Confidence, Richmond Manufacturing Index

- 9:30 p.m. Australia - CPI q/q, Trimmed Mean CPI q/q