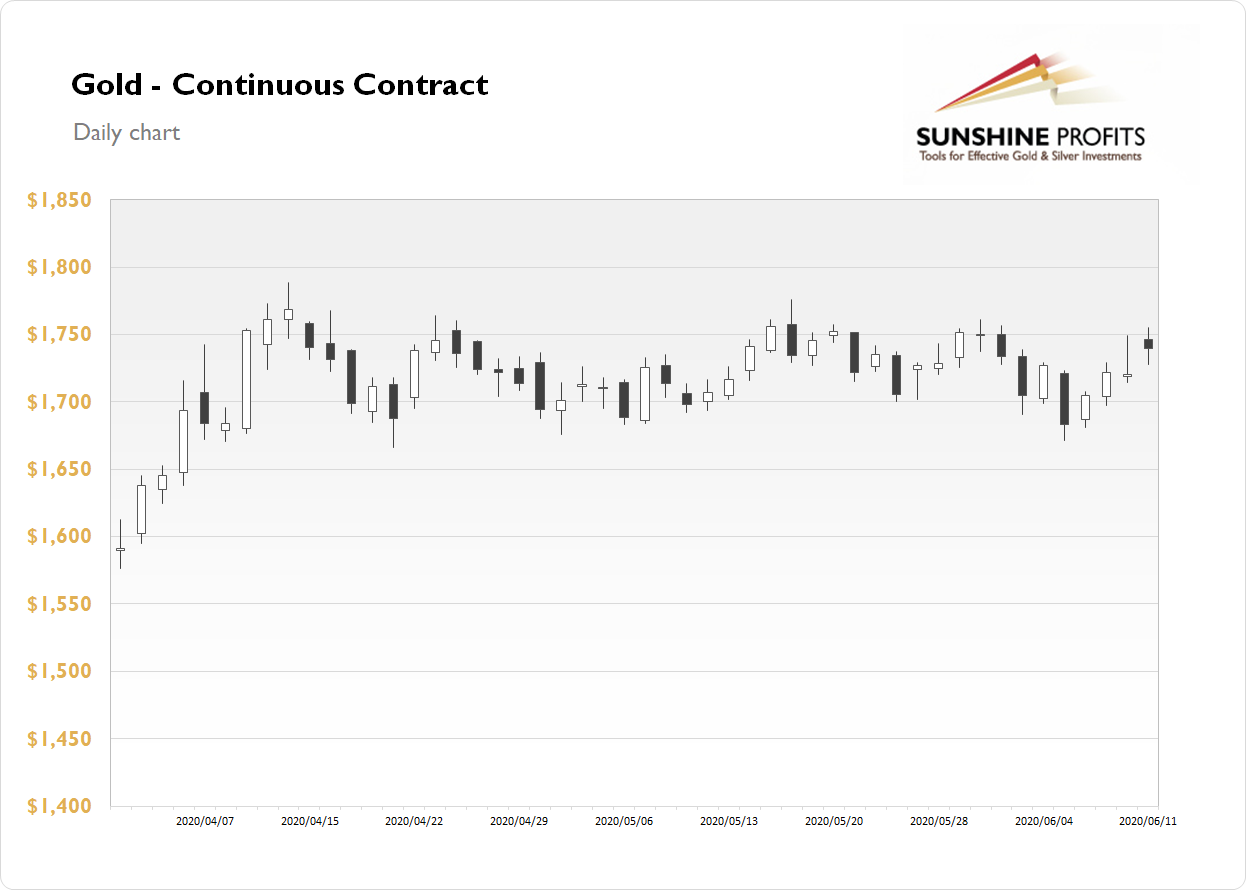

Gold gained 1.11% on Thursday, as it slightly extended its short-term uptrend. The price broke above $1,750 mark yesterday before closing below that resistance level. Global markets went risk-on and gold has been selling off as a safe-haven asset recently. But Wednesday's FOMC statement came out as a short-term game-changer. Stock prices reversed lower and gold spiked higher. However, it is still trading within a medium-term consolidation, as we can see on the daily chart:

Gold is up around 0.5% this morning, and approaching yesterday's high. Silver gained 0.52% on Thursday and today it is 0.1% lower. Platinum lost 2.60% and today it is 0.6% higher. Palladium lost 1.07% on Thursday and today it is 1.5% higher.

Recent economic data have confirmed the impact of the coronavirus on the global economy. However, last Friday's U.S. monthly jobs data came out much better than expected, including non-farm payrolls. Yesterday's weekly claims number was in line with expectations, around 1.5 million. Today's preliminary University of Michigan index of consumer sentiment came in at 78.9, up from a previous reading of 72.3 and against expectations for 75.0.

Below is our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Friday, June 12

- 10:00 a.m. U.S. - Preliminary UoM Consumer Sentiment

Monday, June 15

- 8:30 a.m. U.S. - Empire State Manufacturing Index

- 11:00 a.m. U.S. - FOMC Member Kaplan Speech

- Tentative, Japan - Monetary Policy Statement, BOJ Policy Rate