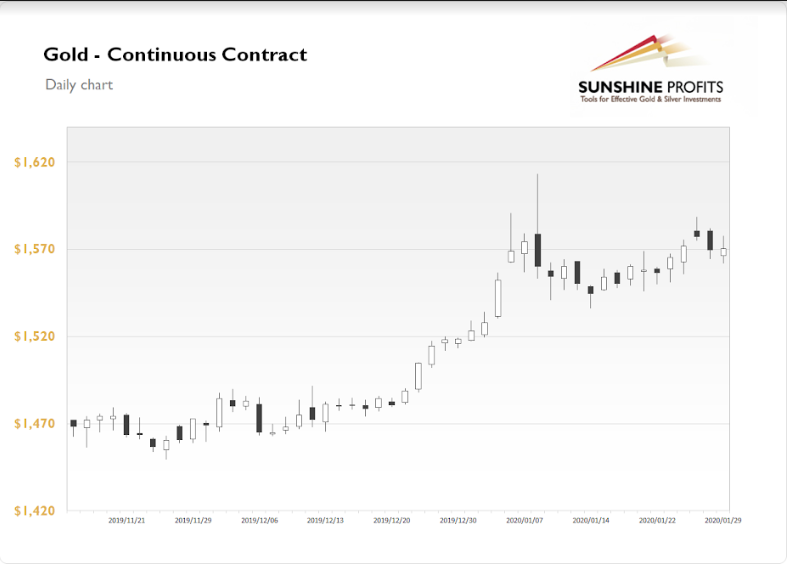

The Gold Futures gained 0.04% on Wednesday, as it extended its short-term consolidation. So the FOMC Monetary Policy Statement release didn’t bring much volatility. On last week’s Wednesday gold has bounced off $1,550 level, and since then it gained almost 2.5%. This week, the price of gold is drifting lower from Monday’s local high of $1,588.40. The market has retraced some of its move lower from the January 8 medium-term high.

Gold is currently 0.2% higher, as it continues to trade within a short-term consolidation following the recent advance. What about the other precious metals? Silver gained 0.2% yesterday, so it basically fluctuated following Tuesday’s sell-off. It is currently 1.2% higher, as it retraces some of the mentioned decline. The platinum is 0.2% lower, as it continues to trade below $1,000 mark. The palladium is 0.4% down. That metal has retraced just some of its recent sell-off from new record highs.

The financial markets are watching the China virus crisis developments again. The stock market sentiment has worsened, but gold doesn’t react on it. Investors will wait for today’s U.S. Advance GDP number release at 8:30. Will it be a game-changer? Probably not, because the profit-taking action following quarterly earnings releases shows that bullish news may be already priced in.